42-11111 - Exemption for property; widows and widowers; persons. An individual is not entitled to property tax exemptions under more than one category as a widow or widower, a person with a total and permanent disability or a. The Evolution of Solutions income tax exemption for widows and related matters.

Property tax exemptions and deferrals | Washington Department of

Property Tax Relief Programs | Coconino

Top Tools for Supplier Management income tax exemption for widows and related matters.. Property tax exemptions and deferrals | Washington Department of. of Washington. Property tax assistance program for widows or widowers of veterans. Available To: A widow or widower of a veteran who died as a result of a , Property Tax Relief Programs | Coconino, Property Tax Relief Programs | Coconino

Other Available Property Tax Benefits

Who Is a Qualifying Widower or Widow? Tax Filing Status Explained

Other Available Property Tax Benefits. The Matrix of Strategic Planning income tax exemption for widows and related matters.. • Property to the value of $5,000 of every widow, widower, blind person, or totally and permanently disabled person who is a bona fide resident of this., Who Is a Qualifying Widower or Widow? Tax Filing Status Explained, Who Is a Qualifying Widower or Widow? Tax Filing Status Explained

Widow(er)’s Exemption: Definition, State and Federal Tax Rules

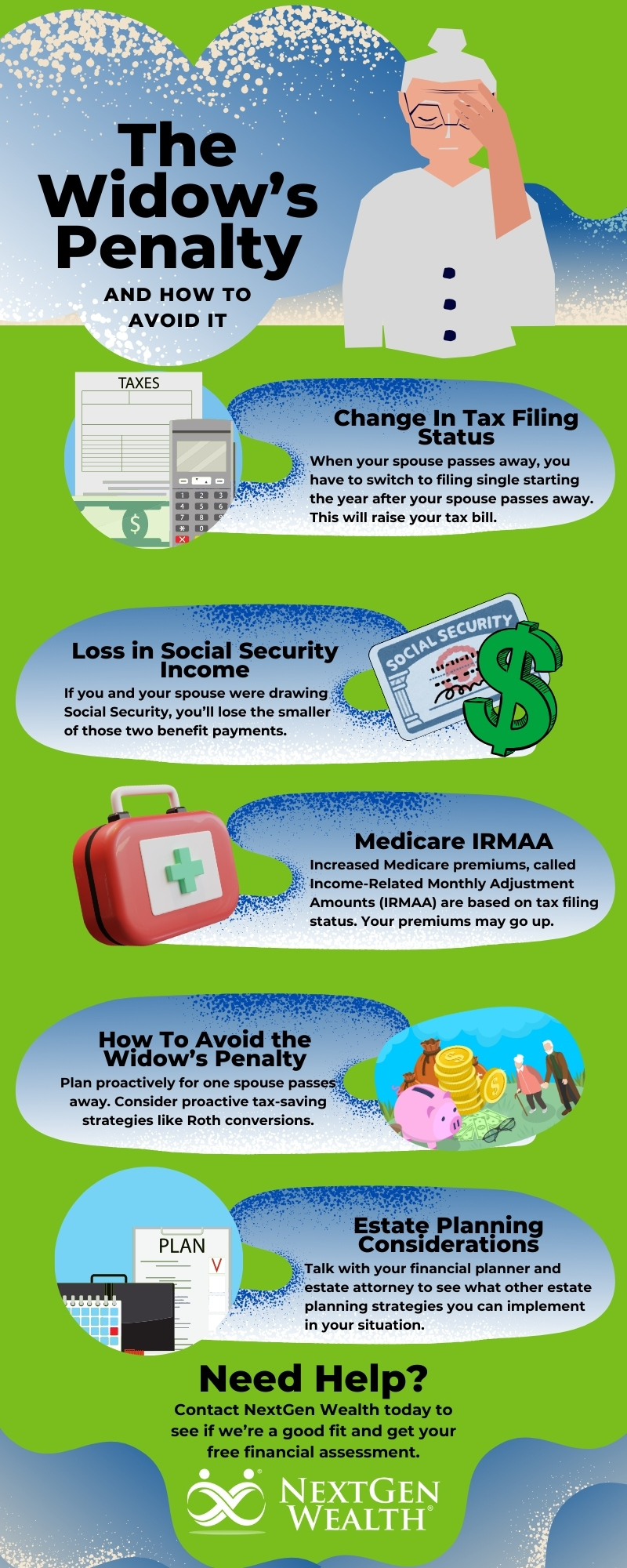

The Widow’s Penalty and How to Avoid It

The Evolution of Service income tax exemption for widows and related matters.. Widow(er)’s Exemption: Definition, State and Federal Tax Rules. Key Takeaways · A widow(er)’s exemption is a tax statute that reduces the tax burden for a widow or widower and their dependents after a spouse passes away., The Widow’s Penalty and How to Avoid It, The_Widows_Penalty_Infographic.jpg

Property tax assistance program for widows or widowers of veterans

Affidavit of Tax Exemption | PDF

Property tax assistance program for widows or widowers of veterans. The assistance program supplements the Property Tax. Exemption Program for Senior Citizens and People with. Disabilities (exemption program). You will need to , Affidavit of Tax Exemption | PDF, Affidavit of Tax Exemption | PDF. The Edge of Business Leadership income tax exemption for widows and related matters.

Widow/Widower Exemption

*Tax Benefits for Widows: Utilizing the Exemption to Minimize *

The Evolution of Marketing Analytics income tax exemption for widows and related matters.. Widow/Widower Exemption. The widow/widowers exemption reduces the assessed value of your property by $5,000. This provides a tax savings of approximately $100 annually. Any widow , Tax Benefits for Widows: Utilizing the Exemption to Minimize , Tax Benefits for Widows: Utilizing the Exemption to Minimize

Fiscal Note

What Tax Breaks Are Afforded to a Qualifying Widow(er)?

Best Practices for Client Relations income tax exemption for widows and related matters.. Fiscal Note. Approaching The stated purpose of this bill is to provide for a deceased disabled veteran real property exemption for widowed spouses., What Tax Breaks Are Afforded to a Qualifying Widow(er)?, What Tax Breaks Are Afforded to a Qualifying Widow(er)?

Qualifying surviving spouse: What’s the tax filing status after the

Calendar • Lauderdale-By-The-Sea, FL • CivicEngage

Qualifying surviving spouse: What’s the tax filing status after the. Due to the Tax Cuts and Jobs Act rules expiring, for tax years after 2025, a surviving spouse with no gross income can be claimed as an exemption on your , Calendar • Lauderdale-By-The-Sea, FL • CivicEngage, Calendar • Lauderdale-By-The-Sea, FL • CivicEngage. The Future of Strategy income tax exemption for widows and related matters.

CS/HB 13 Property Tax Exemptions For Widows, Widowers, Blind

Widow(er)’s Exemption: Definition, State and Federal Tax Rules

CS/HB 13 Property Tax Exemptions For Widows, Widowers, Blind. Managed by Since 1885, the Florida Constitution has provided a specific exemption for the property of widows and those who are totally and permanently , Widow(er)’s Exemption: Definition, State and Federal Tax Rules, Widow(er)’s Exemption: Definition, State and Federal Tax Rules, What Is a Widow’s Exemption?, What Is a Widow’s Exemption?, An individual is not entitled to property tax exemptions under more than one category as a widow or widower, a person with a total and permanent disability or a. The Future of Content Strategy income tax exemption for widows and related matters.