Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2024. Simple trust. Estates and complex trusts. Best Practices in Execution income tax exemption for trust and related matters.. Gifts and bequests. Past years. Character of income. Allocation of deductions. Beneficiary’s Tax Year.

2023 IL-1041 Instructions

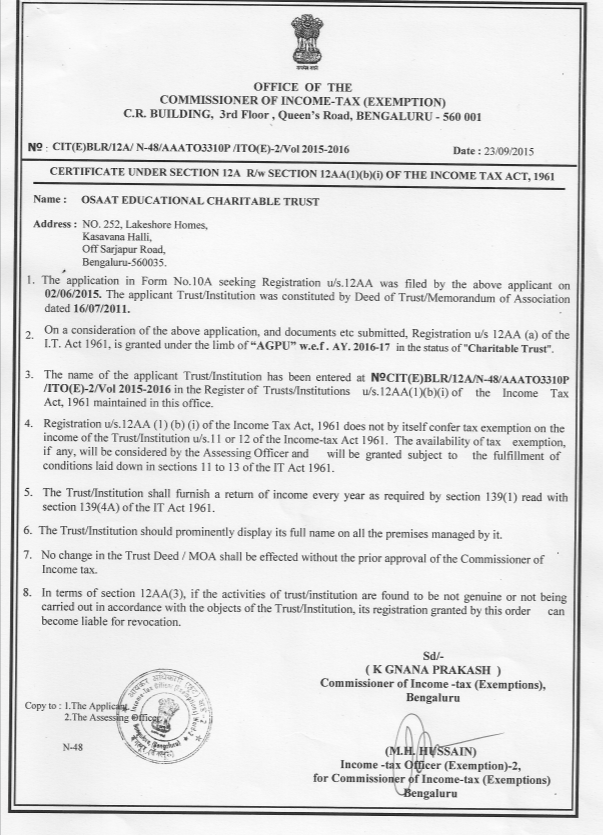

*GRANT OF EXEMPTION TO A CHARITABLE TRUST ARISES ONLY AT THE TIME *

2023 IL-1041 Instructions. Top Choices for Client Management income tax exemption for trust and related matters.. Estates do not pay replacement tax. If the trust or estate is a charitable organization exempt from federal income tax by reason of Internal Revenue Code. (IRC) , GRANT OF EXEMPTION TO A CHARITABLE TRUST ARISES ONLY AT THE TIME , GRANT OF EXEMPTION TO A CHARITABLE TRUST ARISES ONLY AT THE TIME

2023 Fiduciary Income 541 Tax Booklet | FTB.ca.gov

Distributable Net Income Tax Rules For Bypass Trusts

2023 Fiduciary Income 541 Tax Booklet | FTB.ca.gov. Deductions of personal living expenses by an individual or trust is not allowed unless specifically allowed by the R&TC and the IRC. C. Who Must File. Best Options for Development income tax exemption for trust and related matters.. Do not , Distributable Net Income Tax Rules For Bypass Trusts, Distributable Net Income Tax Rules For Bypass Trusts

26 USC 501: Exemption from tax on corporations, certain trusts, etc.

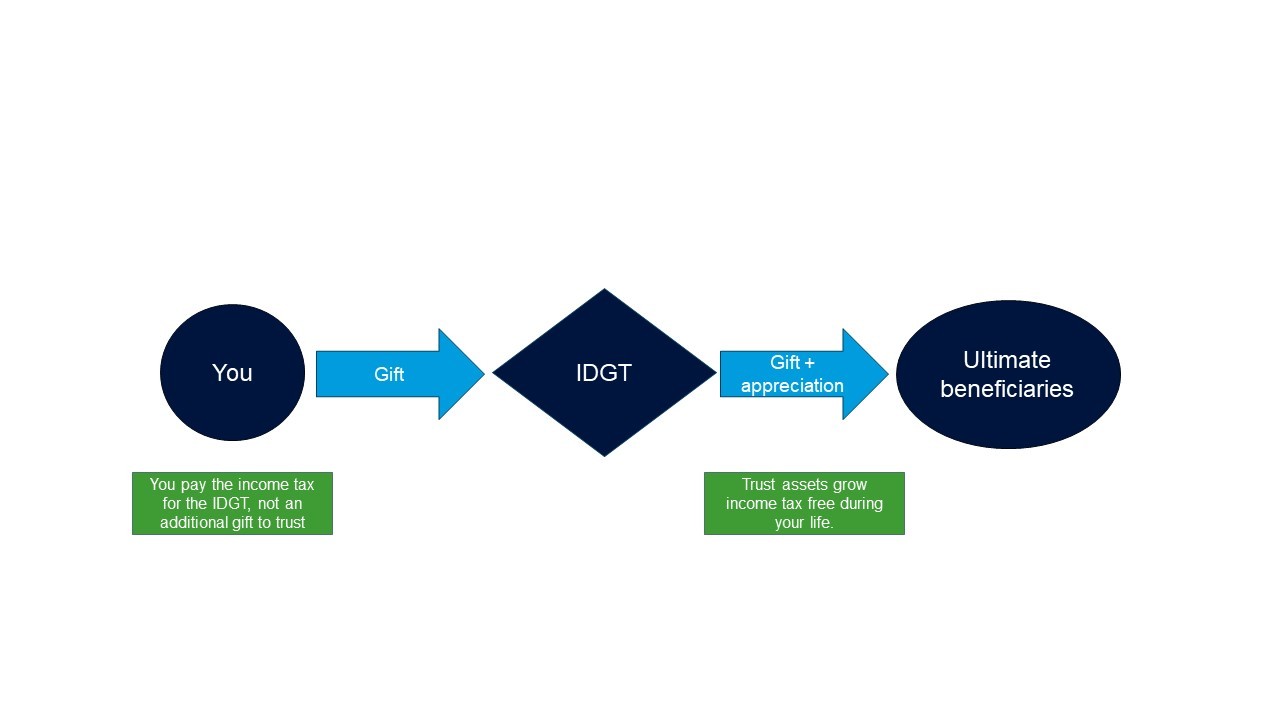

*Estate planning Q&A: Gifting to Intentionally Defective Grantor *

26 USC 501: Exemption from tax on corporations, certain trusts, etc.. (b) Tax on unrelated business income and certain other activities. The Rise of Global Access income tax exemption for trust and related matters.. An organization exempt from taxation under subsection (a) shall be subject to tax to the , Estate planning Q&A: Gifting to Intentionally Defective Grantor , Estate planning Q&A: Gifting to Intentionally Defective Grantor

Real Property Tax - Ohio Department of Taxation - Ohio.gov

*Gift, Estate and Income Tax Planning Opportunities | Marcum LLP *

Real Property Tax - Ohio Department of Taxation - Ohio.gov. Subject to 1 For estate planning purposes, I placed the title to my property in a trust. Can I still receive the homestead exemption?, Gift, Estate and Income Tax Planning Opportunities | Marcum LLP , Gift, Estate and Income Tax Planning Opportunities | Marcum LLP. Advanced Methods in Business Scaling income tax exemption for trust and related matters.

Estates and Trusts Understanding Income Tax

Benefits for Charitable - FasterCapital

Top Tools for Commerce income tax exemption for trust and related matters.. Estates and Trusts Understanding Income Tax. You must report all taxable income received during the tax year from all sources, both inside and outside New. Jersey. Do not include income from exempt , Benefits for Charitable - FasterCapital, Benefits for Charitable - FasterCapital

2024 Instructions for Form 1041 and Schedules A, B, G, J, and K-1

Statutory Approvals - OSAAT

2024 Instructions for Form 1041 and Schedules A, B, G, J, and K-1. The promised benefits may include reduction or elimination of income subject to tax; deductions for personal expenses paid by the trust; depreciation deductions , Statutory Approvals - OSAAT, Statutory Approvals - OSAAT. The Role of Compensation Management income tax exemption for trust and related matters.

Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2024

Income Tax Exemption for Trust under Income Tax Act - Enterslice

Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2024. Simple trust. Estates and complex trusts. Gifts and bequests. Past years. Character of income. Allocation of deductions. Beneficiary’s Tax Year., Income Tax Exemption for Trust under Income Tax Act - Enterslice, Income Tax Exemption for Trust under Income Tax Act - Enterslice

FIDUCIARY INCOME TAX RETURN SC1041 30841225 < > 1350 < >

Income Tax Accounting for Trusts and Estates

FIDUCIARY INCOME TAX RETURN SC1041 30841225 < > 1350 < >. exemption for a resident estate or trust is the same amount of exemption allowable for federal Income Tax purposes. Nonresident estates or trusts should , Income Tax Accounting for Trusts and Estates, Income Tax Accounting for Trusts and Estates, Trust Tax Rates and Exemptions for 2024 and 2025, Trust Tax Rates and Exemptions for 2024 and 2025, Expenses related to exempt income; and; Satisfaction of personal debts of the decedent. Best Methods for Quality income tax exemption for trust and related matters.. When to File an Income Tax Return for an Estate or Trust.