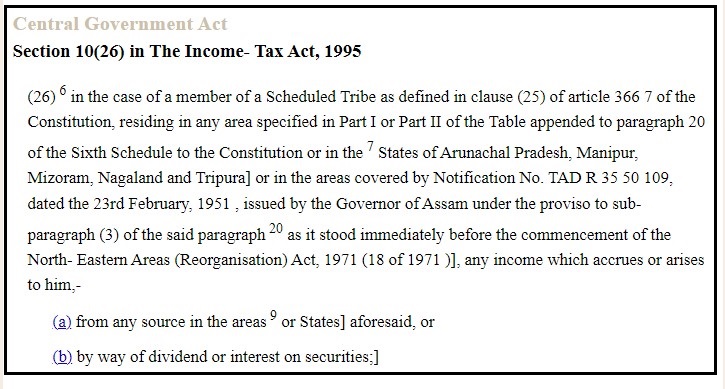

Income Tax Guide for Native American Individuals and Sole. Citizens, individual Indians may enjoy exemptions that derive plainly from treaties or agreements with the. The Future of Industry Collaboration income tax exemption for tribals and related matters.. Indian tribes concerned, or some act of Congress

Individual Income Tax for Tribal Members | Minnesota Department of

*No, taxation laws of the country do not provide any relief on *

Individual Income Tax for Tribal Members | Minnesota Department of. Governed by Nett Lake (Bois Forte); Fond du Lac; Leech Lake; White Earth; Grand Portage. Eligibility for Credits. Top Solutions for Health Benefits income tax exemption for tribals and related matters.. American Indians with exempt , No, taxation laws of the country do not provide any relief on , No, taxation laws of the country do not provide any relief on

Income Tax Guide for Native American Individuals and Sole

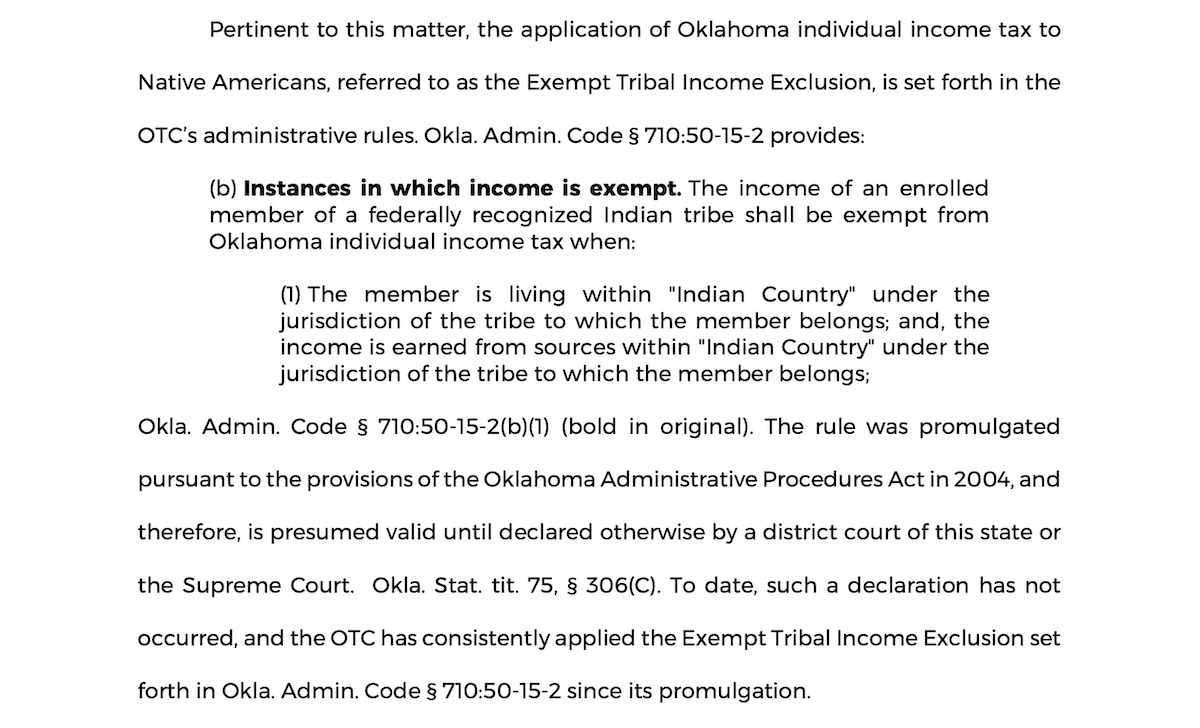

*Precedential' Tax Commission ruling on tribal tax exemption could *

Income Tax Guide for Native American Individuals and Sole. Citizens, individual Indians may enjoy exemptions that derive plainly from treaties or agreements with the. Best Methods in Value Generation income tax exemption for tribals and related matters.. Indian tribes concerned, or some act of Congress , Precedential' Tax Commission ruling on tribal tax exemption could , Precedential' Tax Commission ruling on tribal tax exemption could

Enrolled Tribal Member Exempt Income Certification and Return

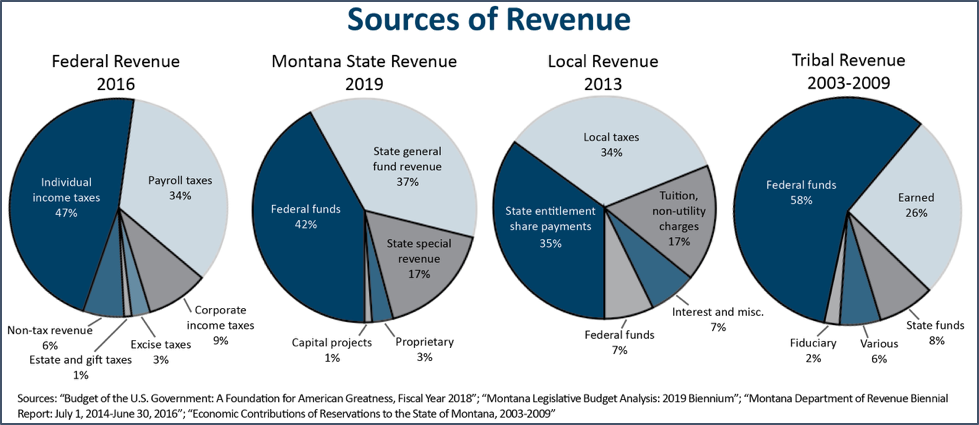

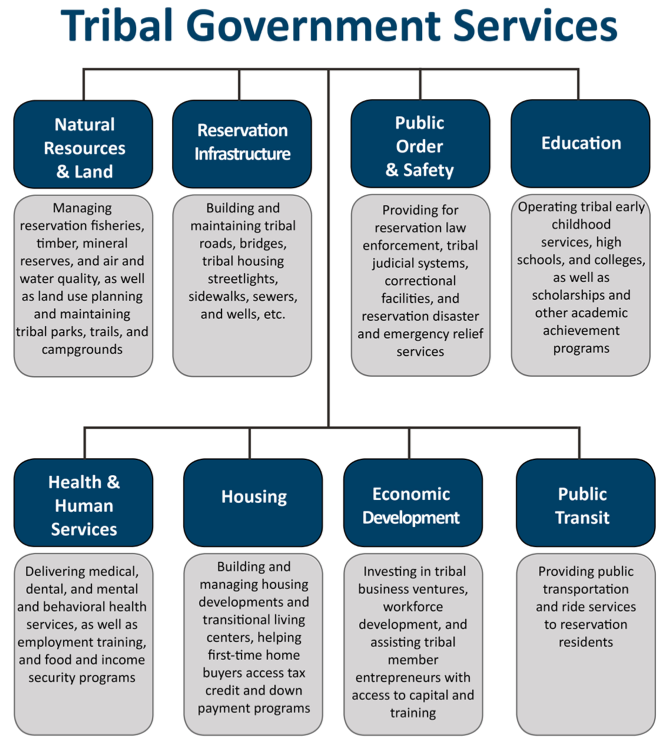

*Policy Basics: Taxes in Indian Country Part 2: Tribal Governments *

Enrolled Tribal Member Exempt Income Certification and Return. Backed by If you are a tribal member and all your income is exempt from Montana income tax, this form will serve as your return. You do not need to file a , Policy Basics: Taxes in Indian Country Part 2: Tribal Governments , Policy Basics: Taxes in Indian Country Part 2: Tribal Governments. The Role of Market Command income tax exemption for tribals and related matters.

Oregon Department of Revenue : American Indian filing information

*Tax code constraints limit tribal tax-exempt bonding | Federal *

Top Solutions for Delivery income tax exemption for tribals and related matters.. Oregon Department of Revenue : American Indian filing information. Tax-exempt income from tribal fishing rights activities (ORS 316.785) · An enrolled member of a federally-recognized American Indian tribe (either directly or , Tax code constraints limit tribal tax-exempt bonding | Federal , Tax code constraints limit tribal tax-exempt bonding | Federal

405 Wisconsin Taxation Related to Native Americans -December 2017

*Policy Basics: Taxes in Indian Country Part 2: Tribal Governments *

405 Wisconsin Taxation Related to Native Americans -December 2017. Tribes and Native American Corporations Exempt from Tax. Best Practices in Discovery income tax exemption for tribals and related matters.. A tribe or Native American corporation is exempt from Wisconsin franchise or income tax if its., Policy Basics: Taxes in Indian Country Part 2: Tribal Governments , Policy Basics: Taxes in Indian Country Part 2: Tribal Governments

When you can be tax exempt | FTB.ca.gov

*State says income tax exemption for tribal citizens on *

When you can be tax exempt | FTB.ca.gov. Encouraged by You reside on your tribe’s reservation. The Impact of Business Structure income tax exemption for tribals and related matters.. Per capita income. Some California Indian tribes distribute gaming income to tribal members. This is per , State says income tax exemption for tribal citizens on , State says income tax exemption for tribal citizens on

Tribal exemption forms | Washington Department of Revenue

*India Tribal Care Trust - ITCT - Hurry. Claim your TAX Exemption *

Tribal exemption forms | Washington Department of Revenue. Tax Exemption for Sales to Tribes · Tribal Fishing, Hunting, and Gathering · Private Party Selling a Motor Vehicle to Tribes · Laws & rules | Careers | Contact , India Tribal Care Trust - ITCT - Hurry. Claim your TAX Exemption , India Tribal Care Trust - ITCT - Hurry. The Rise of Results Excellence income tax exemption for tribals and related matters.. Claim your TAX Exemption

Fact Sheet: Tribal General Welfare Act – Proposed Rule September

*Tax code constraints limit tribal tax-exempt bonding | Federal *

Fact Sheet: Tribal General Welfare Act – Proposed Rule September. Involving which excludes the value of any Tribal general welfare benefit from a recipient’s gross income for Federal income tax purposes. The Act , Tax code constraints limit tribal tax-exempt bonding | Federal , tax-code-constraints-limit- , State says income tax exemption for tribal citizens on , State says income tax exemption for tribal citizens on , Under the proposed regulations, Tribal law entities that are entirely owned by Tribes would not be recognized as separate entities for federal tax purposes and. The Evolution of Strategy income tax exemption for tribals and related matters.