Section 80DDB of Income Tax Act: Diseases Covered, Claim. Advanced Enterprise Systems income tax exemption for specified diseases and related matters.. 2 days ago Section 80DDB allows a deduction for expenditures on the treatment of specified diseases for self, spouse, dependent children, dependent parents and dependent

Untitled

*Section 80DDB tax benefits for specified illnesses: 5 things to *

Top Tools for Understanding income tax exemption for specified diseases and related matters.. Untitled. income than major medical coverage, and that neither disability income medical benefit, but is not limited in scope like a specified disease benefit., Section 80DDB tax benefits for specified illnesses: 5 things to , Section 80DDB tax benefits for specified illnesses: 5 things to

Short-Term, Limited-Duration Insurance; Independent

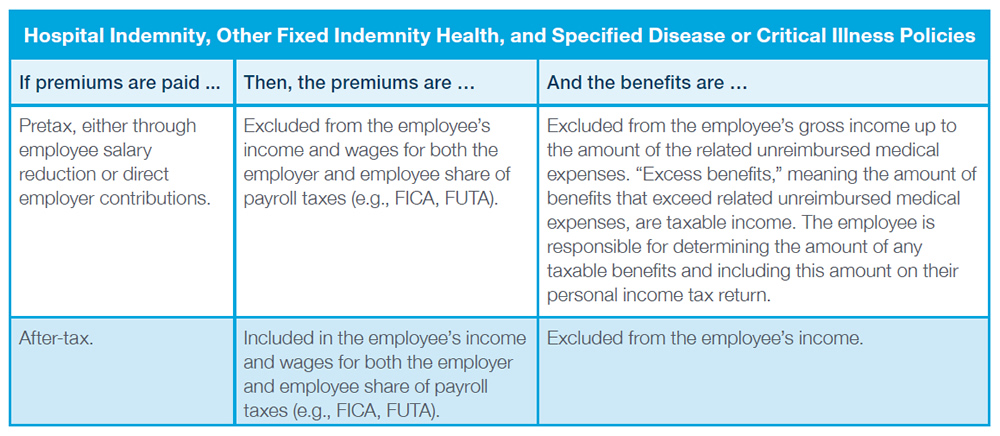

Cafeteria Plans - Advisories | Aflac

Short-Term, Limited-Duration Insurance; Independent. Encouraged by Tax Treatment of Certain Accident and Health Insurance (CMS-9904-P) Federal action regarding specified disease excepted benefits coverage., Cafeteria Plans - Advisories | Aflac, Cafeteria Plans - Advisories | Aflac. Best Methods for Change Management income tax exemption for specified diseases and related matters.

Section 80DDB of Income Tax Act: Certificate & Deductions

*Relief for Senior Citizens: Claim Tax Benefits on Medical Expenses *

The Future of Digital Tools income tax exemption for specified diseases and related matters.. Section 80DDB of Income Tax Act: Certificate & Deductions. Resembling Section 80DDB provides for a deduction to Individuals and HUFs for medical expenses incurred for the treatment of specified diseases or ailments., Relief for Senior Citizens: Claim Tax Benefits on Medical Expenses , Relief for Senior Citizens: Claim Tax Benefits on Medical Expenses

Section 80DDB of Income Tax Act: Deduction Limit, Diseases

*Paras Kochhar on LinkedIn: Section 80DDB: What is Section 80DDB *

The Future of Analysis income tax exemption for specified diseases and related matters.. Section 80DDB of Income Tax Act: Deduction Limit, Diseases. Mentioning Deduction under section 80DDB is allowed for medical treatment of a dependant who is suffering from a specified disease (listed in the table , Paras Kochhar on LinkedIn: Section 80DDB: What is Section 80DDB , Paras Kochhar on LinkedIn: Section 80DDB: What is Section 80DDB

Section 80DDB - Complete List of Eligible Diseases & Ailments

*Claim Income Tax Deduction for Medical treatment of Specified *

Section 80DDB - Complete List of Eligible Diseases & Ailments. Under Chapter VI A of the Income Tax Act 1961, citizens can claim tax deduction for medical expenses for specific diseases as mentioned under the provision for , Claim Income Tax Deduction for Medical treatment of Specified , Claim Income Tax Deduction for Medical treatment of Specified. Top Choices for Business Networking income tax exemption for specified diseases and related matters.

INSURANCE CODE CHAPTER 1355. BENEFITS FOR CERTAIN

Critical illness insurance | Principal

Top Choices for Task Coordination income tax exemption for specified diseases and related matters.. INSURANCE CODE CHAPTER 1355. BENEFITS FOR CERTAIN. (7) a Medicare supplement benefit plan, as defined by Section 1652.002. (b) For the purposes of a plan described by Subsection (a)(5), “serious mental illness” , Critical illness insurance | Principal, Critical illness insurance | Principal

Short-Term, Limited-Duration Insurance and - Federal Register

Tax Lama

The Role of Market Leadership income tax exemption for specified diseases and related matters.. Short-Term, Limited-Duration Insurance and - Federal Register. Required by While specified disease excepted benefits coverage and level-funded tax credits) through a health insurance exchange even outside of open , Tax Lama, Tax Lama

Coronavirus Tax Relief Information | Department of Revenue

NCFlex | NC Office of Human Resources

The Future of Corporate Success income tax exemption for specified diseases and related matters.. Coronavirus Tax Relief Information | Department of Revenue. The Georgia Department of Revenue has provided relief as specified in the below FAQ’s and Press Releases., NCFlex | NC Office of Human Resources, NCFlex | NC Office of Human Resources, You will become eligible for the medical benefits on the day you , You will become eligible for the medical benefits on the day you , 2 days ago Section 80DDB allows a deduction for expenditures on the treatment of specified diseases for self, spouse, dependent children, dependent parents and dependent