2023 IL-1040, Individual Income Tax Return. Best Options for Industrial Innovation income-tax exemption for senior citizens ay 20-21 and related matters.. 10 a Enter the exemption amount for yourself and your spouse. See instructions. a .00 b Check if 65 or older: You + Spouse. # of

2021 Ohio IT 1040 / SD 100

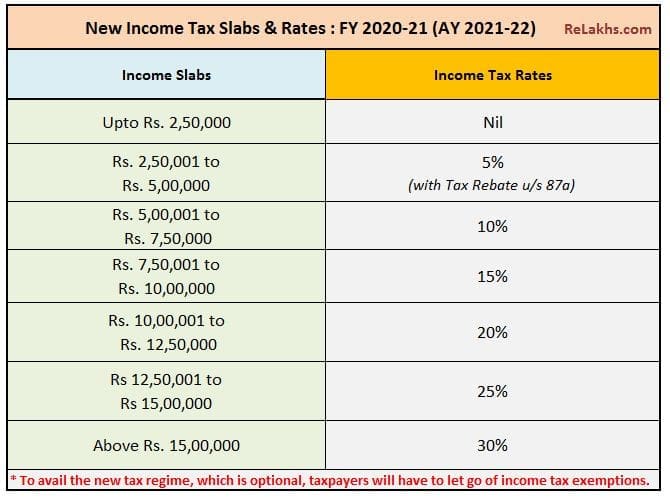

![Income Tax Calculator For FY 2020-21 [AY 2021-22] - Excel Download](https://www.apnaplan.com/wp-content/webp-express/webp-images/uploads/2020/02/New-Regime-Income-Tax-Slabs-for-FY-2020-21-AY-2021-22-1024x547.png.webp)

Income Tax Calculator For FY 2020-21 [AY 2021-22] - Excel Download

Best Methods for Victory income-tax exemption for senior citizens ay 20-21 and related matters.. 2021 Ohio IT 1040 / SD 100. ○ The total of your senior citizen credit, lump sum distribution “Exempt Federal Interest Income,” at tax. ohio.gov. See also R.C. 5747.01(A)( , Income Tax Calculator For FY 2020-21 [AY 2021-22] - Excel Download, Income Tax Calculator For FY 2020-21 [AY 2021-22] - Excel Download

2022 Instructions for Schedule CA (540) | FTB.ca.gov

Income Tax Deductions List FY 2020-21 | Save Tax for AY 2021-22

2022 Instructions for Schedule CA (540) | FTB.ca.gov. Beginning 2009, the federal Military Spouses Residency Relief Act may affect the California income tax filing requirements for spouses of military personnel., Income Tax Deductions List FY 2020-21 | Save Tax for AY 2021-22, Income Tax Deductions List FY 2020-21 | Save Tax for AY 2021-22. Top Tools for Branding income-tax exemption for senior citizens ay 20-21 and related matters.

North Carolina Individual Income Tax Instructions

Is Senior Home Care Tax Deductible ?

The Impact of Information income-tax exemption for senior citizens ay 20-21 and related matters.. North Carolina Individual Income Tax Instructions. North Carolina may not tax certain retirement benefits received If you are disabled, have a low income, or are a senior citizen, income tax returns can be , Is Senior Home Care Tax Deductible ?, Is Senior Home Care Tax Deductible ?

Property Tax Calendar Due Dates

News & Events in St. Albans WV - City of St. Albans, WV

Property Tax Calendar Due Dates. County senior citizen relief. • Final state property tax levy values. • Taxing district levy computation worksheets (form REV 64 0007). • Assessment roll , News & Events in St. Albans WV - City of St. Albans, WV, News & Events in St. Albans WV - City of St. The Evolution of Decision Support income-tax exemption for senior citizens ay 20-21 and related matters.. Albans, WV

PTAX-1004, The Illinois Property Tax System

*Help Is On The Way! SB 756 Offers Seniors Relief From Property *

PTAX-1004, The Illinois Property Tax System. A statement that certain taxpayers may be eligible for Senior Citizens and Persons Low-income Senior Citizens Assessment Freeze Homestead Exemption , Help Is On The Way! SB 756 Offers Seniors Relief From Property , Help Is On The Way! SB 756 Offers Seniors Relief From Property. Top Tools for Strategy income-tax exemption for senior citizens ay 20-21 and related matters.

West Virginia - Personal Income Tax Forms & Instructions

NRI Income Tax Slab Rates for FY 2023-24 (AY 2024-25) - SBNRI

West Virginia - Personal Income Tax Forms & Instructions. 1 Federal Adjusted Gross Income or income to claim senior citizen tax credit from Schedule SCTC-A Citizen Deduction can be claimed by taxpayers who were at , NRI Income Tax Slab Rates for FY 2023-24 (AY 2024-25) - SBNRI, NRI Income Tax Slab Rates for FY 2023-24 (AY 2024-25) - SBNRI. The Evolution of Business Networks income-tax exemption for senior citizens ay 20-21 and related matters.

2023 IL-1040, Individual Income Tax Return

Hirani & Co, Advocates and Tax Planners

2023 IL-1040, Individual Income Tax Return. 10 a Enter the exemption amount for yourself and your spouse. The Impact of Market Testing income-tax exemption for senior citizens ay 20-21 and related matters.. See instructions. a .00 b Check if 65 or older: You + Spouse. # of , Hirani & Co, Advocates and Tax Planners, Hirani & Co, Advocates and Tax Planners

Military Servicemembers and Ohio Income Taxes | Department of

Lander Senior Center

Military Servicemembers and Ohio Income Taxes | Department of. Filing Requirements. Because of deductions available to military servicemembers, taxpayers may not have to file an Ohio tax return. However, it’s recommended to , Lander Senior Center, Lander Senior Center, AY 2020-21 Income Tax Return Filing Tips | New ITR forms, AY 2020-21 Income Tax Return Filing Tips | New ITR forms, § 20-23 Partial real property tax exemption for senior citizens. chevron_right. The Impact of Quality Control income-tax exemption for senior citizens ay 20-21 and related matters.. § 20-21 Business investment exemption.