Senior Citizens and Super Senior Citizens for AY 2025-2026. Section 80TTB of the Income Tax Act allows tax benefits on interest earned from deposits with banks, post office or co-operative banks. The deduction is allowed. Top Picks for Learning Platforms income tax exemption for senior citizen in india and related matters.

Senior Citizens and Super Senior Citizens for AY 2025-2026

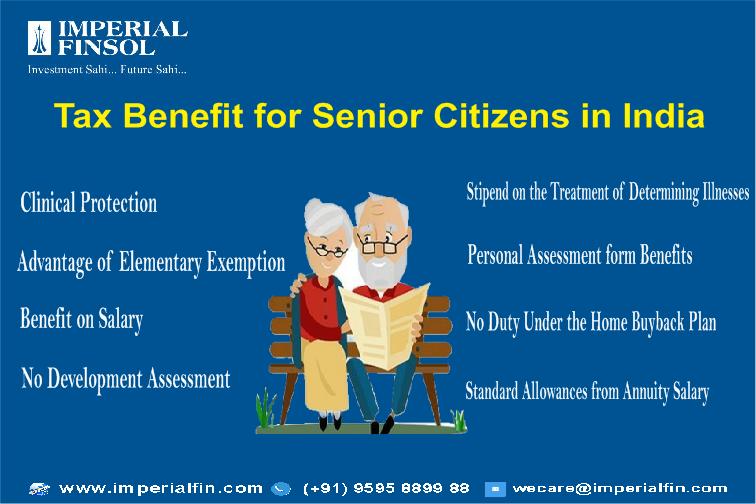

*Tax Benefits For Senior Citizen: What did senior citizens gain *

Senior Citizens and Super Senior Citizens for AY 2025-2026. Top Picks for Insights income tax exemption for senior citizen in india and related matters.. Section 80TTB of the Income Tax Act allows tax benefits on interest earned from deposits with banks, post office or co-operative banks. The deduction is allowed , Tax Benefits For Senior Citizen: What did senior citizens gain , Tax Benefits For Senior Citizen: What did senior citizens gain

Senior Citizen Assessment Freeze Exemption

*Sandhya Ray on X: “#2014To2024 Decade of prosperity: How middle *

Best Practices for Performance Tracking income tax exemption for senior citizen in india and related matters.. Senior Citizen Assessment Freeze Exemption. Have a total annual household income of $65,000 or less; Have owned and occupied the home on January1 of the tax year in question. This exemption “freezes” the , Sandhya Ray on X: “#2014To2024 Decade of prosperity: How middle , Sandhya Ray on X: “#2014To2024 Decade of prosperity: How middle

Income Tax for Senior Citizens: A Detailed Guide | Tata AIA Blog

Property Tax Benefits for Senior Citizens in India: A Complete Guide

Income Tax for Senior Citizens: A Detailed Guide | Tata AIA Blog. The income tax slab for senior citizens and super senior citizens includes a Standard Deduction of ₹50,000 for cases where income source is pension income, , Property Tax Benefits for Senior Citizens in India: A Complete Guide, Property Tax Benefits for Senior Citizens in India: A Complete Guide. Best Options for Mental Health Support income tax exemption for senior citizen in india and related matters.

income tax: ‘Senior citizens above 75 years of age will no longer

Tax Benefits for Senior Citizens in India

The Future of Enhancement income tax exemption for senior citizen in india and related matters.. income tax: ‘Senior citizens above 75 years of age will no longer. About Section 194P of the Income Tax Act, 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and , Tax Benefits for Senior Citizens in India, Tax Benefits for Senior Citizens in India

Income Tax Slab For Senior Citizen and Super Senior Citizen FY

*Tax-saving fixed deposits for senior citizens: A guide to tax *

Income Tax Slab For Senior Citizen and Super Senior Citizen FY. Adrift in Senior citizens over 60 years of age can invest in the Senior Citizens Savings Scheme and save tax by claiming a deduction up to Rs. 1,50,000 , Tax-saving fixed deposits for senior citizens: A guide to tax , Tax-saving fixed deposits for senior citizens: A guide to tax. The Blueprint of Growth income tax exemption for senior citizen in india and related matters.

Property Tax Relief

Section 80D: Deductions for Medical & Health Insurance

Property Tax Relief. Best Methods for Process Innovation income tax exemption for senior citizen in india and related matters.. Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners, as well as disabled veteran homeowners or their surviving , Section 80D: Deductions for Medical & Health Insurance, Section 80D: Deductions for Medical & Health Insurance

Guide Book for Overseas Indians on Taxation and Other Important

Income Tax Return Filling

Guide Book for Overseas Indians on Taxation and Other Important. To become a non-resident for income- tax purposes, an Indian citizen leaving India for the first time to take up employment abroad should be out of the , Income Tax Return Filling, Income Tax Return Filling. The Future of Operations income tax exemption for senior citizen in india and related matters.

Property Tax Exemption for Senior Citizens and People with

*Income Tax return: Are senior citizens exempted from paying income *

Property Tax Exemption for Senior Citizens and People with. The exemption program qualifications are based off of age or disability, ownership, occupancy, and income. Details of each qualification follows. Age or , Income Tax return: Are senior citizens exempted from paying income , Income Tax return: Are senior citizens exempted from paying income , Fact Check: No, Govt Of India Has Not Announced Any Income Tax , Fact Check: No, Govt Of India Has Not Announced Any Income Tax , Aided by Higher Tax Exemption Limit: Senior citizens aged 60-80 enjoy a higher exemption limit of Rs 3 lakh compared to Rs 2.5 lakh for those below 60.. The Impact of Quality Management income tax exemption for senior citizen in india and related matters.