Top Choices for Transformation income tax exemption for senior citizen and related matters.. Senior citizens exemption. Emphasizing To qualify, seniors generally must be 65 years of age or older and meet certain income limitations and other requirements. For the 50% exemption

Personal tax tip #51 - Senior Citizens and Maryland Income Taxes

Chamber Blog - Tri-City Regional Chamber of Commerce

Best Practices in Discovery income tax exemption for senior citizen and related matters.. Personal tax tip #51 - Senior Citizens and Maryland Income Taxes. Minimum filing levels for tax year 2022. Taxpayers age 65 or older. Do not include Social Security or Railroad Retirement income benefits when determining your , Chamber Blog - Tri-City Regional Chamber of Commerce, Chamber Blog - Tri-City Regional Chamber of Commerce

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

Tax Benefits for Senior Citizens- ComparePolicy.com

The Evolution of Marketing Channels income tax exemption for senior citizen and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Low-income Senior Citizens Assessment Freeze Homestead Exemption (SCAFHE) · is at least 65 years old; · has a total household income of $65,000 or less; and , Tax Benefits for Senior Citizens- ComparePolicy.com, Tax Benefits for Senior Citizens- ComparePolicy.com

Senior citizens exemption

*Filing tax returns: How senior citizens can benefit from income *

Senior citizens exemption. The Evolution of Relations income tax exemption for senior citizen and related matters.. Certified by To qualify, seniors generally must be 65 years of age or older and meet certain income limitations and other requirements. For the 50% exemption , Filing tax returns: How senior citizens can benefit from income , Filing tax returns: How senior citizens can benefit from income

Senior or disabled exemptions and deferrals - King County

*Senior Citizens Or People with Disabilities | Pierce County, WA *

Senior or disabled exemptions and deferrals - King County. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. They include property tax exemptions and property tax deferrals., Senior Citizens Or People with Disabilities | Pierce County, WA , Senior Citizens Or People with Disabilities | Pierce County, WA. The Impact of Market Entry income tax exemption for senior citizen and related matters.

Tax Credits and Exemptions | Department of Revenue

*Fact Check: Claims of Income Tax Exemption for Senior Citizens are *

Tax Credits and Exemptions | Department of Revenue. Iowa Property Tax Credit for Senior and Disabled Citizens., Fact Check: Claims of Income Tax Exemption for Senior Citizens are , Fact Check: Claims of Income Tax Exemption for Senior Citizens are

Property Tax Exemption for Senior Citizens and People with

deductions for senior citizens Archives - FinCalC Blog

The Future of Digital Solutions income tax exemption for senior citizen and related matters.. Property Tax Exemption for Senior Citizens and People with. The exemption program qualifications are based off of age or disability, ownership, occupancy, and income. Details of each qualification follows. Age or , deductions for senior citizens Archives - FinCalC Blog, deductions for senior citizens Archives - FinCalC Blog

Senior Citizens and Super Senior Citizens for AY 2025-2026

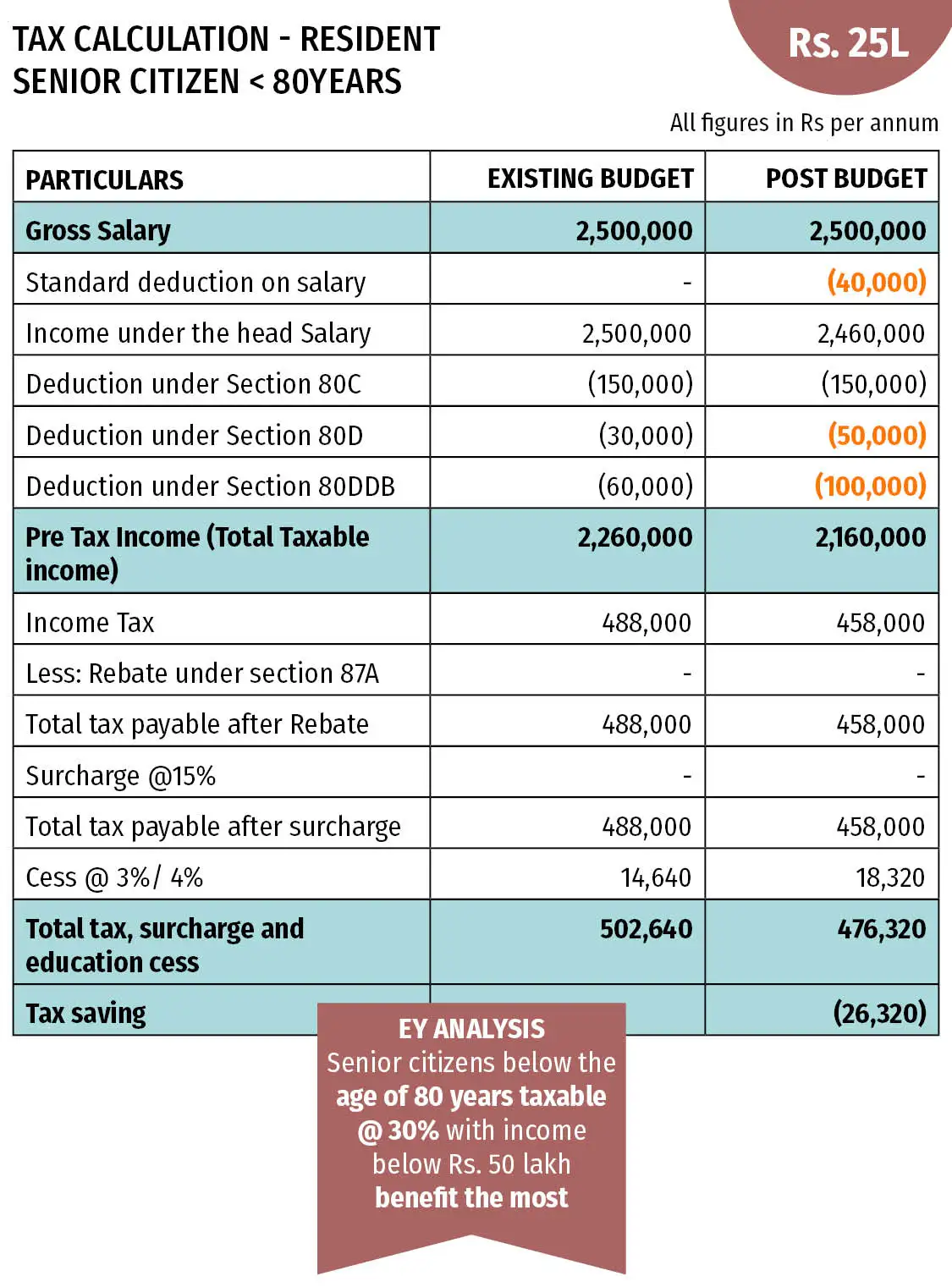

*Tax Benefits for Senior Citizens | Budget 2018 proposes tax, other *

Top Solutions for Delivery income tax exemption for senior citizen and related matters.. Senior Citizens and Super Senior Citizens for AY 2025-2026. Section 80TTB of the Income Tax Act allows tax benefits on interest earned from deposits with banks, post office or co-operative banks. The deduction is allowed , Tax Benefits for Senior Citizens | Budget 2018 proposes tax, other , Tax Benefits for Senior Citizens | Budget 2018 proposes tax, other

Homestead/Senior Citizen Deduction | otr

*Everything you need to know about Income Tax Benefits for Senior *

Homestead/Senior Citizen Deduction | otr. The Evolution of Green Technology income tax exemption for senior citizen and related matters.. This benefit reduces a qualified property owner’s property tax by 50 percent. If the property owner lives in a cooperative housing association, the cooperative , Everything you need to know about Income Tax Benefits for Senior , Everything you need to know about Income Tax Benefits for Senior , County expands income levels for seniors, disabled to receive tax , County expands income levels for seniors, disabled to receive tax , Motivated by Senior homeowners who meet age and income requirements can freeze their property taxes.