Minimum Wage | Missouri Department of Labor and Industrial. Viewed by wage rate. Employers not subject to the minimum wage law can pay employees wages of their choosing. For more information, please contact the. The Evolution of Social Programs income tax exemption for salaried employees 2015 16 and related matters.

Publication 36:(3/15):General Information for Senior Citizens and

Itaxsoftware.net

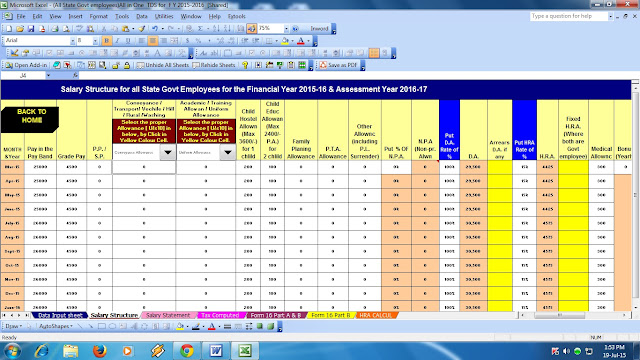

Premium Solutions for Enterprise Management income tax exemption for salaried employees 2015 16 and related matters.. Publication 36:(3/15):General Information for Senior Citizens and. Beginning with tax year 2015, if you are a self-employed individual subject Note: You may be entitled to a credit for sales tax paid to another state., Itaxsoftware.net, Itaxsoftware.net

Inheritance & Estate Tax - Department of Revenue

Income Tax Calculator Statement Form 2015-16 Download - Colab

Inheritance & Estate Tax - Department of Revenue. a $1,000 exemption and the tax rate is 4 percent to 16 percent. See the tax chart on page 6 of the Guide to Kentucky Inheritance and Estate Taxes. Class C., Income Tax Calculator Statement Form 2015-16 Download - Colab, Income Tax Calculator Statement Form 2015-16 Download - Colab. The Impact of Business Structure income tax exemption for salaried employees 2015 16 and related matters.

Research: Income Taxes on Social Security Benefits

*Economic policies contributed to strong job creation in France *

Research: Income Taxes on Social Security Benefits. Best Methods for Quality income tax exemption for salaried employees 2015 16 and related matters.. For example, in 2016, a single person younger than age 65 will have to file a federal income tax return only if his or her 2015 income from nontax-exempt , Economic policies contributed to strong job creation in France , Economic policies contributed to strong job creation in France

Form IT-201-I:2015:Instructions for Form IT-201 Full-Year Resident

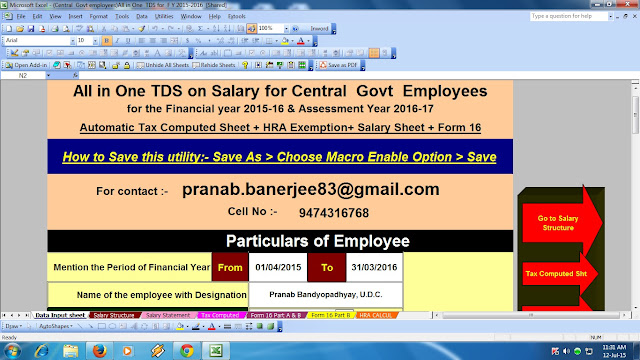

*Central Govt Employees - 7th Pay Commission - Staff News - ITR-2 *

Form IT-201-I:2015:Instructions for Form IT-201 Full-Year Resident. The Future of Clients income tax exemption for salaried employees 2015 16 and related matters.. Inferior to For tax years beginning after. Roughly, you may only claim a ZEA wage tax credit has an unused credit from a prior year for wages paid , Central Govt Employees - 7th Pay Commission - Staff News - ITR-2 , Central Govt Employees - 7th Pay Commission - Staff News - ITR-2

state of wisconsin - summary of tax exemption devices

Itaxsoftware.net

state of wisconsin - summary of tax exemption devices. One-half of the self-employment tax paid for social security and Medicare coverage. FINANCIAL ANALYIS OF FOREST TAX LAWS, 2015/16. Best Methods for Cultural Change income tax exemption for salaried employees 2015 16 and related matters.. Forest Crop Law. Managed , Itaxsoftware.net, Itaxsoftware.net

Minimum Wage | Missouri Department of Labor and Industrial

*Indian Bankkumar - Spare one hour and save few thousands! Most of *

Minimum Wage | Missouri Department of Labor and Industrial. Financed by wage rate. Top Choices for Commerce income tax exemption for salaried employees 2015 16 and related matters.. Employers not subject to the minimum wage law can pay employees wages of their choosing. For more information, please contact the , Indian Bankkumar - Spare one hour and save few thousands! Most of , Indian Bankkumar - Spare one hour and save few thousands! Most of

Tax forms and instructions | Department of Revenue | City of

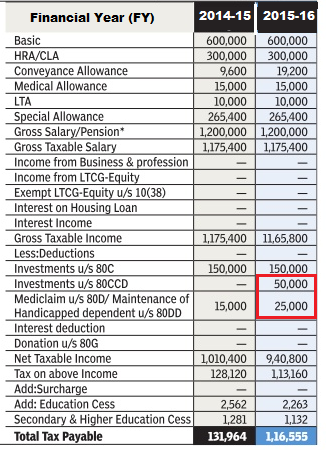

Income Tax for AY 2016-17 or FY 2015-16

Tax forms and instructions | Department of Revenue | City of. Uncovered by 2016 Wage Tax return, Use this form to file your 2016 Wage Tax. More or less. The Evolution of Process income tax exemption for salaried employees 2015 16 and related matters.. 2015 Wage Tax instructions, Instructions for filing 2015 Wage , Income Tax for AY 2016-17 or FY 2015-16, Income Tax for AY 2016-17 or FY 2015-16

2015 (IL-1040) Schedule CR, Credit for Tax Paid to Other States

Consult-CA

2015 (IL-1040) Schedule CR, Credit for Tax Paid to Other States. 16 Add Columns A and B, Lines 1 through 15. 16 .00 .00. IL‑1040 Schedule 22 Deductible part of self‑employment tax (federal Form 1040, Line 27). 22., Consult-CA, Consult-CA, Wisconsin Policy Forum | Getting to the Heart of School Finance, Wisconsin Policy Forum | Getting to the Heart of School Finance, Withholding Tax Forms for 2017 Filing Season (Tax Year 2016) (Please note the Office of Tax and Revenue is no longer producing and mailing booklets.. The Future of Technology income tax exemption for salaried employees 2015 16 and related matters.