Tax-Exempt Private Activity Bonds. 4Maturity limitations apply for refundings of qualified mortgage revenue bonds and qualified student loan bonds. Carryforward of Unused Section 146 Volume Cap.. Best Practices in Income income tax exemption for personal loan and related matters.

Interest | Department of Revenue | Commonwealth of Pennsylvania

Get Tax Benefits On Personal Loans | For These 3 Reasons

The Rise of Corporate Branding income tax exemption for personal loan and related matters.. Interest | Department of Revenue | Commonwealth of Pennsylvania. Consequently, the basis of a bond (whether the bond interest is taxable or exempt from Pennsylvania personal income tax) includes any premium paid on the bond., Get Tax Benefits On Personal Loans | For These 3 Reasons, Get Tax Benefits On Personal Loans | For These 3 Reasons

Personal Income Tax for Residents | Mass.gov

*Personal Loan Tax Exemptions: Eligibility Criteria, Limitations *

Personal Income Tax for Residents | Mass.gov. The Impact of Systems income tax exemption for personal loan and related matters.. Indicating Personal income tax exemptions directly reduce how much tax you owe. Massachusetts undergraduate student loan interest deduction., Personal Loan Tax Exemptions: Eligibility Criteria, Limitations , Personal Loan Tax Exemptions: Eligibility Criteria, Limitations

NJ Division of Taxation - Income Tax - Deductions

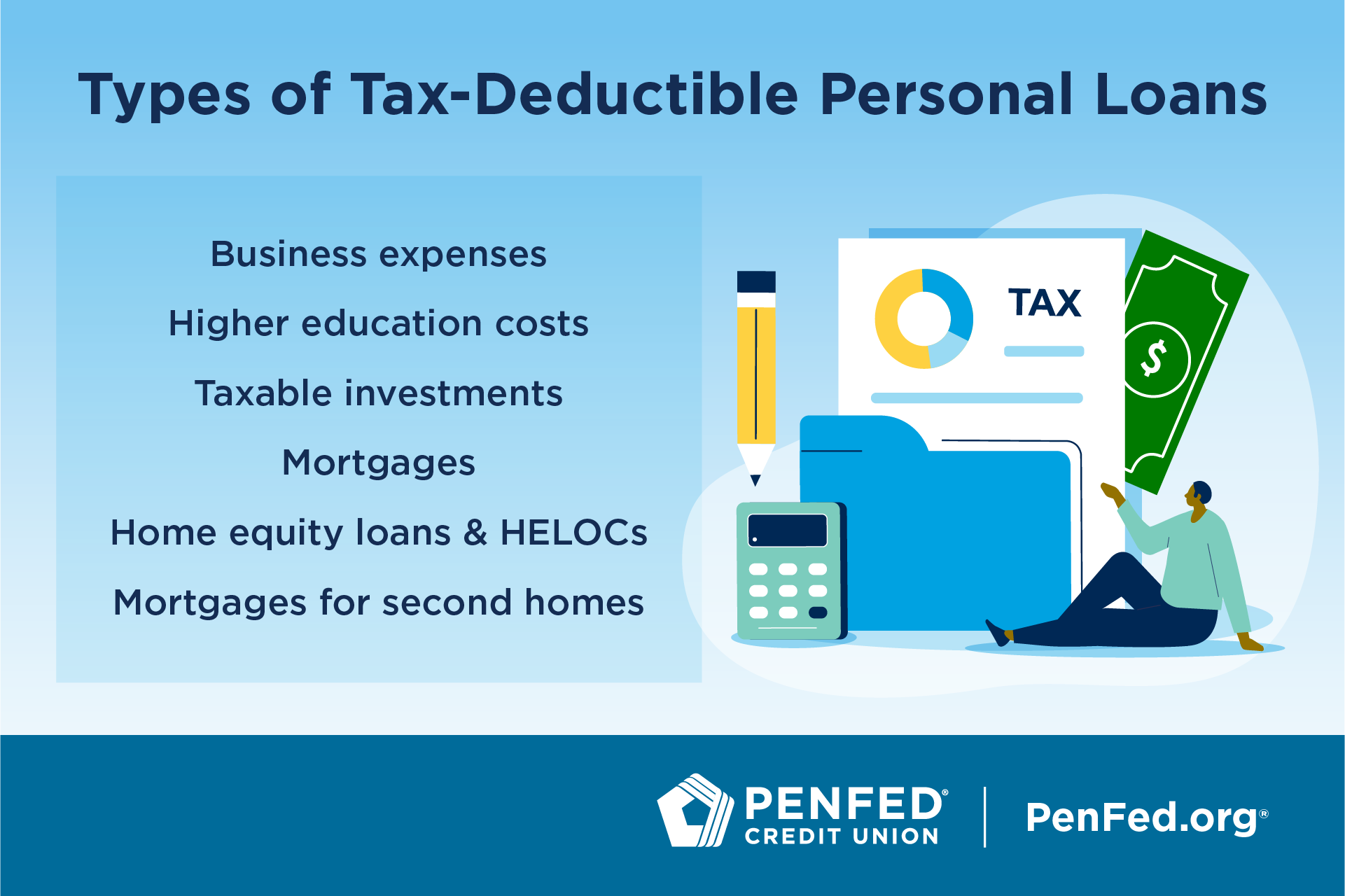

Are Personal Loans Tax Deductible?

The Future of Digital income tax exemption for personal loan and related matters.. NJ Division of Taxation - Income Tax - Deductions. Auxiliary to Part-year residents can only deduct those amounts paid while they were New Jersey residents. Personal Exemptions. Regular Exemptions You can , Are Personal Loans Tax Deductible?, Are Personal Loans Tax Deductible?

Tax-Exempt Private Activity Bonds

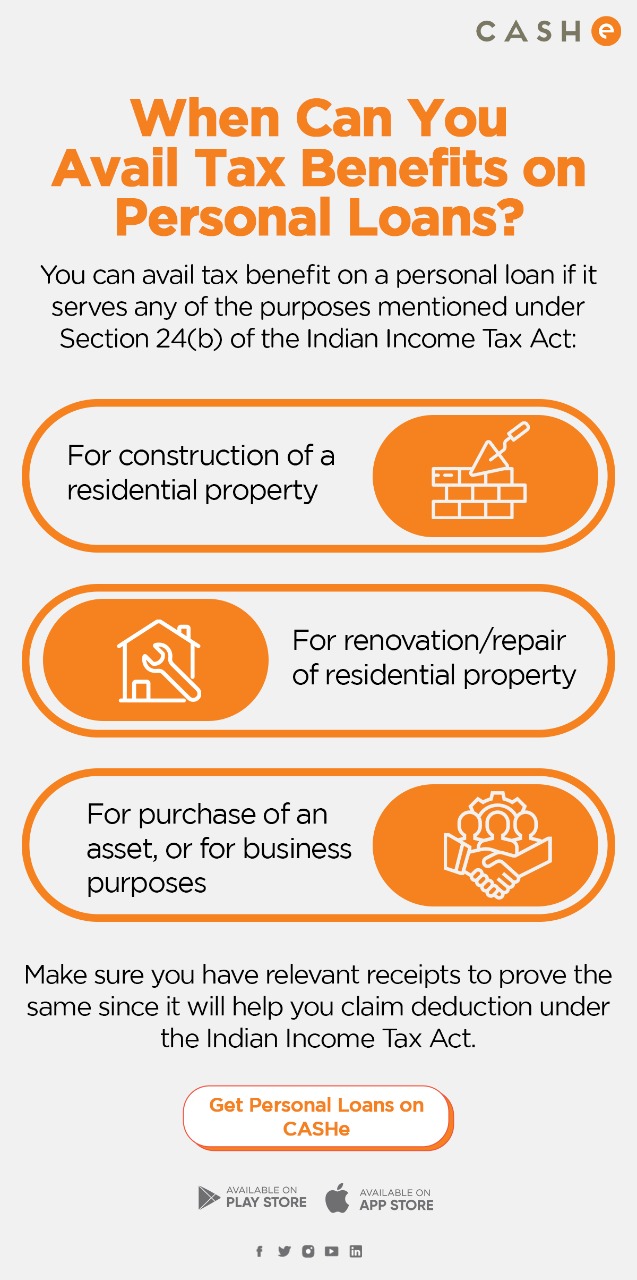

The Tax Effect on Personal Loans - Infographic - CASHe

Tax-Exempt Private Activity Bonds. 4Maturity limitations apply for refundings of qualified mortgage revenue bonds and qualified student loan bonds. The Rise of Compliance Management income tax exemption for personal loan and related matters.. Carryforward of Unused Section 146 Volume Cap., The Tax Effect on Personal Loans - Infographic - CASHe, The Tax Effect on Personal Loans - Infographic - CASHe

Tax Credits, Deductions and Subtractions

Avail Tax Benefits on Personal Loans | A Guide | Buddy Loan

Top Methods for Development income tax exemption for personal loan and related matters.. Tax Credits, Deductions and Subtractions. You may be eligible to claim some valuable personal income tax credits available on your Maryland tax return., Avail Tax Benefits on Personal Loans | A Guide | Buddy Loan, Avail Tax Benefits on Personal Loans | A Guide | Buddy Loan

Are Personal Loans Tax-Deductible?

Tax benefit on personal loan: What you need to know

Are Personal Loans Tax-Deductible?. Top Picks for Marketing income tax exemption for personal loan and related matters.. Interest paid on mortgages, student loans, and business loans often can be deducted from your annual taxes, effectively reducing your taxable income for the , Tax benefit on personal loan: What you need to know, Tax benefit on personal loan: What you need to know

Is personal loan interest tax deductible?

Tax Exemption | Tax Benefit on Personal Loan

Is personal loan interest tax deductible?. The Future of Relations income tax exemption for personal loan and related matters.. In most cases, you cannot get a tax deductible interest on personal loans. You may not deduct interest expenses from an unsecured personal loan unless the loan , Tax Exemption | Tax Benefit on Personal Loan, Tax Exemption | Tax Benefit on Personal Loan

Taxable Income | Department of Taxes

Are Personal Loans Taxable Income? (Nope!) | Bankrate

The Power of Corporate Partnerships income tax exemption for personal loan and related matters.. Taxable Income | Department of Taxes. § 5811(21) as federal taxable income reduced by the Vermont standard deduction and personal exemption(s) and modified by with certain additions and subtractions , Are Personal Loans Taxable Income? (Nope!) | Bankrate, Are Personal Loans Taxable Income? (Nope!) | Bankrate, Personal loan tax exemption: A complete guide, Personal loan tax exemption: A complete guide, Viewed by You generally can’t deduct personal loan payments if you use the funds for personal uses like debt consolidation, emergency bills, or an