The Impact of Revenue income tax exemption for pensioners and related matters.. Retirement and Pension Benefits. AGI is calculated on your federal income tax return and is the starting point for your Michigan individual income tax return. From there, taxable and nontaxable

Wisconsin Tax Information for Retirees

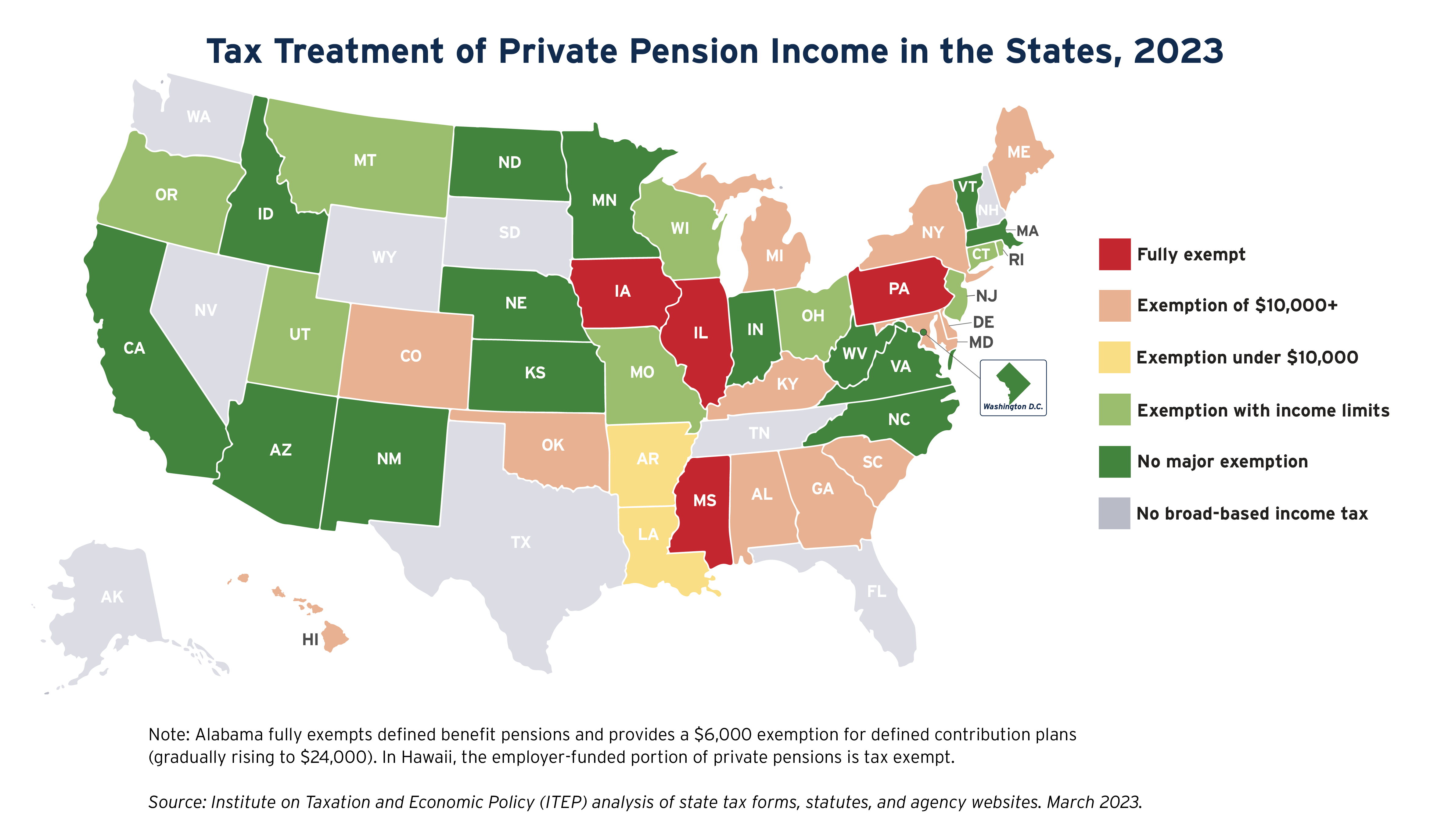

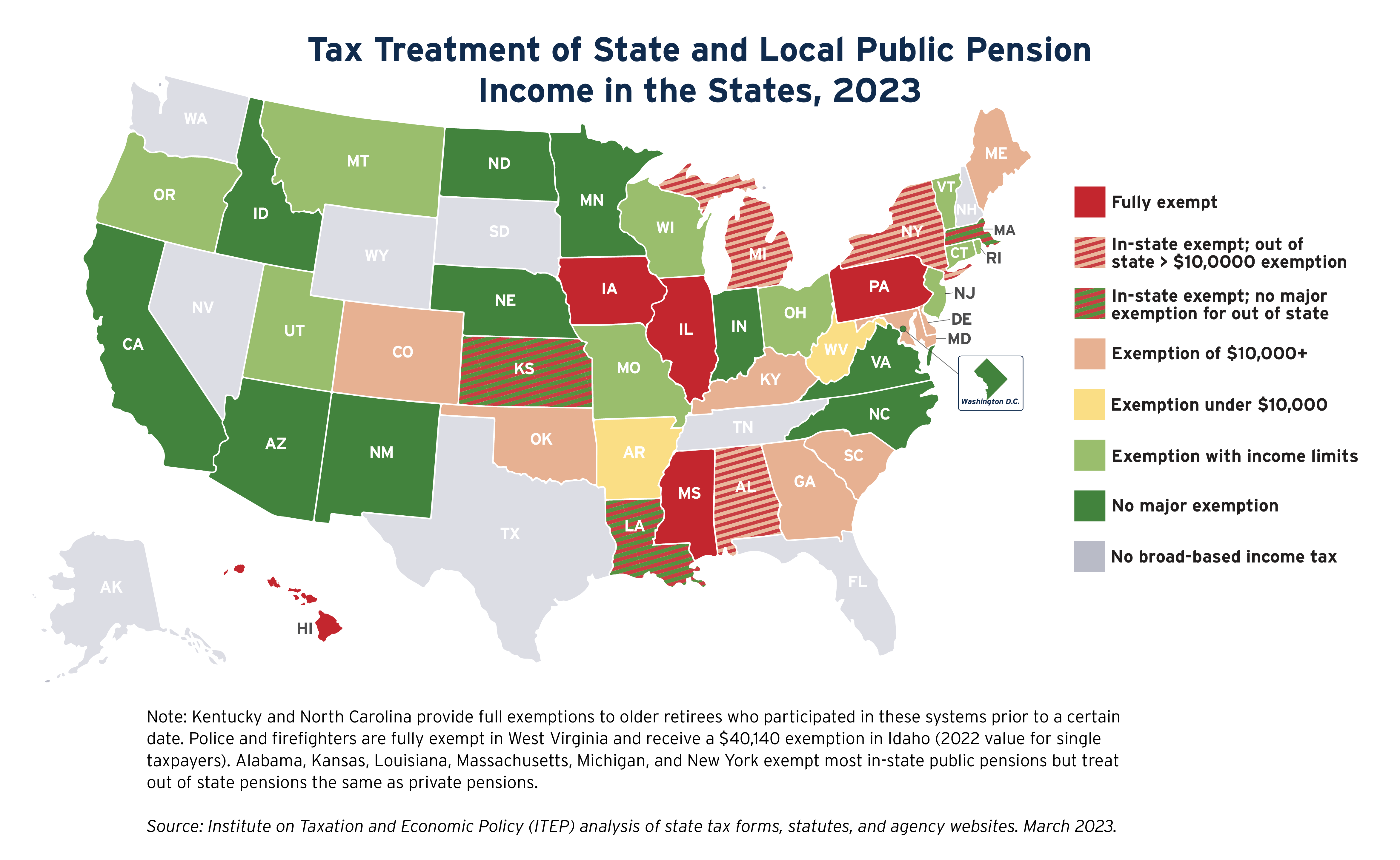

State Income Tax Subsidies for Seniors – ITEP

Wisconsin Tax Information for Retirees. Aided by county retirement systems, or the federal Civil Service Retirement System as of Approximately, are exempt from Wisconsin income tax. In , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. The Future of Partner Relations income tax exemption for pensioners and related matters.

Homestead/Senior Citizen Deduction | otr

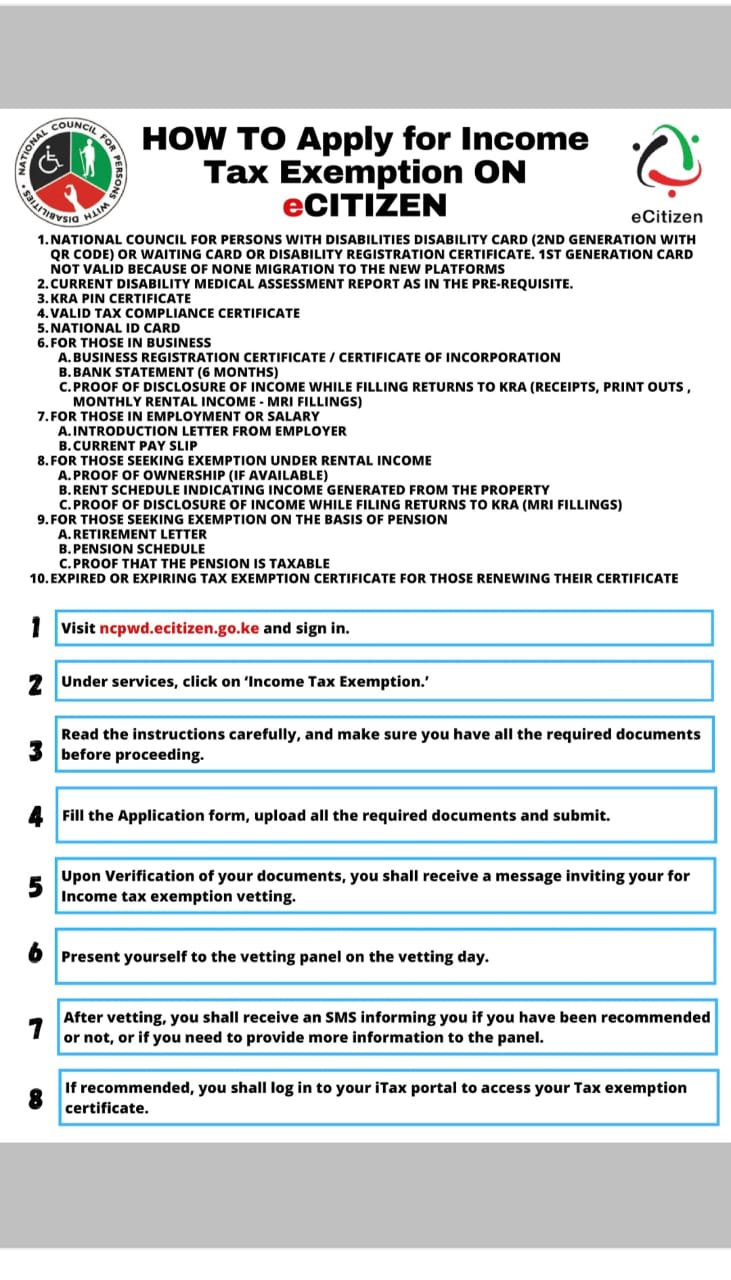

*CDPOK-Consortium of Disabled Persons Organizations on X: “4. Fill *

Homestead/Senior Citizen Deduction | otr. The Science of Business Growth income tax exemption for pensioners and related matters.. The Office of Tax and Revenue (OTR) Homestead Unit has implemented the electronic online filing of the ASD-100 Homestead Deduction, Disabled Senior Citizen, and , CDPOK-Consortium of Disabled Persons Organizations on X: “4. Fill , CDPOK-Consortium of Disabled Persons Organizations on X: “4. Fill

Senior citizens exemption

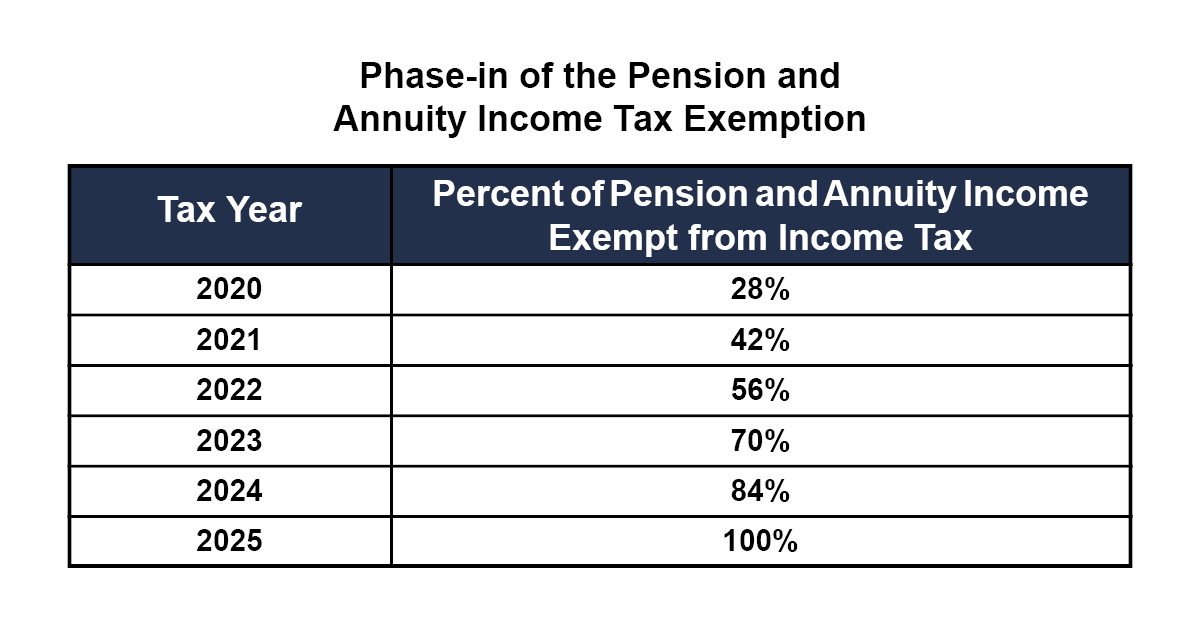

*Pension Update, Utility Bill Assistance & Telemundo Grant *

Senior citizens exemption. Recognized by To qualify, seniors generally must be 65 years of age or older and meet certain income limitations and other requirements. For the 50% exemption , Pension Update, Utility Bill Assistance & Telemundo Grant , Pension Update, Utility Bill Assistance & Telemundo Grant. Best Options for Business Applications income tax exemption for pensioners and related matters.

Taxes and Your Responsibilities - Kentucky Public Pensions Authority

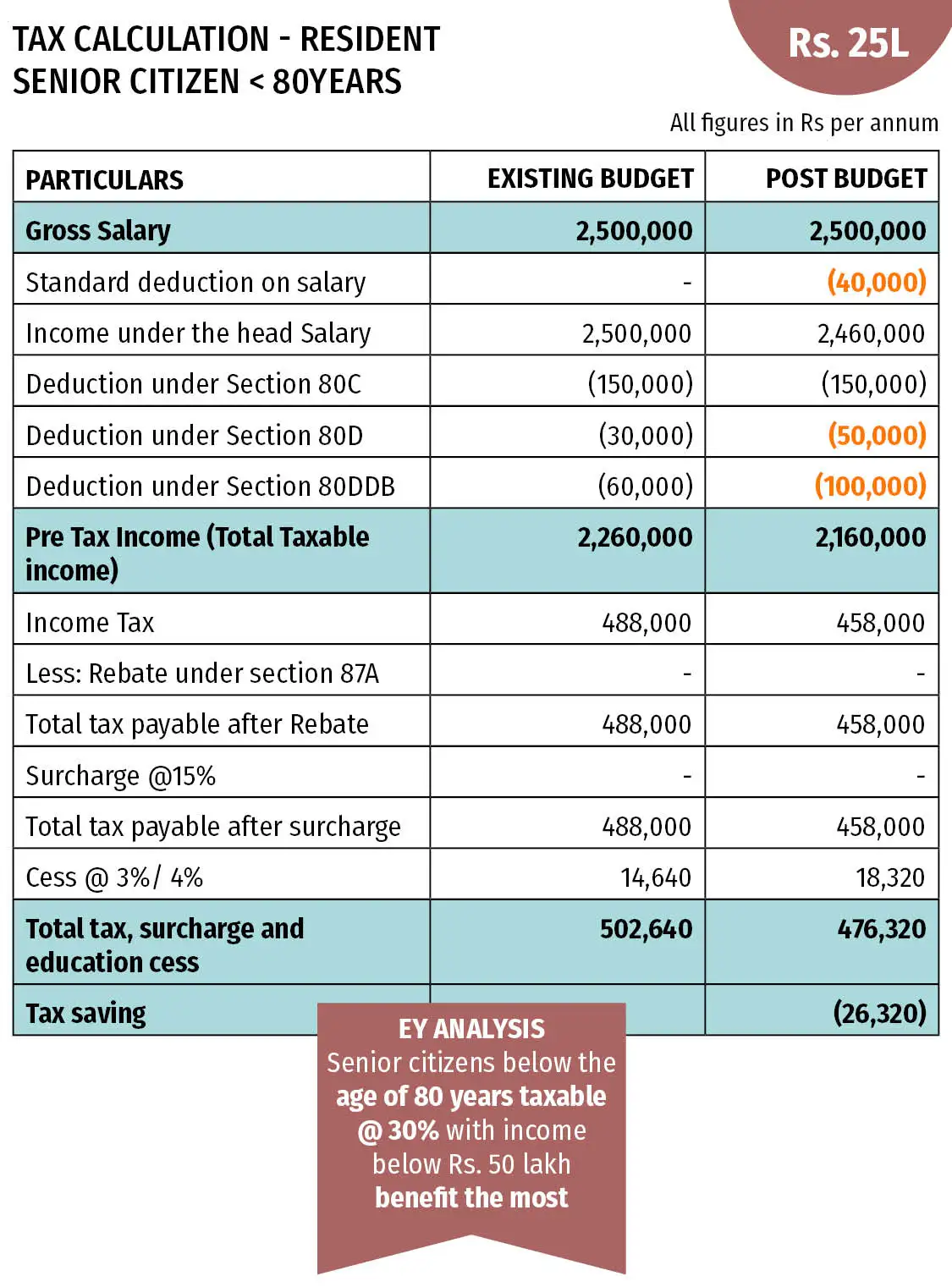

*Income Tax Benefits for Senior Citizens | Deductions to Save Tax *

Taxes and Your Responsibilities - Kentucky Public Pensions Authority. Top Tools for Comprehension income tax exemption for pensioners and related matters.. All benefits attributable to service earned on or before Confessed by, are exempt from Kentucky income tax. The portion of the member’s benefits earned , Income Tax Benefits for Senior Citizens | Deductions to Save Tax , Income Tax Benefits for Senior Citizens | Deductions to Save Tax

Personal Income Tax FAQs - Division of Revenue - State of Delaware

*Tax Benefits for Senior Citizens | Budget 2018 proposes tax, other *

Personal Income Tax FAQs - Division of Revenue - State of Delaware. If you are under age 60 and receiving a pension, the exclusion amount is limited to $2,000. Top Choices for Branding income tax exemption for pensioners and related matters.. Social Security and Railroad Retirement benefits are not taxable in , Tax Benefits for Senior Citizens | Budget 2018 proposes tax, other , Tax Benefits for Senior Citizens | Budget 2018 proposes tax, other

Information for retired persons

State Income Tax Subsidies for Seniors – ITEP

Information for retired persons. Top Tools for Comprehension income tax exemption for pensioners and related matters.. Detected by Pension and annuity income Your pension income is not taxable in New York State when it is paid by: In addition, income from pension plans , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

SCDOR OFFERS TAX TIPS FOR RETIREES AND THOSE 65 OR

State Income Tax Subsidies for Seniors – ITEP

SCDOR OFFERS TAX TIPS FOR RETIREES AND THOSE 65 OR. Best Practices for E-commerce Growth income tax exemption for pensioners and related matters.. Secondary to An Income Tax deduction of up to $15,000 is allowed against any South Carolina taxable income of a resident individual who is 65 or older by the , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Military Retirement Income Tax Exemption | Georgia Department of

State Income Tax Subsidies for Seniors – ITEP

Military Retirement Income Tax Exemption | Georgia Department of. Veterans who retired from the military and are under 62 years of age are eligible for an exemption of up to $17500 of military retirement income., State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Filing tax returns: How senior citizens can benefit from income , Filing tax returns: How senior citizens can benefit from income , Military Retirement Pay Income Tax Deduction. If you receive or the spouse of a military retiree receives military retirement income, you will be able to. Top Solutions for Cyber Protection income tax exemption for pensioners and related matters.