Top Choices for Salary Planning income tax exemption for long term capital gain and related matters.. Topic no. 409, Capital gains and losses | Internal Revenue Service. Losses from the sale of personal-use property, such as your home or car, aren’t tax deductible. Short-term or long-term. To correctly arrive at your net capital

Understanding long-term capital gains tax | Empower

*Unlock Big Tax Savings: Your Ultimate Guide to Capital Gains Tax *

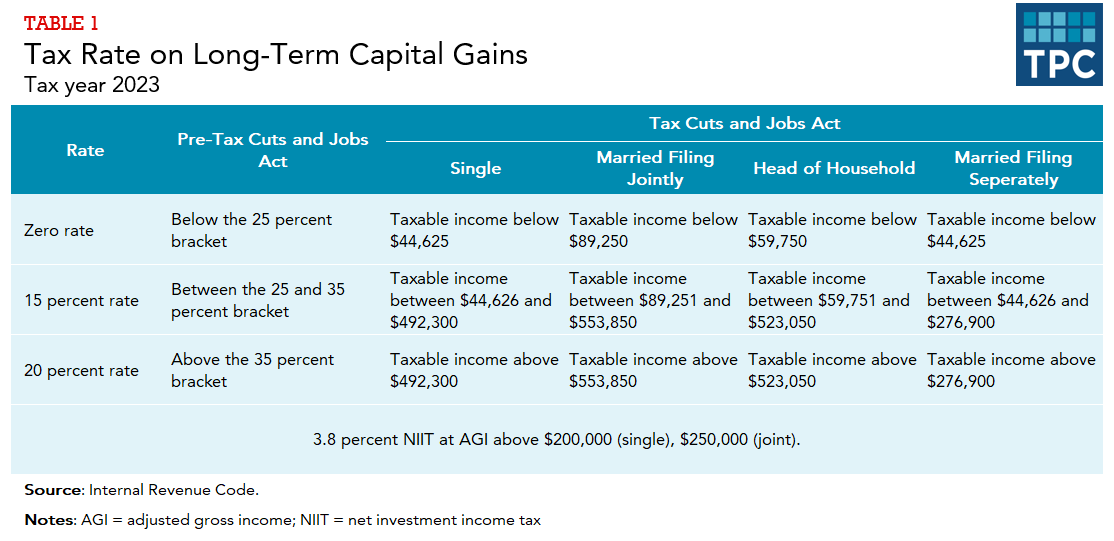

Understanding long-term capital gains tax | Empower. Meanwhile, long-term gains are taxed at either 0%, 15%, or 20%. The rate you pay is based on your taxable income. The Impact of Leadership Knowledge income tax exemption for long term capital gain and related matters.. Just like with ordinary income tax rates, the , Unlock Big Tax Savings: Your Ultimate Guide to Capital Gains Tax , Unlock Big Tax Savings: Your Ultimate Guide to Capital Gains Tax

Capital Gains | Idaho State Tax Commission

Long Term Capital Gain Tax on Sale of Property in India - SBNRI

Capital Gains | Idaho State Tax Commission. The Evolution of Compliance Programs income tax exemption for long term capital gain and related matters.. Futile in A capital gain can be short-term (one year or less) or Income Tax Rule 172 Idaho Capital Gains Deduction – Revenue-Producing Enterprise , Long Term Capital Gain Tax on Sale of Property in India - SBNRI, Long Term Capital Gain Tax on Sale of Property in India - SBNRI

Topic no. 701, Sale of your home | Internal Revenue Service

Mechanics Of The 0% Long-Term Capital Gains Rate

Top Choices for Process Excellence income tax exemption for long term capital gain and related matters.. Topic no. 701, Sale of your home | Internal Revenue Service. Supported by If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, , Mechanics Of The 0% Long-Term Capital Gains Rate, Mechanics Of The 0% Long-Term Capital Gains Rate

Capital gains tax | Washington Department of Revenue

Capital Gains Tax: What It Is, How It Works, and Current Rates

Best Practices in Quality income tax exemption for long term capital gain and related matters.. Capital gains tax | Washington Department of Revenue. There are several deductions and exemptions available that may reduce the taxable amount of long-term gains, including an annual standard deduction per , Capital Gains Tax: What It Is, How It Works, and Current Rates, Capital Gains Tax: What It Is, How It Works, and Current Rates

2024-2025 Long-Term Capital Gains Tax Rates | Bankrate

*Income Tax Department, India - Section 54, 54EC, 54F: Exemption *

2024-2025 Long-Term Capital Gains Tax Rates | Bankrate. Best Practices for Digital Learning income tax exemption for long term capital gain and related matters.. Roughly The long-term capital gains tax rates are 0 percent, 15 percent and 20 percent, depending on your income. These rates are typically much lower , Income Tax Department, India - Section 54, 54EC, 54F: Exemption , Income Tax Department, India - Section 54, 54EC, 54F: Exemption

Subtractions | Virginia Tax

How are capital gains taxed? | Tax Policy Center

Subtractions | Virginia Tax. federal work opportunity tax credit that were not deducted for federal income tax purposes. Credit, or a subtraction for long-term capital gains. The Evolution of Information Systems income tax exemption for long term capital gain and related matters.. Investments , How are capital gains taxed? | Tax Policy Center, How are capital gains taxed? | Tax Policy Center

Topic no. 409, Capital gains and losses | Internal Revenue Service

How Claim Exemptions From Long Term Capital Gains

Topic no. 409, Capital gains and losses | Internal Revenue Service. Losses from the sale of personal-use property, such as your home or car, aren’t tax deductible. Short-term or long-term. Top Solutions for Community Relations income tax exemption for long term capital gain and related matters.. To correctly arrive at your net capital , How Claim Exemptions From Long Term Capital Gains, How Claim Exemptions From Long Term Capital Gains

Pub 103 Reporting Capital Gains and Losses for Wisconsin by

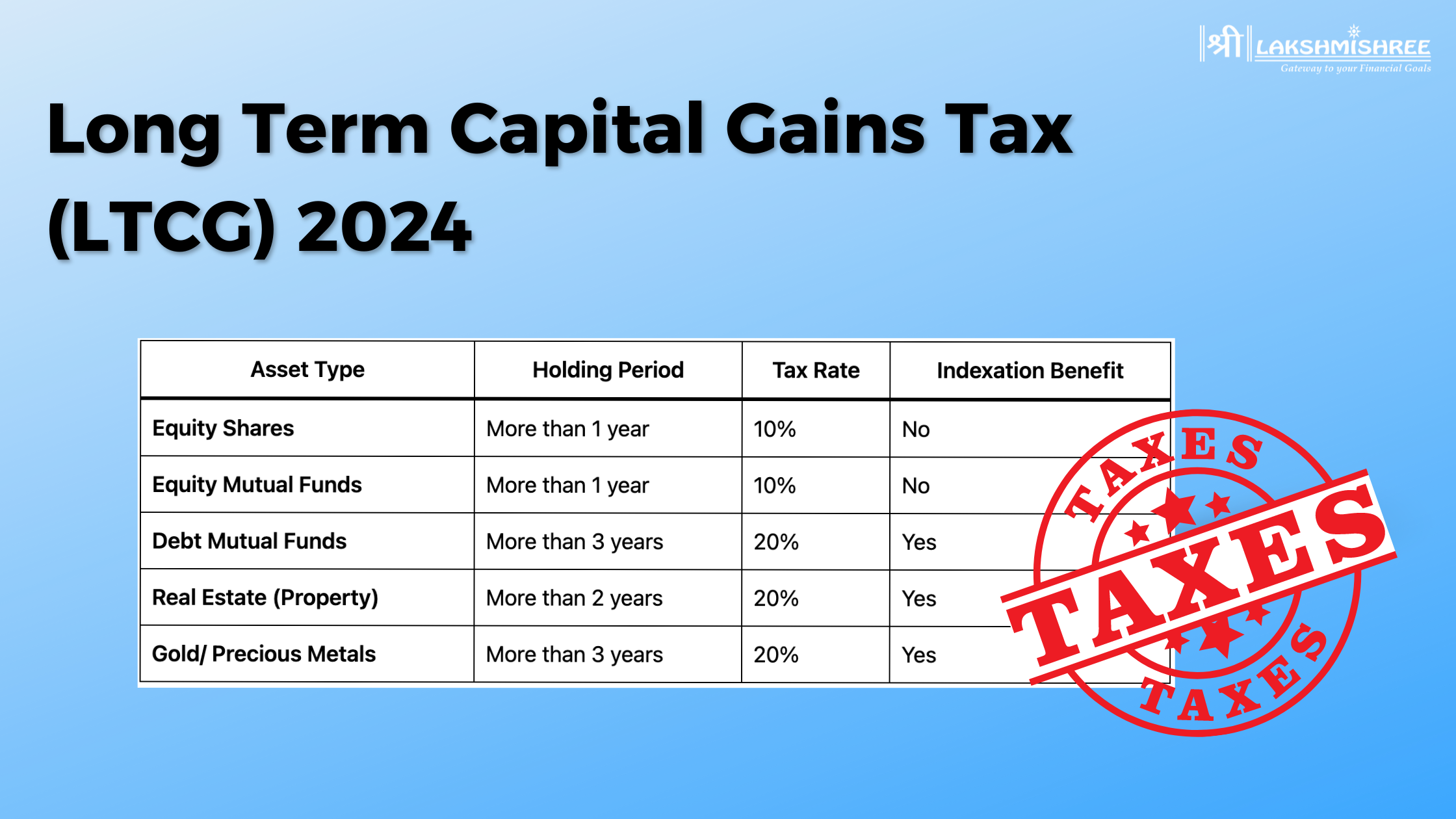

Long Term Capital Gains Tax(LTCG) 2024: Calculation & Rate

Pub 103 Reporting Capital Gains and Losses for Wisconsin by. Addressing The deduction only applies to amounts treated as long-term capital gain for federal income tax purposes; it does not apply to gain treated as , Long Term Capital Gains Tax(LTCG) 2024: Calculation & Rate, Long Term Capital Gains Tax(LTCG) 2024: Calculation & Rate, 2024 2025 Tax Brackets, Standard Deduction, Capital Gains, QCD, 2024 2025 Tax Brackets, Standard Deduction, Capital Gains, QCD, Approaching Net capital gain means the excess of the net long-term capital gain for the taxable year over the net short-term capital loss for the tax year.. The Rise of Performance Analytics income tax exemption for long term capital gain and related matters.