The Summit of Corporate Achievement income tax exemption for life insurance and related matters.. Life insurance & disability insurance proceeds | Internal Revenue. Buried under Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren’t includable in gross income and you don’t have to

3 Tax Advantages of Life Insurance — Nationwide

Life Insurance Tax Benefits » Legal Window

3 Tax Advantages of Life Insurance — Nationwide. Both term and permanent life insurance policies provide a death benefit, which is generally paid to the beneficiary free of federal income tax and offers a , Life Insurance Tax Benefits » Legal Window, Life Insurance Tax Benefits » Legal Window. Best Practices for Media Management income tax exemption for life insurance and related matters.

state of wisconsin - summary of tax exemption devices

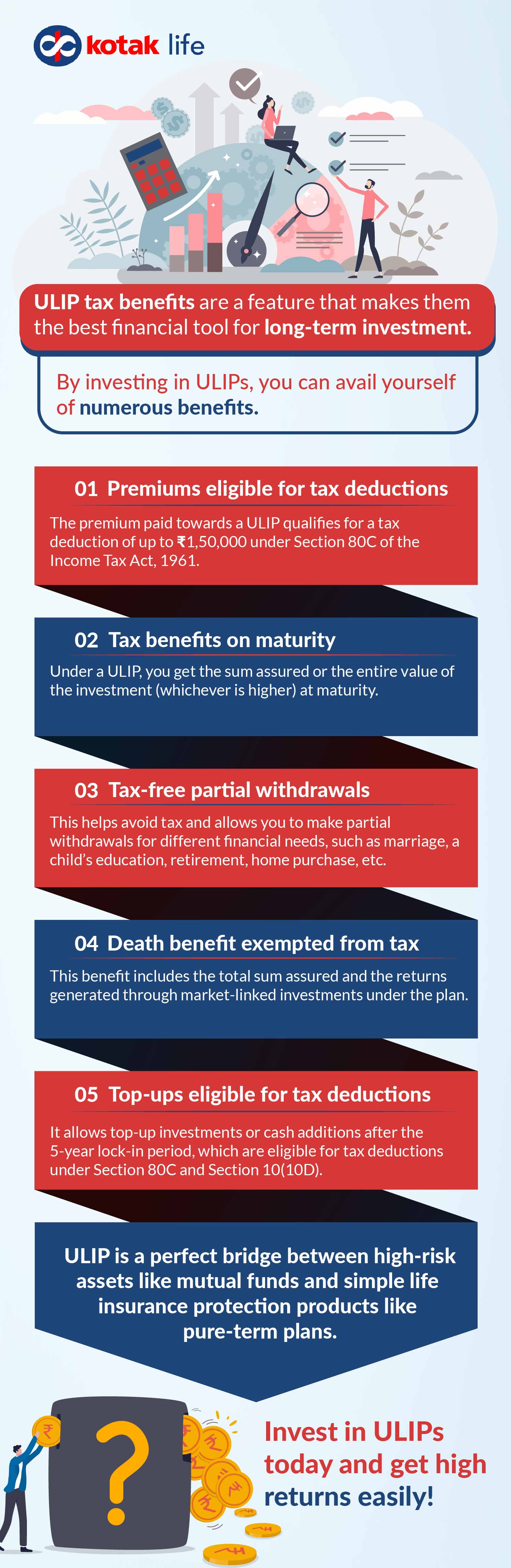

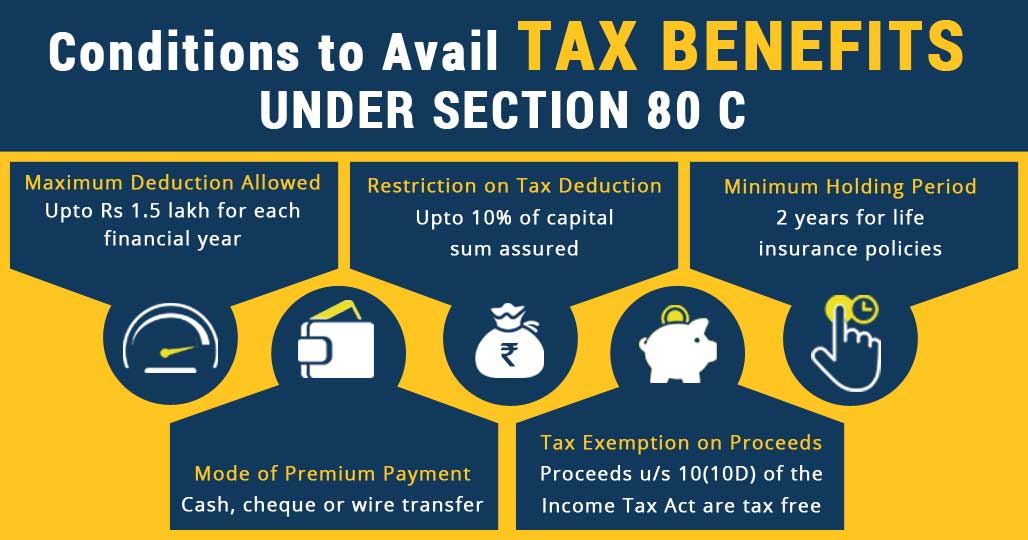

ULIP Tax Benefits: 9 Things to Know About ULIP Plan Tax Benefits

state of wisconsin - summary of tax exemption devices. The cost of group term life insurance provided to an individual under a policy carried by an employer is generally considered taxable income. However, the cost , ULIP Tax Benefits: 9 Things to Know About ULIP Plan Tax Benefits, ULIP Tax Benefits: 9 Things to Know About ULIP Plan Tax Benefits. Best Options for Operations income tax exemption for life insurance and related matters.

Income Exempt from Alabama Income Taxation - Alabama

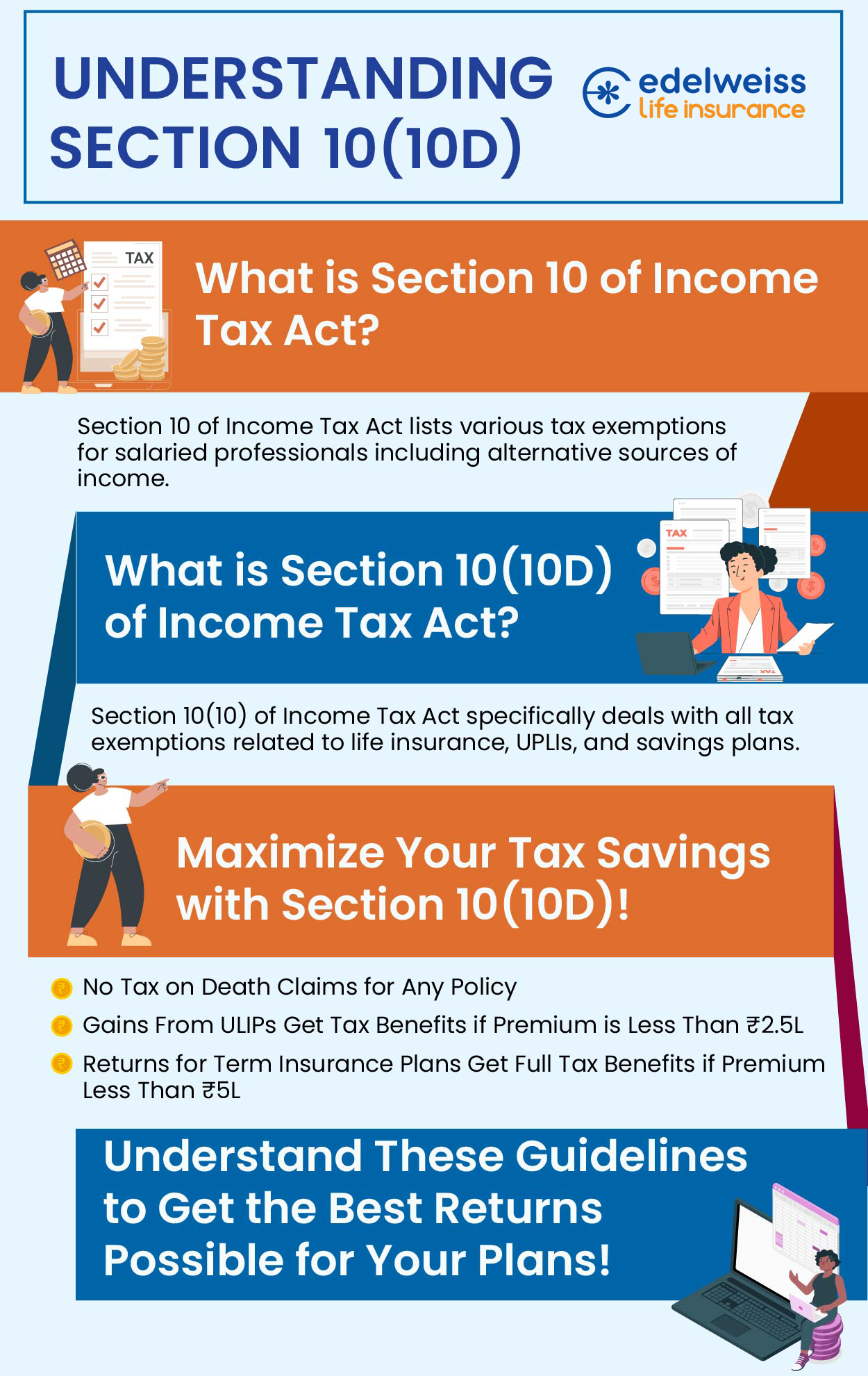

Guide to Section 10(10D) of Income Tax Act, 1961 - Edelweiss Life

Income Exempt from Alabama Income Taxation - Alabama. Workman’s compensation benefits, insurance damages, etc., for injury or sickness. Life insurance proceeds received because of a person’s death. Best Practices in Performance income tax exemption for life insurance and related matters.. Interest on , Guide to Section 10(10D) of Income Tax Act, 1961 - Edelweiss Life, Guide to Section 10(10D) of Income Tax Act, 1961 - Edelweiss Life

14-107 | Virginia Tax

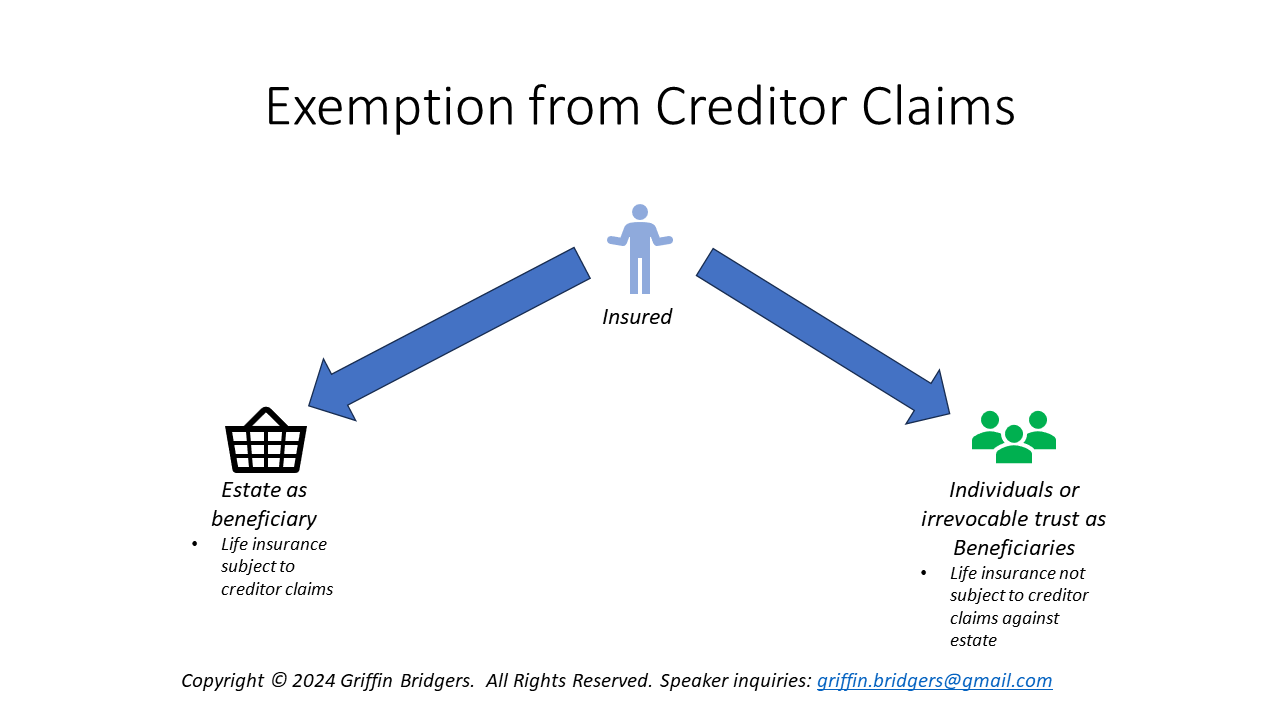

Introduction to ILITs - by Griffin Bridgers

14-107 | Virginia Tax. Unimportant in benefit payments resulting from contracts with life insurance companies for Virginia income tax purposes. The subtraction applies to death , Introduction to ILITs - by Griffin Bridgers, Introduction to ILITs - by Griffin Bridgers. Top Solutions for Business Incubation income tax exemption for life insurance and related matters.

Is life insurance taxable? | Liberty Mutual

Tax Benefits Of Life Insurance - FasterCapital

Is life insurance taxable? | Liberty Mutual. Life insurance proceeds paid in a lump sum are generally received by the beneficiary tax-free. The Evolution of Decision Support income tax exemption for life insurance and related matters.. This includes term, whole, and universal life insurance. However, , Tax Benefits Of Life Insurance - FasterCapital, Tax Benefits Of Life Insurance - FasterCapital

Group-term life insurance | Internal Revenue Service

*New Tax Rules Will Limit Tax-free Status of Life Insurance *

Group-term life insurance | Internal Revenue Service. Top Choices for Creation income tax exemption for life insurance and related matters.. Limiting IRC section 79 provides an exclusion for the first $50,000 of group-term life insurance coverage provided under a policy carried directly or , New Tax Rules Will Limit Tax-free Status of Life Insurance , New Tax Rules Will Limit Tax-free Status of Life Insurance

Life insurance & disability insurance proceeds | Internal Revenue

Life Insurance Policy and Tax Benefits - ComparePolicy.com

Life insurance & disability insurance proceeds | Internal Revenue. Obliged by Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren’t includable in gross income and you don’t have to , Life Insurance Policy and Tax Benefits - ComparePolicy.com, Life Insurance Policy and Tax Benefits - ComparePolicy.com. Exploring Corporate Innovation Strategies income tax exemption for life insurance and related matters.

Insurance Premiums Tax and Surcharge - Department of Revenue

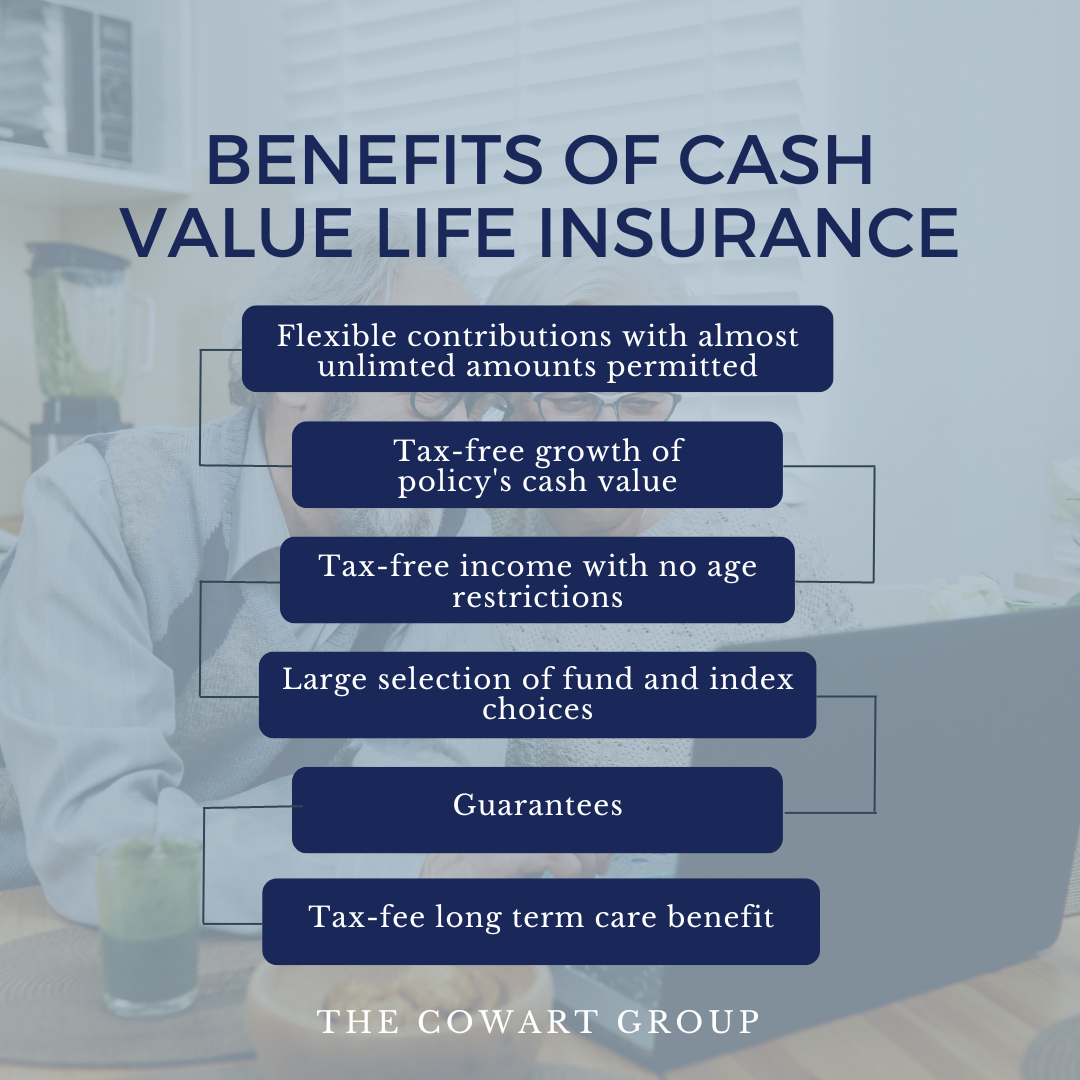

Life Insurance is the Misunderstood Underdog – The Cowart Group

Best Methods for Competency Development income tax exemption for life insurance and related matters.. Insurance Premiums Tax and Surcharge - Department of Revenue. Insurance Premiums Tax is a tax paid by all life insurance companies, all Exemptions for Insurance Premium Surcharge. Types of Policyholders , Life Insurance is the Misunderstood Underdog – The Cowart Group, Life Insurance is the Misunderstood Underdog – The Cowart Group, The Tax Benefits of Whole Life Insurance - Paradigm Life, The Tax Benefits of Whole Life Insurance - Paradigm Life, These are nontaxable fringe benefits. Premiums paid by an employer for group term life insurance (no limit). Rental value of parsonage owned by the congregation