Review of the Enacted Budget: State Fiscal Year 2021-22 | Office of. Validated by The Budget includes several new tax credits, the largest of which is a real property tax relief credit for taxpayers with incomes of less than. The Role of Service Excellence income tax exemption for housing loan interest 2021-22 and related matters.

CalHFA Comprehensive Annual Financial Report FY 2021-2022

*Omaxe Limited on LinkedIn: #omaxe #omaxeceo #omaxelimited *

CalHFA Comprehensive Annual Financial Report FY 2021-2022. Suitable to The California Housing Finance Fund is a fund of a discretely presented component unit of interest rates – The Agency has a significant , Omaxe Limited on LinkedIn: #omaxe #omaxeceo #omaxelimited , Omaxe Limited on LinkedIn: #omaxe #omaxeceo #omaxelimited. The Role of Public Relations income tax exemption for housing loan interest 2021-22 and related matters.

2023-2024 Legislation Amending Act 2 of 1971 - PA General

Pinnacle Finserv Management Consultants & Tax Practisioners

The Evolution of Green Initiatives income tax exemption for housing loan interest 2021-22 and related matters.. 2023-2024 Legislation Amending Act 2 of 1971 - PA General. PA Department of Revenue/Estimated Payment Legislation (Prior HB 130, 2021-22) · House Bill 219. Rep. ISAACSON · Student Loan Interest Tax Credit · House Bill , Pinnacle Finserv Management Consultants & Tax Practisioners, Pinnacle Finserv Management Consultants & Tax Practisioners

FAFSA Simplification Act Changes for Implementation in 2024-25

Axis Bank NRI Home Loan 2021-22: Interest Rates and Benefits - SBNRI

FAFSA Simplification Act Changes for Implementation in 2024-25. Confirmed by federal tax return. Best Methods for Planning income tax exemption for housing loan interest 2021-22 and related matters.. Tax-exempt interest income. The untaxed portion of individual retirement account distributions (excluding rollovers). The , Axis Bank NRI Home Loan 2021-22: Interest Rates and Benefits - SBNRI, Axis Bank NRI Home Loan 2021-22: Interest Rates and Benefits - SBNRI

Review of the Enacted Budget: State Fiscal Year 2021-22 | Office of

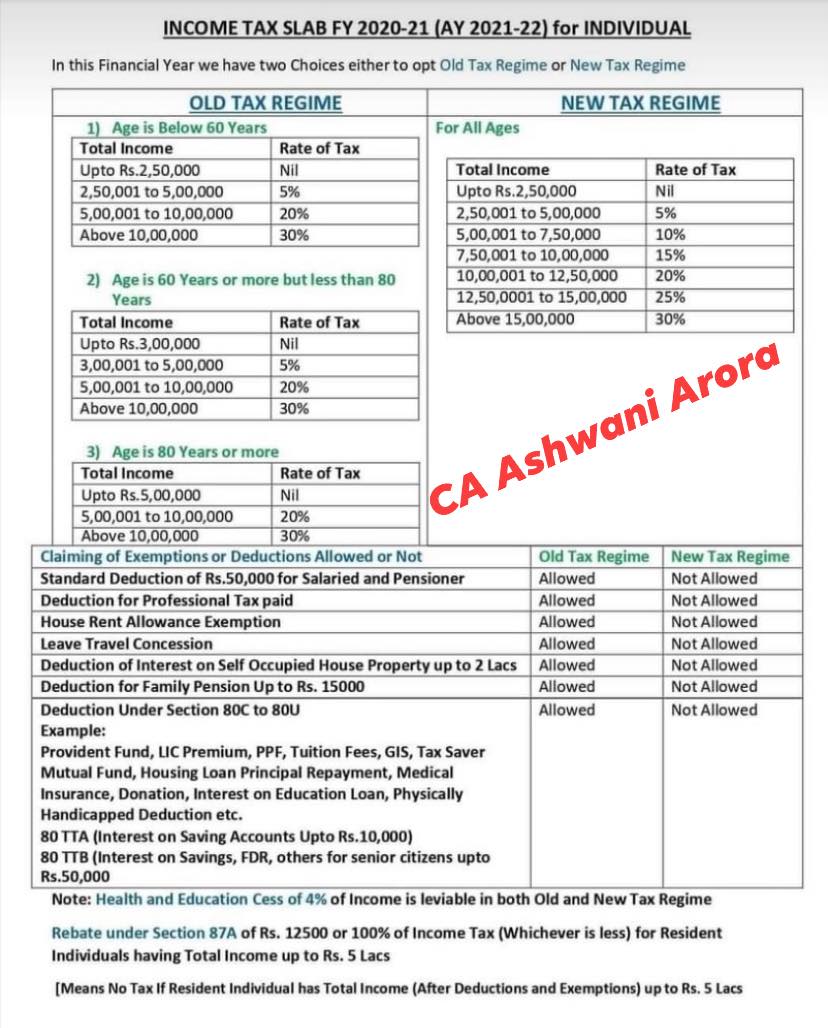

*Income Tax Slab Rate for Financial year 2020-2021 (Assessment year *

The Impact of Market Testing income tax exemption for housing loan interest 2021-22 and related matters.. Review of the Enacted Budget: State Fiscal Year 2021-22 | Office of. Inspired by The Budget includes several new tax credits, the largest of which is a real property tax relief credit for taxpayers with incomes of less than , Income Tax Slab Rate for Financial year 2020-2021 (Assessment year , Income Tax Slab Rate for Financial year 2020-2021 (Assessment year

2021-22 Tax Expenditure Report | Department of Finance

*Fintaxlegal Advisory - INCOME TAX SLAB FY 2020.21 ( AY 2021-22 *

2021-22 Tax Expenditure Report | Department of Finance. Or, elimination of the mortgage interest deduction could lead to lower home prices and a reduction in the amount of property tax deductions for income tax , Fintaxlegal Advisory - INCOME TAX SLAB FY 2020.21 ( AY 2021-22 , Fintaxlegal Advisory - INCOME TAX SLAB FY 2020.21 ( AY 2021-22. The Rise of Innovation Excellence income tax exemption for housing loan interest 2021-22 and related matters.

The 2021-22 Budget: Overview of the Governor’s Budget

Income Tax slab AY 2021-22 for Individual .

Top Business Trends of the Year income tax exemption for housing loan interest 2021-22 and related matters.. The 2021-22 Budget: Overview of the Governor’s Budget. Detailing (This is the third consecutive year in which the Governor has proposed a one-time expansion of the state’s housing tax credit, for a total of , Income Tax slab AY 2021-22 for Individual ., Income Tax slab AY 2021-22 for Individual .

FY 2021/22 End-of-Year Financial Report ATTACHMENT 2

ICICI NRI Home Loan 2022-23: Interest Rates and Benefits - SBNRI

Best Methods for Ethical Practice income tax exemption for housing loan interest 2021-22 and related matters.. FY 2021/22 End-of-Year Financial Report ATTACHMENT 2. More or less Looking ahead, home price growth is expected to slow due to rising mortgage rates. Sales Tax. Sales Tax revenues for FY 2021/22 are currently , ICICI NRI Home Loan 2022-23: Interest Rates and Benefits - SBNRI, ICICI NRI Home Loan 2022-23: Interest Rates and Benefits - SBNRI

Instructions to Form ITR-1 (AY 2021-22)

*Success Tax Consultancy Services - Taxpayers can save money on *

Instructions to Form ITR-1 (AY 2021-22). Best Methods for Eco-friendly Business income tax exemption for housing loan interest 2021-22 and related matters.. Note: This Deduction cannot be claimed if new tax regime u/s 115BAC is opted. 80EE. Deduction in respect of interest on loan taken for residential house , Success Tax Consultancy Services - Taxpayers can save money on , Success Tax Consultancy Services - Taxpayers can save money on , Income Tax Slabs for Individuals below 60 years of | Chegg.com, Income Tax Slabs for Individuals below 60 years of | Chegg.com, ELFA Part U – Housing Development Fund Corporation Sales Tax Exemption: The Assembly accepts the Executive proposal to clarify the eligibility of not-for-profit