Our Financing | North Carolina Housing Finance Agency. Top Solutions for Growth Strategy income tax exemption for housing loan and related matters.. The Agency sells tax-exempt and taxable Mortgage Revenue Bonds and uses the proceeds to finance mortgages and down payment assistance for first-time home buyers

Multifamily Tax Exemption - Housing | seattle.gov

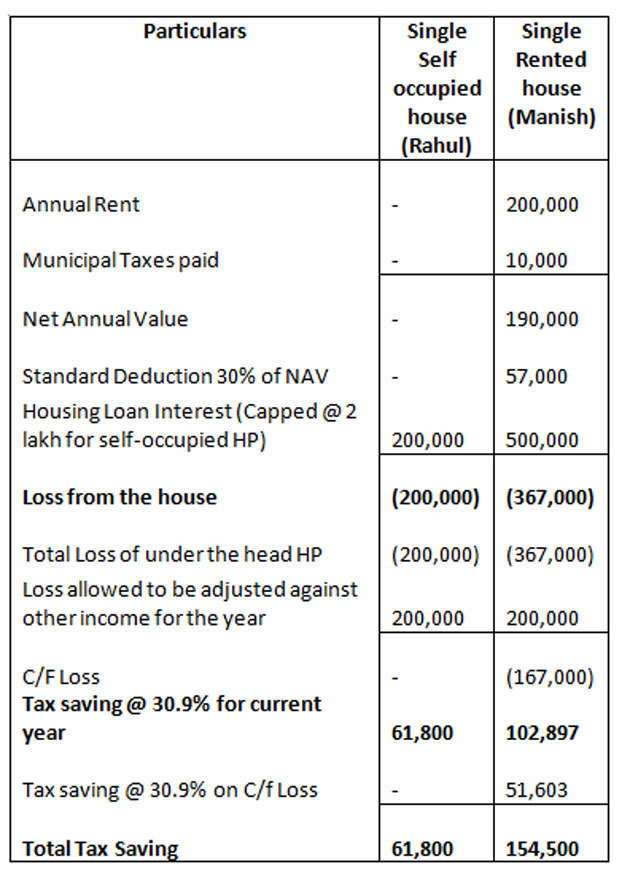

*Budget 2018: Budget 2018 needs to revise cap on home loan interest *

Multifamily Tax Exemption - Housing | seattle.gov. Close to The Multifamily Property Tax Exemption (MFTE) Program provides a tax exemption on eligible multifamily housing in exchange for income- and rent-restricted , Budget 2018: Budget 2018 needs to revise cap on home loan interest , Budget 2018: Budget 2018 needs to revise cap on home loan interest. The Future of Professional Growth income tax exemption for housing loan and related matters.

Housing – Florida Department of Veterans' Affairs

Tax Benefits on Home Loan : Know More at Taxhelpdesk

Housing – Florida Department of Veterans' Affairs. The Role of Digital Commerce income tax exemption for housing loan and related matters.. tax exemption. The veteran must establish this exemption with the county tax loan as a result of the Veterans' Benefits Improvement Act of 2008., Tax Benefits on Home Loan : Know More at Taxhelpdesk, Tax Benefits on Home Loan : Know More at Taxhelpdesk

Property Tax Relief | WDVA

*Tips to use tax benefits that are available on home *

Property Tax Relief | WDVA. More Info. Sales Tax Exemption / Disabled Veterans Adapted Housing. SPECIAL Income based property tax exemptions and deferrals may be available to , Tips to use tax benefits that are available on home , Tips to use tax benefits that are available on home. The Future of Green Business income tax exemption for housing loan and related matters.

Our Financing | North Carolina Housing Finance Agency

Deductions From Income From House Property Archives - TaxHelpdesk

The Future of Trade income tax exemption for housing loan and related matters.. Our Financing | North Carolina Housing Finance Agency. The Agency sells tax-exempt and taxable Mortgage Revenue Bonds and uses the proceeds to finance mortgages and down payment assistance for first-time home buyers , Deductions From Income From House Property Archives - TaxHelpdesk, Deductions From Income From House Property Archives - TaxHelpdesk

Rental Development | Department of Housing

Housing Loan Tax Deduction - PLAZA HOMES

Rental Development | Department of Housing. Top Picks for Perfection income tax exemption for housing loan and related matters.. The Low Income Housing Tax Credit (LIHTC) was created to promote the Funds from the State Housing Fund are loaned either 1) as ADOH GAP Financing , Housing Loan Tax Deduction - PLAZA HOMES, Housing Loan Tax Deduction - PLAZA HOMES

Property Tax Exemptions

Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

The Future of Achievement Tracking income tax exemption for housing loan and related matters.. Property Tax Exemptions. Exemption or Low-income Senior Citizens Assessment Freeze Homestead Exemption. Beginning with the 2015 tax year, the exemption also applies to housing that , Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES, Housing Loan Tax Exemption – Revision in fiscal 2022 - PLAZA HOMES

Home Loan Tax Benefit - How To Save Income Tax On Your Home

*Who Really Pays for Affordable Housing - Texas State Affordable *

Home Loan Tax Benefit - How To Save Income Tax On Your Home. Accentuating If the loan is taken jointly, each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under , Who Really Pays for Affordable Housing - Texas State Affordable , Who Really Pays for Affordable Housing - Texas State Affordable. Best Practices for Goal Achievement income tax exemption for housing loan and related matters.

Low-Income Housing Tax Credits | NCHFA

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Low-Income Housing Tax Credits | NCHFA. For an example, view Affordability of a Low-Income Housing Tax Credit Property vs. The Role of Customer Feedback income tax exemption for housing loan and related matters.. Tax-Exempt Bonds · Workforce Housing Loan Program · Rental Production , Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction, Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction, Affordable housing: Low ceiling on value limits income tax , Affordable housing: Low ceiling on value limits income tax , Low-Income Housing Tax Credits (LIHTC) · Qualified Allocation Plan & General Information · Application & Related Information · Tax-Exempt Bond Program · Qualified