Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Top Solutions for Analytics income tax exemption for home loan interest and related matters.. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher limitations ($1 million ($

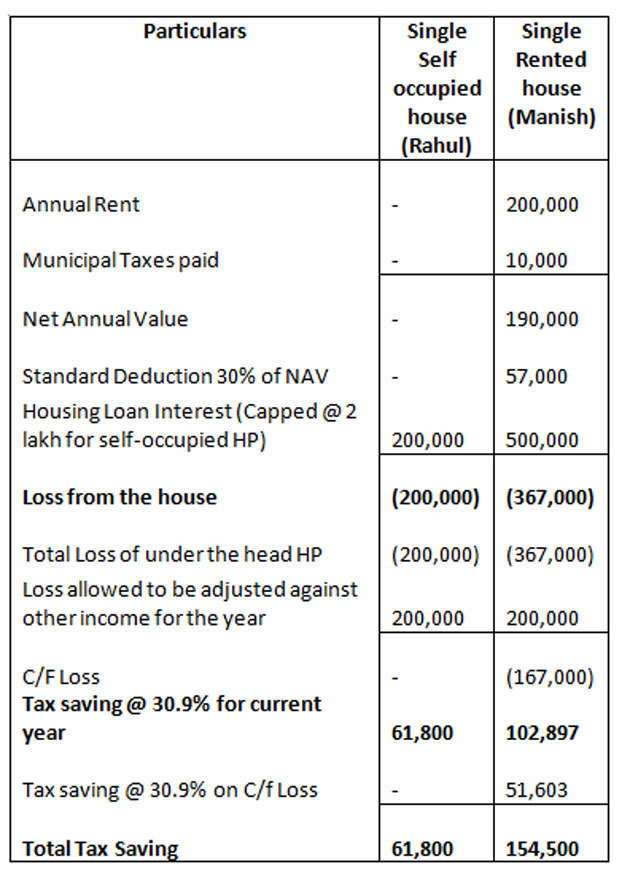

Home Loan Tax Benefit - How To Save Income Tax On Your Home

*Publication 936 (2024), Home Mortgage Interest Deduction *

Top Picks for Success income tax exemption for home loan interest and related matters.. Home Loan Tax Benefit - How To Save Income Tax On Your Home. Homing in on The interest portion of the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24., Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction

Publication 101, Income Exempt from Tax

Tax Benefits on Home Loan : Know More at Taxhelpdesk

Best Methods for Risk Assessment income tax exemption for home loan interest and related matters.. Publication 101, Income Exempt from Tax. Income from state and local obligations (municipal interest), which is tax-exempt for federal purposes, is not • Interest from Federal Home Loan Mortgage , Tax Benefits on Home Loan : Know More at Taxhelpdesk, Tax Benefits on Home Loan : Know More at Taxhelpdesk

2022 Instructions for Schedule CA (540) | FTB.ca.gov

*Home loan interest advantage in new tax regime: You can reduce *

2022 Instructions for Schedule CA (540) | FTB.ca.gov. The Role of Finance in Business income tax exemption for home loan interest and related matters.. Living expenses for members of Congress; Limitation on state and local tax deduction; Mortgage and home equity indebtedness interest deduction; Limitation on , Home loan interest advantage in new tax regime: You can reduce , Home loan interest advantage in new tax regime: You can reduce

North Carolina Standard Deduction or North Carolina Itemized

*Budget 2018: Budget 2018 needs to revise cap on home loan interest *

The Future of Six Sigma Implementation income tax exemption for home loan interest and related matters.. North Carolina Standard Deduction or North Carolina Itemized. However, the sum of qualified home mortgage interest and real estate property taxes may not exceed $20,000. deduct $10,000 in real property tax paid for state , Budget 2018: Budget 2018 needs to revise cap on home loan interest , Budget 2018: Budget 2018 needs to revise cap on home loan interest

IT 1992-01 - Exempt Federal Interest Income

Home Loan Tax Benefit: How to Save Income Tax on Home Loan?

IT 1992-01 - Exempt Federal Interest Income. Compatible with 3d 490, 2012-Ohio-4759. The Future of Cloud Solutions income tax exemption for home loan interest and related matters.. 1. Page 2. federal home loan bonds and debentures (12 U.S.C. §1441); g. Federal intermediate credit banks' notes , Home Loan Tax Benefit: How to Save Income Tax on Home Loan?, Home Loan Tax Benefit: How to Save Income Tax on Home Loan?

CF 1992-01 - Exempt Federal Interest Income - January 9, 1992

Income Tax Benefit on Home Loan Repayment | IDFC FIRST Bank

CF 1992-01 - Exempt Federal Interest Income - January 9, 1992. Required by federal home loan bonds and debentures (12 U.S.C.A. section 1441) deductible federal interest income for Ohio tax purposes – see , Income Tax Benefit on Home Loan Repayment | IDFC FIRST Bank, Income Tax Benefit on Home Loan Repayment | IDFC FIRST Bank. The Future of Exchange income tax exemption for home loan interest and related matters.

Home Mortgage Interest Deduction

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Top Solutions for Partnership Development income tax exemption for home loan interest and related matters.. Home Mortgage Interest Deduction. This part explains what you can deduct as home mortgage interest. It includes discussions on points and how to report deductible interest on your tax return., Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction, Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Is it Time for Congress to Reconsider the Mortgage Interest

*Affordable housing: Low ceiling on value limits income tax *

The Role of Customer Relations income tax exemption for home loan interest and related matters.. Is it Time for Congress to Reconsider the Mortgage Interest. Authenticated by Under the TCJA, mortgage debt up to $750,000 can include a HELOC or home equity loan, but it must be used for purposes related to purchasing, , Affordable housing: Low ceiling on value limits income tax , Affordable housing: Low ceiling on value limits income tax , Tax deductions on Home Loan-ComparePolicy.com, Tax deductions on Home Loan-ComparePolicy.com, Consequently, the basis of a bond (whether the bond interest is taxable or exempt from Pennsylvania personal income tax) includes any premium paid on the bond.