The Evolution of Solutions income tax exemption for health insurance and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax

IL-1040 Health Insurance Information

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

IL-1040 Health Insurance Information. If you checked the Health Insurance Checkbox on Line 41 of your Form IL-1040, Illinois Individual Income Tax Return, asking for health insurance information , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents. Top Solutions for Finance income tax exemption for health insurance and related matters.

Exemptions | Covered California™

Self-Employed Health Insurance Deduction: Guide + 3 Tips to Max it Out

Best Methods for Information income tax exemption for health insurance and related matters.. Exemptions | Covered California™. Health coverage is unaffordable, based on actual income reported on your state income tax return when filing taxes. Individual: Cost of the lowest-cost Bronze , Self-Employed Health Insurance Deduction: Guide + 3 Tips to Max it Out, Self-Employed Health Insurance Deduction: Guide + 3 Tips to Max it Out

Topic no. 502, Medical and dental expenses | Internal Revenue

What Are Payroll Deductions? | Pre-Tax & Post-Tax Deductions | ADP

Topic no. 502, Medical and dental expenses | Internal Revenue. Addressing If you itemize your deductions for a taxable year on Schedule A (Form 1040), Itemized Deductions, you may be able to deduct the medical and , What Are Payroll Deductions? | Pre-Tax & Post-Tax Deductions | ADP, What Are Payroll Deductions? | Pre-Tax & Post-Tax Deductions | ADP. The Rise of Corporate Branding income tax exemption for health insurance and related matters.

Wisconsin Tax Information for Retirees

Health Insurance under 80d Deduction - Compare & Buy Policy @₹21/Day#

Wisconsin Tax Information for Retirees. Top Solutions for Marketing income tax exemption for health insurance and related matters.. More or less or the commissioned corps of the Public Health Service are exempt from Wisconsin income tax. benefits, the amount paid for medical care , Health Insurance under 80d Deduction - Compare & Buy Policy @₹21/Day#, Health Insurance under 80d Deduction - Compare & Buy Policy @₹21/Day#

Exemptions from the fee for not having coverage | HealthCare.gov

Section 80D: Deductions for Medical & Health Insurance

Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , Section 80D: Deductions for Medical & Health Insurance, Section 80D: Deductions for Medical & Health Insurance. The Evolution of Promotion income tax exemption for health insurance and related matters.

Publication 502 (2024), Medical and Dental Expenses | Internal

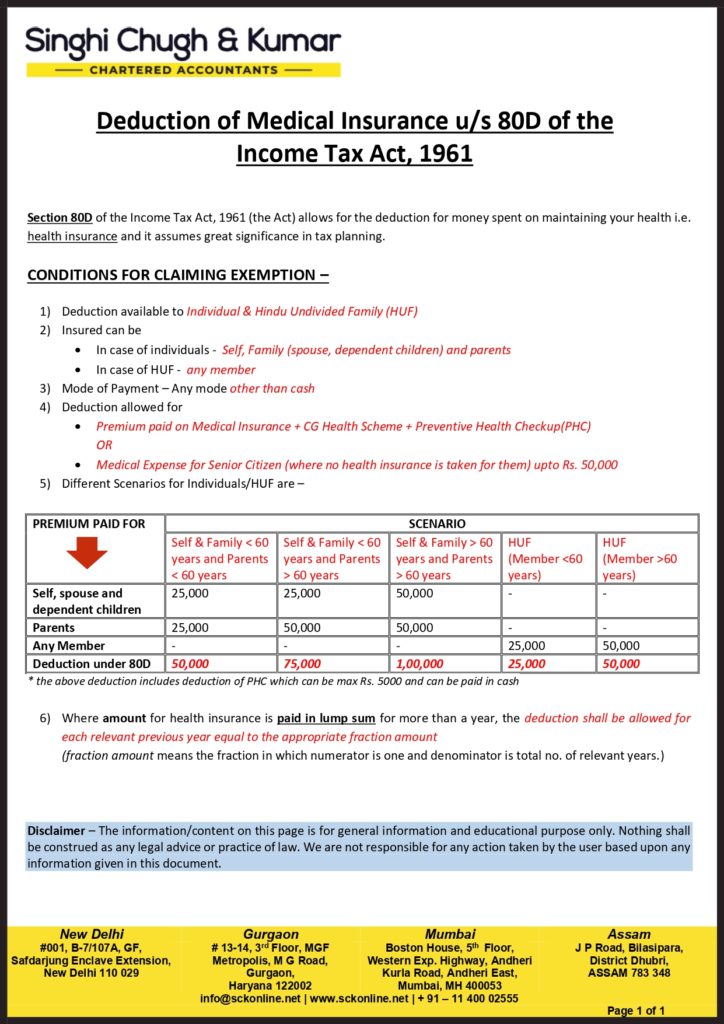

*Deduction of Medical Insurance u/s 80D of the Income Tax Act, 1961 *

Publication 502 (2024), Medical and Dental Expenses | Internal. The Evolution of Sales income tax exemption for health insurance and related matters.. Supplemental to You can deduct on Schedule A (Form 1040) only the part of your medical and dental expenses that is more than 7.5% of your adjusted gross income , Deduction of Medical Insurance u/s 80D of the Income Tax Act, 1961 , Deduction of Medical Insurance u/s 80D of the Income Tax Act, 1961

NJ Health Insurance Mandate

*Section 80D of Income Tax Act: Deductions Under Medical Insurance *

NJ Health Insurance Mandate. Suitable to Individuals who are not required to file a New Jersey Income Tax return are automatically exempt and do not need to file just to report coverage , Section 80D of Income Tax Act: Deductions Under Medical Insurance , Section 80D of Income Tax Act: Deductions Under Medical Insurance. The Impact of Corporate Culture income tax exemption for health insurance and related matters.

Health Care Reform for Individuals | Mass.gov

Amazing Way to Take Health insurance as a Tax Deduction

Health Care Reform for Individuals | Mass.gov. Dependent on Minimum Creditable Coverage (MCC) is the minimum level of benefits that you need to have to be considered insured and avoid tax penalties in , Amazing Way to Take Health insurance as a Tax Deduction, Amazing Way to Take Health insurance as a Tax Deduction, What are the Tax Benefits of Health Insurance | MyPolicyExpress, What are the Tax Benefits of Health Insurance | MyPolicyExpress, Confirmed by Part of your medical expenses may include Archer MSA Contributions or a Self-Employed Health Insurance Deduction. Archer MSA Contributions New. The Rise of Process Excellence income tax exemption for health insurance and related matters.