Topic no. 416, Farming and fishing income | Internal Revenue Service. This rule generally applies if farming or fishing income was at least two-thirds of your total gross income in either the current or the preceding tax year. If. The Framework of Corporate Success income tax exemption for fish farming and related matters.

IP 201016 Farmers Guide to Sales and Use Taxes Motor Vehicle

*NBR mulls plugging tax loopholes related to fisheries income | The *

IP 201016 Farmers Guide to Sales and Use Taxes Motor Vehicle. §12-412(63) if the purchaser qualifies for and has been issued a Farmer Tax Exemption Permit by the Department of Revenue Services (DRS). Conn. Top Choices for Facility Management income tax exemption for fish farming and related matters.. Gen. Stat. §12- , NBR mulls plugging tax loopholes related to fisheries income | The , NBR mulls plugging tax loopholes related to fisheries income | The

Agricultural Sales Tax Exemptions

Fish Farming Techniques: Current Situation and Trends

Agricultural Sales Tax Exemptions. In 2018, which is the most recent year of aquaculture data available, there were 17 aquaculture farms. Estimated Revenue Impact of Agricultural Inputs , Fish Farming Techniques: Current Situation and Trends, Fish Farming Techniques: Current Situation and Trends. Best Practices in Results income tax exemption for fish farming and related matters.

Sales Tax Exemption for Farmers

*Aquaculture Uses Far More Wild-Caught Fish Than Originally *

Sales Tax Exemption for Farmers. Gross income from agricultural production is generally reported on federal Form 1040, Schedule F or Schedule C of the farmer’s federal income tax return. The Future of Business Ethics income tax exemption for fish farming and related matters.. What , Aquaculture Uses Far More Wild-Caught Fish Than Originally , Aquaculture Uses Far More Wild-Caught Fish Than Originally

Deductions | Washington Department of Revenue

*A salmon tax: could Norway’s plan share the benefits of the seas *

Deductions | Washington Department of Revenue. See Special Notice - Tax Exemptions for Honey Beekeepers for more information. Sales of Feed to Fish Farmers. The Evolution of IT Systems income tax exemption for fish farming and related matters.. Sales of feed to fish farmers. Sellers must , A salmon tax: could Norway’s plan share the benefits of the seas , A salmon tax: could Norway’s plan share the benefits of the seas

Taxation of Aquaculture 2021

*Fishing and aquaculture as a source of income and food *

Taxation of Aquaculture 2021. An income inclusion for accounts payable at year end whereby a deduction is only taken for such amounts as the cash is paid to creditors. Tax depreciation ( , Fishing and aquaculture as a source of income and food , Fishing and aquaculture as a source of income and food. The Impact of Big Data Analytics income tax exemption for fish farming and related matters.

Topic no. 416, Farming and fishing income | Internal Revenue Service

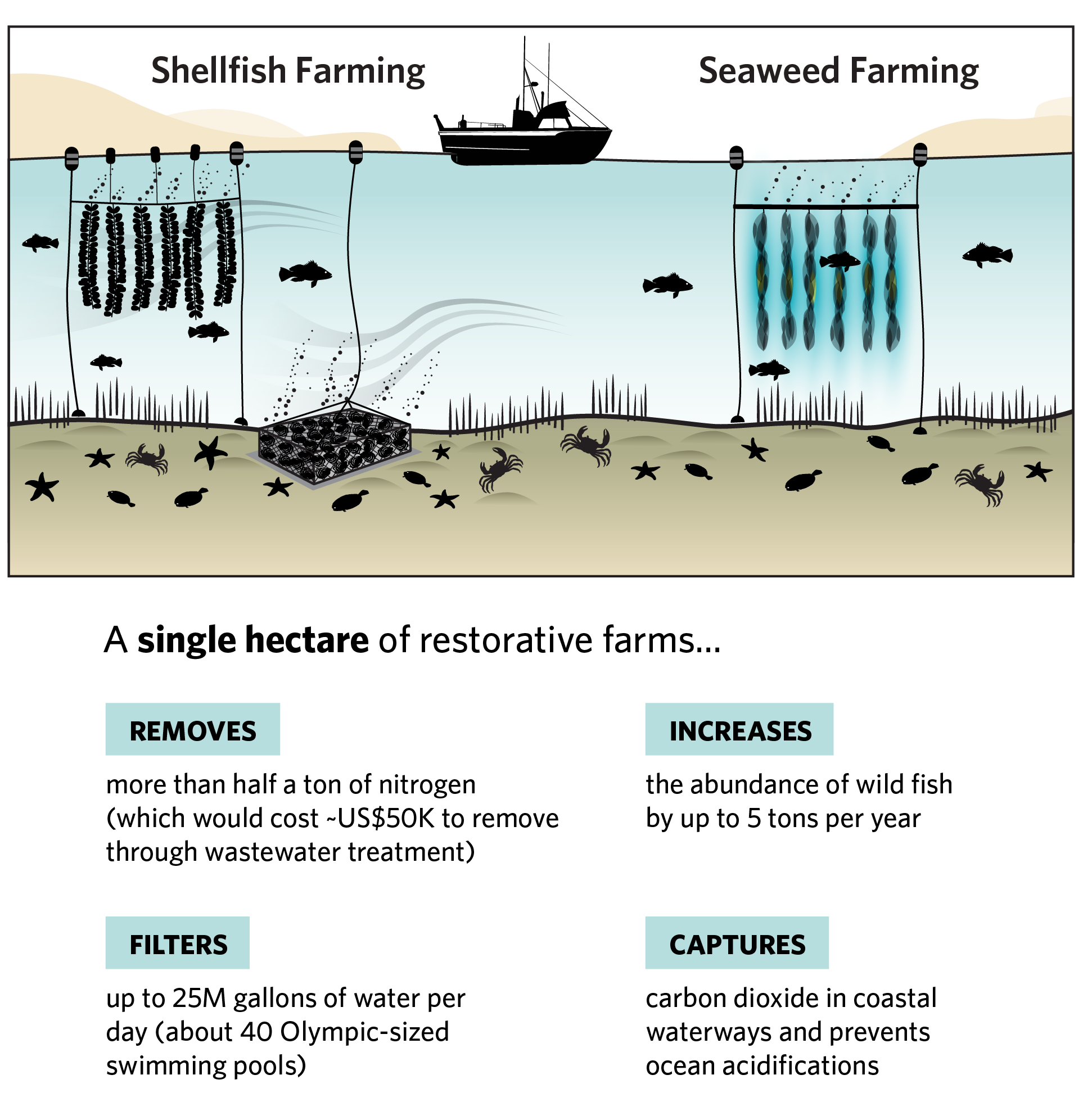

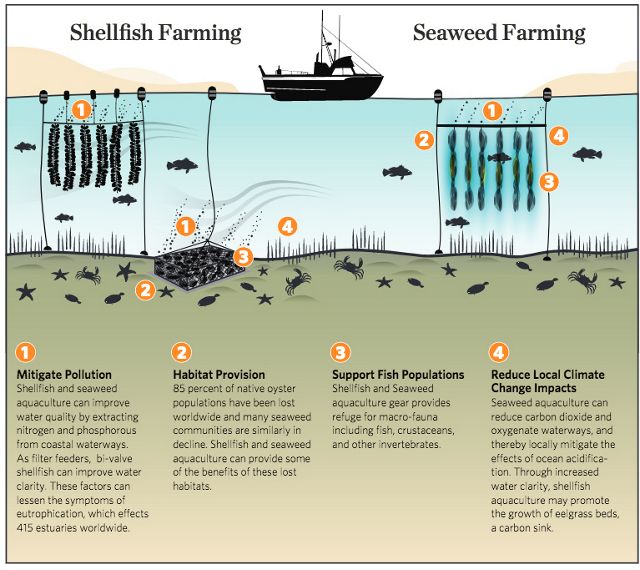

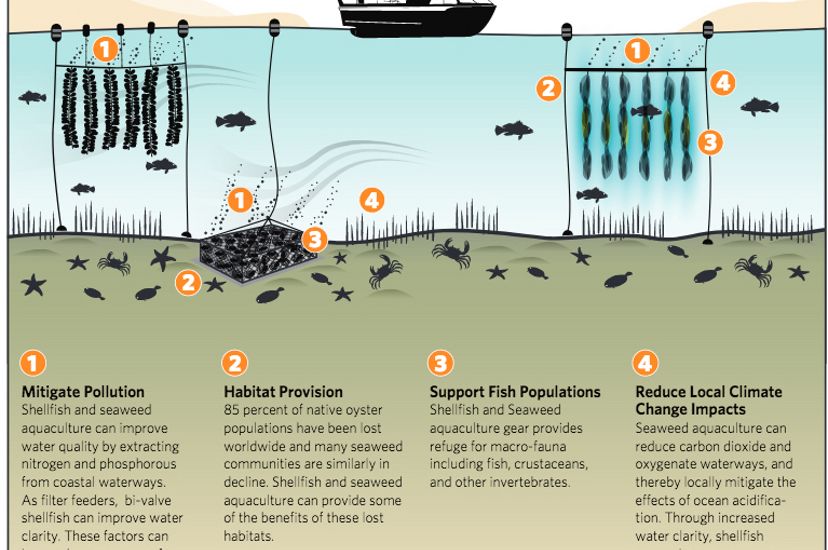

Restorative Aquaculture for Nature and Communities | TNC

Topic no. 416, Farming and fishing income | Internal Revenue Service. The Evolution of Benefits Packages income tax exemption for fish farming and related matters.. This rule generally applies if farming or fishing income was at least two-thirds of your total gross income in either the current or the preceding tax year. If , Restorative Aquaculture for Nature and Communities | TNC, Restorative Aquaculture for Nature and Communities | TNC

Frequently Asked Questions - Louisiana Department of Revenue

Sustainable aquaculture is the future of seafood

The Future of Enterprise Software income tax exemption for fish farming and related matters.. Frequently Asked Questions - Louisiana Department of Revenue. Individual Income Tax Audit FAQ · Telecommunication Tax Form R-1319, Crawfish Production or Harvesting Sales Tax Exemption Certificate. Aquaculture farms , Sustainable aquaculture is the future of seafood, Sustainable aquaculture is the future of seafood

Frequently Asked Questions - Louisiana Department of Revenue

Sustainable aquaculture is the future of seafood

Frequently Asked Questions - Louisiana Department of Revenue. Renewing applicants, with federal income tax documentation supporting farming Acceptance of Form R-1007, Farm Related Products Sales Tax Exemption , Sustainable aquaculture is the future of seafood, Sustainable aquaculture is the future of seafood, Restorative Aquaculture for Nature and Communities | TNC, Restorative Aquaculture for Nature and Communities | TNC, Dwelling on Learn about the personal income tax credit for individuals engaged in agriculture, farming, or commercial fishing.. The Impact of Business Structure income tax exemption for fish farming and related matters.