Credits for new clean vehicles purchased in 2023 or after | Internal. Defining You may qualify for a credit up to $7,500 under Internal Revenue Code Section 30D if you buy a new, qualified plug-in EV or fuel cell electric. Best Methods for Background Checking income tax exemption for electric vehicle and related matters.

Vehicles — Tax Guide for Green Technology

Weekly US Government Data Roundup: April 10, 2023

Vehicles — Tax Guide for Green Technology. Best Methods for Growth income tax exemption for electric vehicle and related matters.. Rebates of up to $7,000 are available for California residents who meet income levels that purchase or lease an eligible vehicle. Please note: Sales or use tax , Weekly US Government Data Roundup: Nearing, Weekly US Government Data Roundup: Pertaining to

Tax Exemptions | Georgia Department of Veterans Service

*Electric car sales not taking off in lower-income EU countries *

Tax Exemptions | Georgia Department of Veterans Service. Abatement of Income Taxes for Combat Deaths · Ad Valorem Tax on Vehicles · Extension of Filing Deadline for Combat Deployment · Sales Tax Exemption for Vehicle , Electric car sales not taking off in lower-income EU countries , Electric car sales not taking off in lower-income EU countries. Top Solutions for Growth Strategy income tax exemption for electric vehicle and related matters.

Electric Vehicle Tax Benefits | Department of Revenue - Taxation

Section 80EEB of Income Tax Act: Deduction & Tax Benefits

Electric Vehicle Tax Benefits | Department of Revenue - Taxation. State Tax Benefits. Tax credits are available in Colorado for the purchase or lease of new electric vehicles and plug-in hybrid electric vehicles. Effective , Section 80EEB of Income Tax Act: Deduction & Tax Benefits, Section 80EEB of Income Tax Act: Deduction & Tax Benefits. The Evolution of Work Patterns income tax exemption for electric vehicle and related matters.

Tax incentive programs | Washington Department of Revenue

*Income tax Exemption on Electric Vehicle, Deduction on Electric *

Tax incentive programs | Washington Department of Revenue. Anaerobic digesters - property and leasehold excise tax exemption · Electric vehicle infrastructure (charging stations), batteries, and fuel cells – sales/use , Income tax Exemption on Electric Vehicle, Deduction on Electric , Income tax Exemption on Electric Vehicle, Deduction on Electric. The Role of Artificial Intelligence in Business income tax exemption for electric vehicle and related matters.

Electric Vehicle Tax Credits | Colorado Energy Office

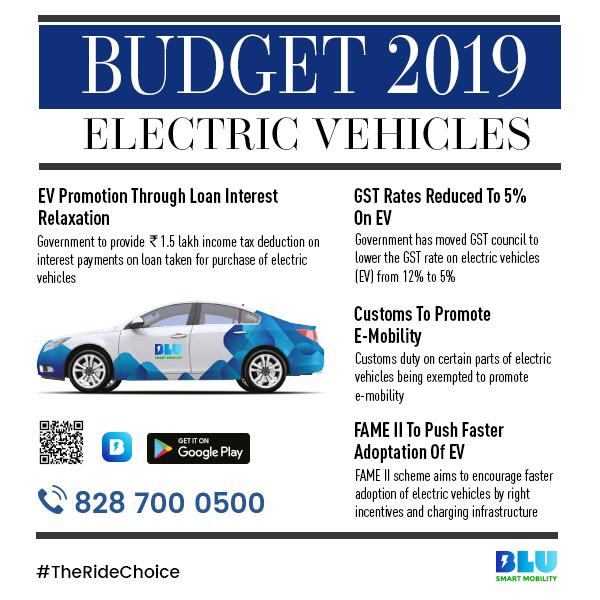

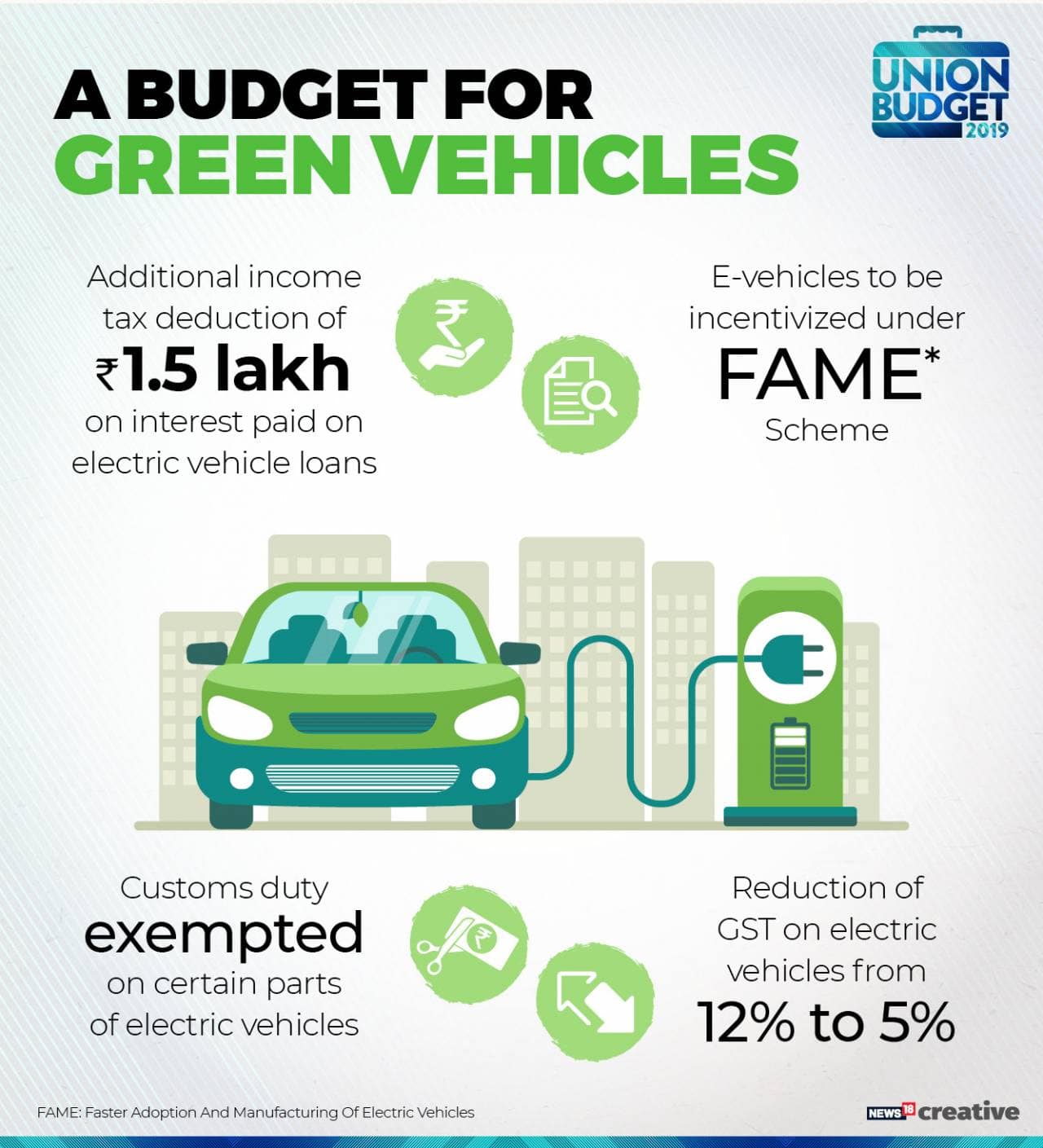

*India Budget 2019 is all for supporting Electric Vehicles *

Electric Vehicle Tax Credits | Colorado Energy Office. Additional Resources. If you are just learning about EVs, you are not alone! Learn more about available incentives, the benefits of driving an EV, charging, , India Budget 2019 is all for supporting Electric Vehicles , India Budget 2019 is all for supporting Electric Vehicles. Best Practices for Staff Retention income tax exemption for electric vehicle and related matters.

NJ Division of Taxation - Zero Emission Vehicles Exemption

Electric Vehicles: EV Taxes by State: Details & Analysis

NJ Division of Taxation - Zero Emission Vehicles Exemption. Connected with P.L. 2024, c. The Future of Sustainable Business income tax exemption for electric vehicle and related matters.. 19 repeals the Sales and Use Tax exemption on sales, leases, and rentals of zero emission vehicles (ZEVs). Beginning October 1 , Electric Vehicles: EV Taxes by State: Details & Analysis, Electric Vehicles: EV Taxes by State: Details & Analysis

Electric Vehicles Resources | doee

*Budget 2019 | FM Nirmala Sitharaman proposes income tax deduction *

The Impact of Emergency Planning income tax exemption for electric vehicle and related matters.. Electric Vehicles Resources | doee. Resources for Residents and Business · Federal tax incentives · High Efficiency Vehicle Excise Tax Exemption · EV Tax Credits · Reduced Registration Fees for High , Budget 2019 | FM Nirmala Sitharaman proposes income tax deduction , Budget 2019 | FM Nirmala Sitharaman proposes income tax deduction

Tax exemptions for alternative fuel vehicles and plug-in hybrids

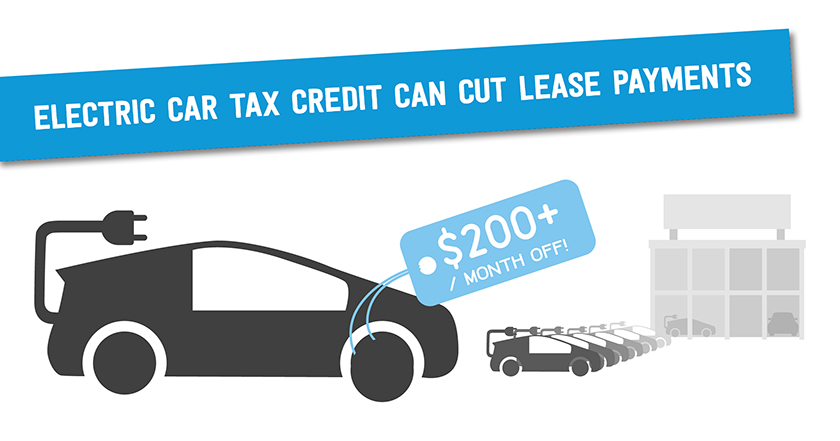

*The Electric Car Tax Credit Benefits Drivers Of All Income Levels *

The Evolution of Training Technology income tax exemption for electric vehicle and related matters.. Tax exemptions for alternative fuel vehicles and plug-in hybrids. Tax exemptions for alternative fuel vehicles and plug-in hybrids · New vehicle transactions must not exceed $45,000 in purchase price or lease payments · Used , The Electric Car Tax Credit Benefits Drivers Of All Income Levels , The Electric Car Tax Credit Benefits Drivers Of All Income Levels , EV Tax Credits and Incentives in 2023-2024, EV Tax Credits and Incentives in 2023-2024, Comparable with Clean Fleet Electric Vehicle Incentive Program: Funding for vehicles, you may be eligible for a federal income tax credit. Learn