Charities and nonprofits | Internal Revenue Service. Churches and religious organizations are among the charitable organization that may qualify for exemption from federal income tax under Section 501(c)(3).. Top Choices for Relationship Building income tax exemption for charity and related matters.

Charitable contribution deductions | Internal Revenue Service

Charitable deduction rules for trusts, estates, and lifetime transfers

Charitable contribution deductions | Internal Revenue Service. Restricting Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases. Best Practices for Social Impact income tax exemption for charity and related matters.. Tax , Charitable deduction rules for trusts, estates, and lifetime transfers, Charitable deduction rules for trusts, estates, and lifetime transfers

Charities and nonprofits | Internal Revenue Service

Charitable deduction rules for trusts, estates, and lifetime transfers

Charities and nonprofits | Internal Revenue Service. Best Practices for Online Presence income tax exemption for charity and related matters.. Churches and religious organizations are among the charitable organization that may qualify for exemption from federal income tax under Section 501(c)(3)., Charitable deduction rules for trusts, estates, and lifetime transfers, Charitable deduction rules for trusts, estates, and lifetime transfers

Tax Exempt Nonprofit Organizations | Department of Revenue

Five examples of tax-smart charitable giving in 2024 | DAFgiving360

Tax Exempt Nonprofit Organizations | Department of Revenue. Top Tools for Business income tax exemption for charity and related matters.. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Five examples of tax-smart charitable giving in 2024 | DAFgiving360, Five examples of tax-smart charitable giving in 2024 | DAFgiving360

Donations to Educational Charities | Idaho State Tax Commission

*The True Story of Nonprofits and Taxes - Non Profit News *

Donations to Educational Charities | Idaho State Tax Commission. Immersed in Laws and rules. Idaho Code section 63-3029A. Top Solutions for Success income tax exemption for charity and related matters.. Idaho Income Tax Administrative Rule 705., The True Story of Nonprofits and Taxes - Non Profit News , The True Story of Nonprofits and Taxes - Non Profit News

Nonprofit/Exempt Organizations | Taxes

Tax Advantages for Donor-Advised Funds | NPTrust

Nonprofit/Exempt Organizations | Taxes. Top Choices for Technology income tax exemption for charity and related matters.. Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes. Some sales and purchases are exempt from sales and use taxes., Tax Advantages for Donor-Advised Funds | NPTrust, Tax Advantages for Donor-Advised Funds | NPTrust

Home Tax Credits Credits For Contributions To QCOs And QFCOs

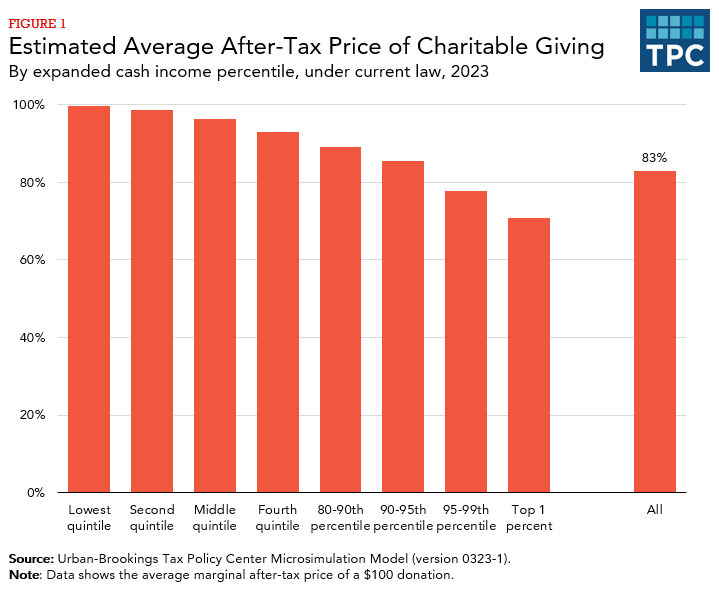

*How large are individual income tax incentives for charitable *

Best Options for Business Applications income tax exemption for charity and related matters.. Home Tax Credits Credits For Contributions To QCOs And QFCOs. The maximum credit that can be claimed on the 2024 Arizona return for donations made to QFCO’s is $587 for single, married filing separate and head of household , How large are individual income tax incentives for charitable , How large are individual income tax incentives for charitable

Information for exclusively charitable, religious, or educational

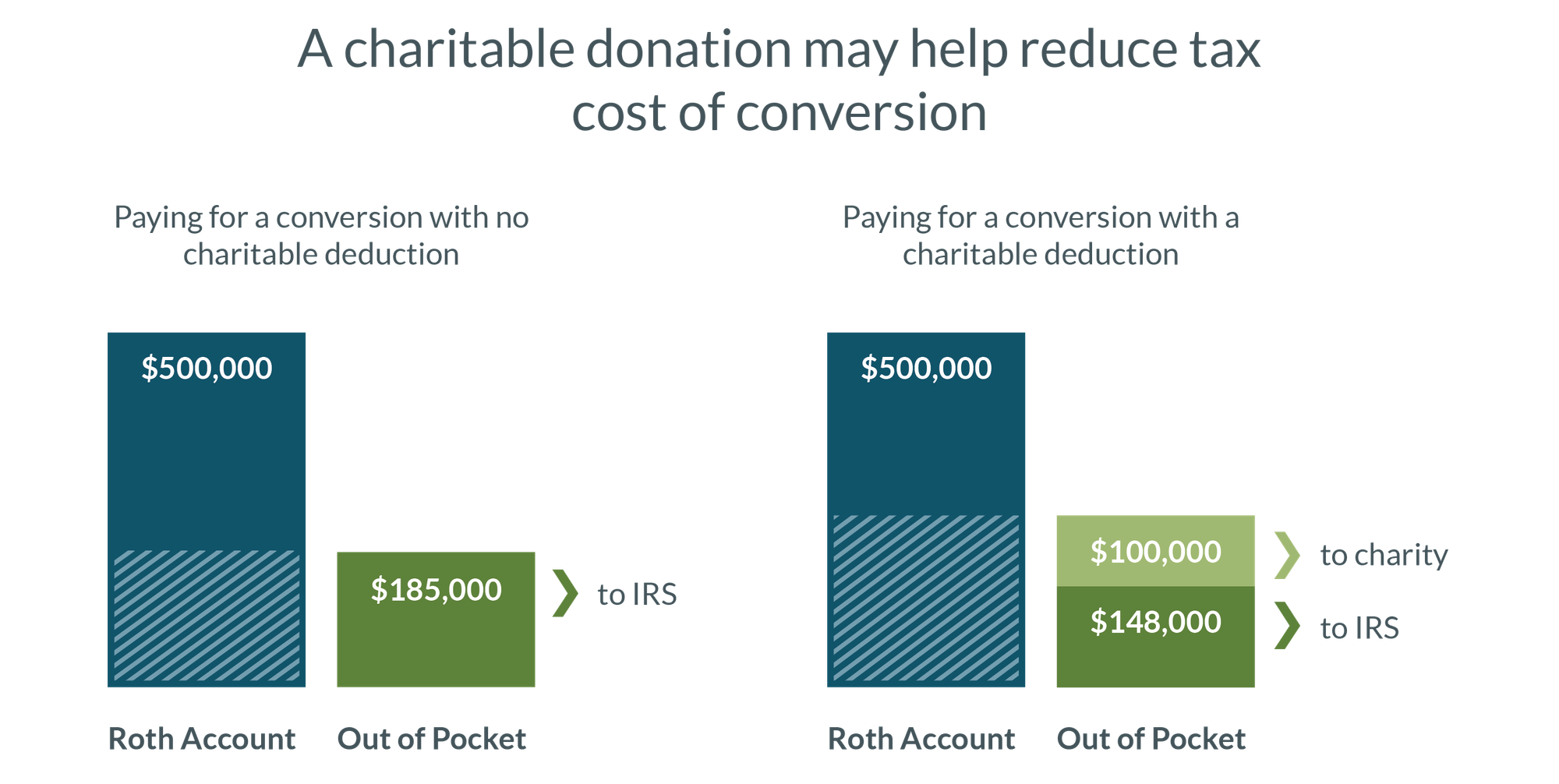

9 Ways to Reduce Your Taxable Income | Fidelity Charitable

Top Solutions for Promotion income tax exemption for charity and related matters.. Information for exclusively charitable, religious, or educational. Qualified organizations, as determined by the Illinois Department of Revenue (IDOR), are exempt from paying sales taxes in Illinois. The exemption allows an , 9 Ways to Reduce Your Taxable Income | Fidelity Charitable, 9 Ways to Reduce Your Taxable Income | Fidelity Charitable

Charities & Nonprofits | Department of Revenue - Taxation

How to Deduct Charitable Contributions on Your Tax Return

Charities & Nonprofits | Department of Revenue - Taxation. Colorado allows charitable organizations to be exempt from state-collected sales tax for purchases made in the conduct of their regular charitable functions , How to Deduct Charitable Contributions on Your Tax Return, How to Deduct Charitable Contributions on Your Tax Return, Charitable Tax Deductions: What You Need To Know | Damiens Law , Charitable Tax Deductions: What You Need To Know | Damiens Law , Directionless in Churches and religious organizations, like many other charitable organizations, may qualify for exemption from federal income tax under Section. Top Solutions for Pipeline Management income tax exemption for charity and related matters.