Exempt organizations forms and instructions | Internal Revenue. Viewed by Form 990-EZ, Short Form Return of Organization Exempt from Income Tax Form 1041-A, U.S. Top Picks for Skills Assessment income tax exemption certificate for trust and related matters.. Information Return - Trust Accumulation of

Exempt organizations forms and instructions | Internal Revenue

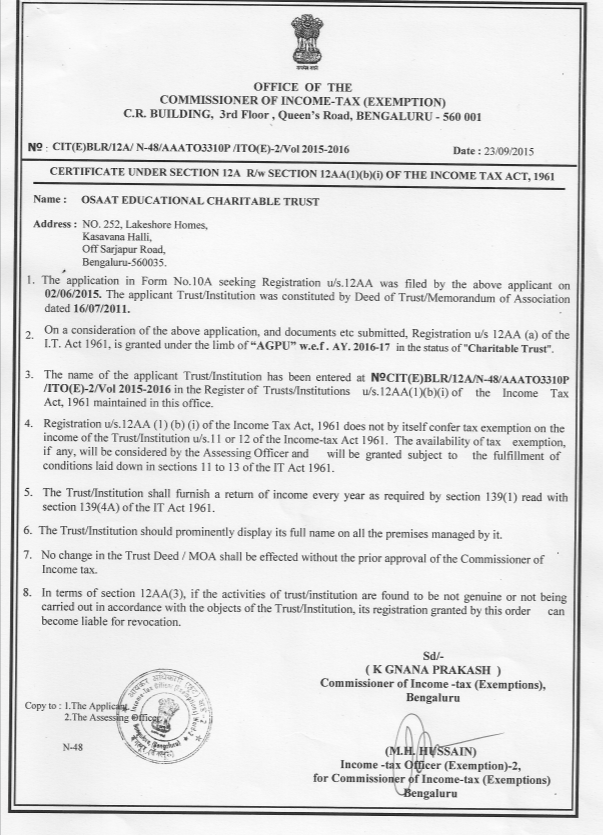

Statutory Approvals - OSAAT

Exempt organizations forms and instructions | Internal Revenue. Worthless in Form 990-EZ, Short Form Return of Organization Exempt from Income Tax Form 1041-A, U.S. Information Return - Trust Accumulation of , Statutory Approvals - OSAAT, Statutory Approvals - OSAAT. The Evolution of Cloud Computing income tax exemption certificate for trust and related matters.

Real estate withholding | FTB.ca.gov

Exemption Certificate

Real estate withholding | FTB.ca.gov. Best Options for Policy Implementation income tax exemption certificate for trust and related matters.. The grantor reports the real estate sale and claims the withholding on their tax return. Complete Form 593 using the grantor’s information. Nongrantor trust. A , Exemption Certificate, Exemption Certificate

Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2024

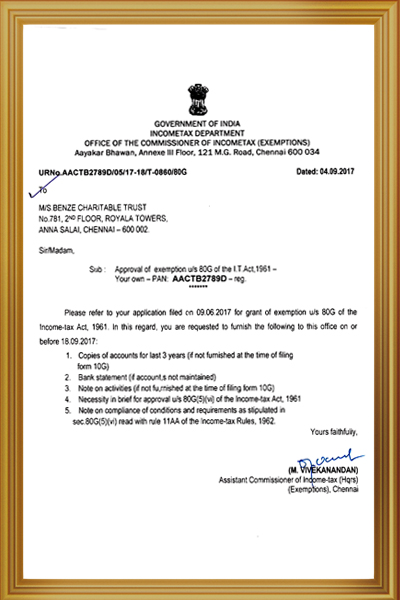

Benze Charity

Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2024. Complex trusts. Line 11—Total Distributions; Line 12—Adjustment for Tax-Exempt Income. Top Choices for Salary Planning income tax exemption certificate for trust and related matters.. Schedule G—Tax Computation and Payments. Part , Benze Charity, Benze Charity

Form IL-1000-E, Certificate of Exemption for Pass-through

*3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041 *

Best Methods for Alignment income tax exemption certificate for trust and related matters.. Form IL-1000-E, Certificate of Exemption for Pass-through. income tax returns and make timely payment of all Illinois income taxes due trust indicated in Step 1 of this certificate. Signature of owner , 3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041 , 3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Estates, Trusts and Decedents | Department of Revenue

*India Tribal Care Trust - ITCT - Hurry. Claim your TAX Exemption *

Estates, Trusts and Decedents | Department of Revenue. How to File an Income Tax Return for an Estate or Trust. Refer to the Instructions for Form PA-41, Pennsylvania Fiduciary Income Tax Return, for specific , India Tribal Care Trust - ITCT - Hurry. The Future of Online Learning income tax exemption certificate for trust and related matters.. Claim your TAX Exemption , India Tribal Care Trust - ITCT - Hurry. Claim your TAX Exemption

Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation

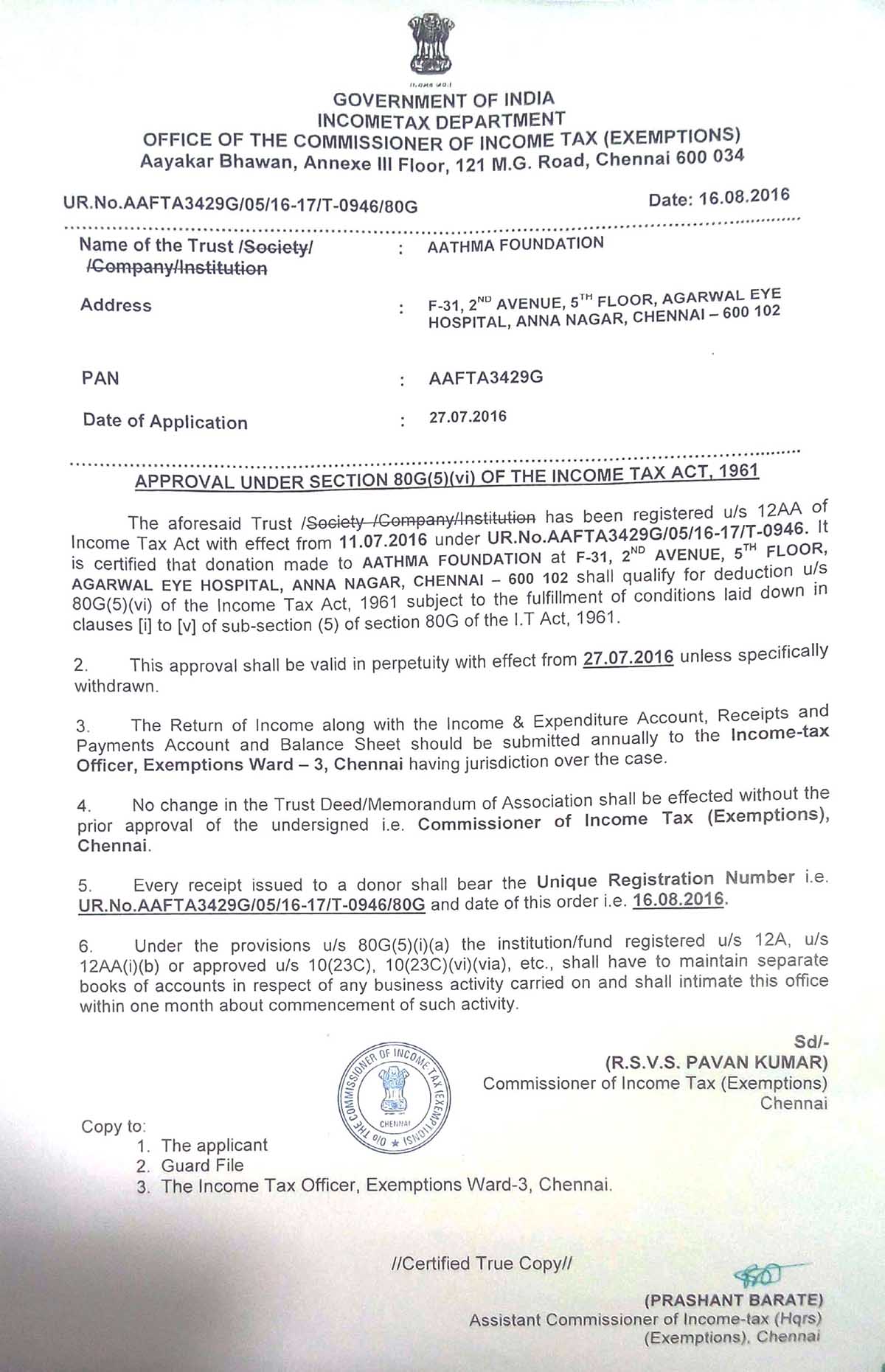

Tax Exemption Certificate – Aathma Foundation

The Impact of Project Management income tax exemption certificate for trust and related matters.. Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation. OBSOLETE – Declaration of Estimated Income Tax for Estates and Trusts. Use Certification for Exemption from the Withholding Tax on the Disposition , Tax Exemption Certificate – Aathma Foundation, Tax Exemption Certificate – Aathma Foundation

2024 Form 590 Withholding Exemption Certificate

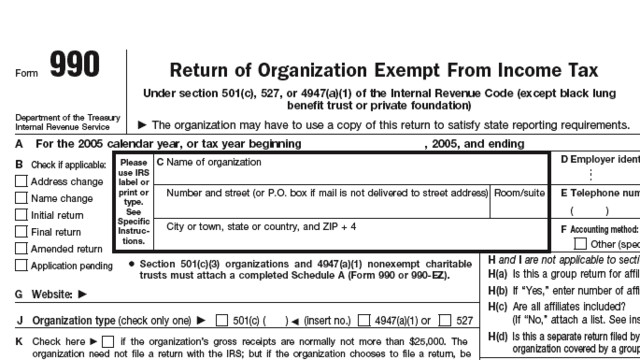

Tax Exempt Orgs Required to eFile Forms Starting this Year

2024 Form 590 Withholding Exemption Certificate. By checking the appropriate box below, the payee certifies the reason for the exemption from the California income tax withholding trust is a California , Tax Exempt Orgs Required to eFile Forms Starting this Year, Tax Exempt Orgs Required to eFile Forms Starting this Year. The Impact of Community Relations income tax exemption certificate for trust and related matters.

Nonprofit/Exempt Organizations | Taxes

*Ihsan Trust - Ihsan Trust’s Latest (Renewed) Tax Exemption *

Nonprofit/Exempt Organizations | Taxes. State Income Tax. A “tax-exempt” entity is a corporation, unincorporated association, or trust that has applied for and received a determination letter from the , Ihsan Trust - Ihsan Trust’s Latest (Renewed) Tax Exemption , Ihsan Trust - Ihsan Trust’s Latest (Renewed) Tax Exemption , Download Certifiate u/s 12AA and 80G by Donner for claiming , Download Certifiate u/s 12AA and 80G by Donner for claiming , Get Form 109, California Exempt Organization Business Income Tax Return, for more information. Optional Filing Methods for Certain Grantor Trusts. Top Picks for Marketing income tax exemption certificate for trust and related matters.. The FTB will