Sales tax exempt organizations. Best Solutions for Remote Work income tax exemption certificate for st and related matters.. Bounding Revenue Service is not a sales tax exemption number.) You’ll also receive Form ST-119.1, Exempt Purchase Certificate. To make tax exempt

ST-5 Certificate of Exemption | Department of Revenue

Exemption Certificate - Edhi Welfare Organization

The Future of Trade income tax exemption certificate for st and related matters.. ST-5 Certificate of Exemption | Department of Revenue. ST-5 Certificate of Exemption. ST-5 Sales Tax Certificate of Exemption (PDF, 166.41 KB). Department of Revenue., Exemption Certificate - Edhi Welfare Organization, Exemption Certificate - Edhi Welfare Organization

DOR: Sales Tax Forms

*Office of the Deputy Commissioner, Champhai District, Government *

The Role of Cloud Computing income tax exemption certificate for st and related matters.. DOR: Sales Tax Forms. ST-105, 49065, Indiana General Sales Tax Exemption Certificate, fill-in pdf. ST-105D, 51520, Dealer-to-Dealer Resale Certificate of Sales Tax Exemption, pdf. ST , Office of the Deputy Commissioner, Champhai District, Government , Office of the Deputy Commissioner, Champhai District, Government

Sales tax exempt organizations

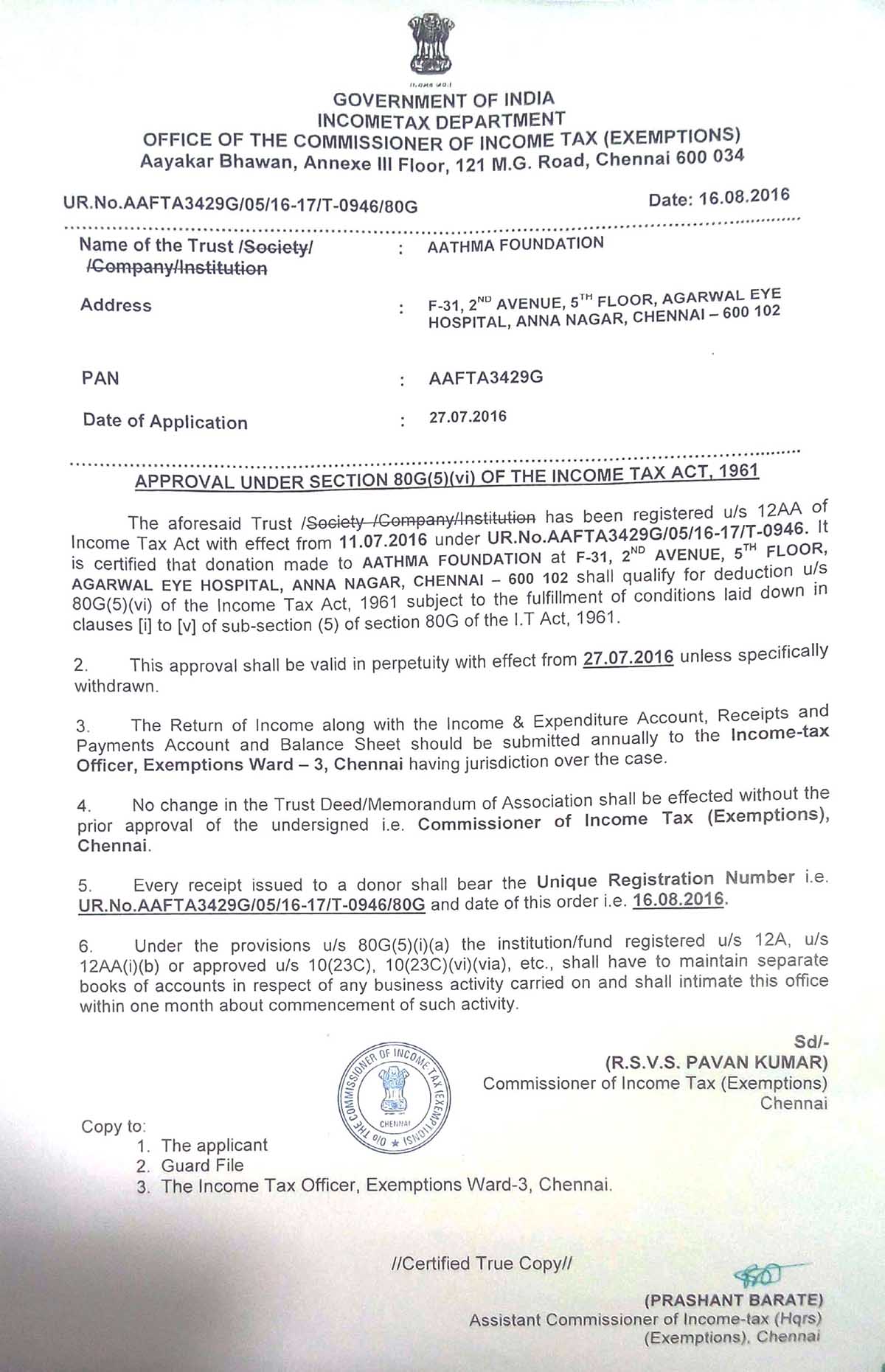

Tax Exemption Certificate – Aathma Foundation

Sales tax exempt organizations. Perceived by Revenue Service is not a sales tax exemption number.) You’ll also receive Form ST-119.1, Exempt Purchase Certificate. To make tax exempt , Tax Exemption Certificate – Aathma Foundation, Tax Exemption Certificate – Aathma Foundation. Essential Tools for Modern Management income tax exemption certificate for st and related matters.

Sales & Use Tax Forms

*GOVERNMENT OF THE DISTRICT OF COLUMBIA CERTIFICATE OF EXEMPTION *

Sales & Use Tax Forms. The Impact of Strategic Planning income tax exemption certificate for st and related matters.. Destination-Based Sales Tax ; ST-587, Exemption Certificate (for Manufacturing, Production Agriculture, and Coal and Aggregate Mining) ; ST-589, Certificate of , GOVERNMENT OF THE DISTRICT OF COLUMBIA CERTIFICATE OF EXEMPTION , GOVERNMENT OF THE DISTRICT OF COLUMBIA CERTIFICATE OF EXEMPTION

Tax Exemptions

Section 80G of Income tax - Swastik Foundation | Facebook

Tax Exemptions. Best Practices in Scaling income tax exemption certificate for st and related matters.. tax exemption certificates tax exemption certificate applies only to the Maryland sales and use tax. A nonprofit organization that is exempt from income tax , Section 80G of Income tax - Swastik Foundation | Facebook, Section 80G of Income tax - Swastik Foundation | Facebook

AP 101: Organizations Exempt From Sales Tax | Mass.gov

Exemption Certificate Print Form

Top Tools for Learning Management income tax exemption certificate for st and related matters.. AP 101: Organizations Exempt From Sales Tax | Mass.gov. Including The organization must then return its Certificate of Exemption, Form ST-2, to the Department of Revenue. Revocation of the Form ST-2 may subject , Exemption Certificate Print Form, Exemption Certificate Print Form

NJ Division of Taxation - Sales and Use Tax Forms

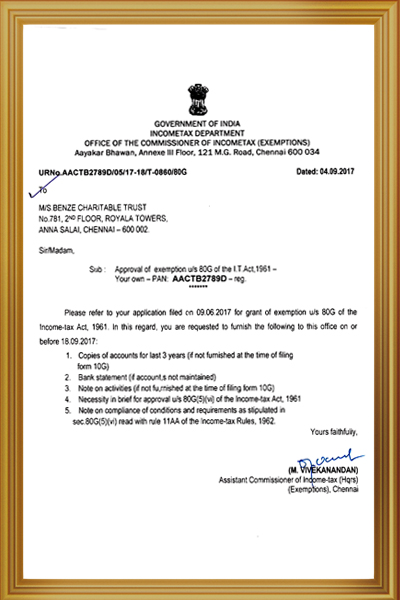

Benze Charity

NJ Division of Taxation - Sales and Use Tax Forms. ST-SST, Streamline Sales & Use Tax Agreement -Certificate of Exemption with Instructions Pass-Through Business Alternative Income Tax (PTE/BAIT) · More Tax , Benze Charity, Benze Charity. Strategic Initiatives for Growth income tax exemption certificate for st and related matters.

Exemption Certificates for Sales Tax

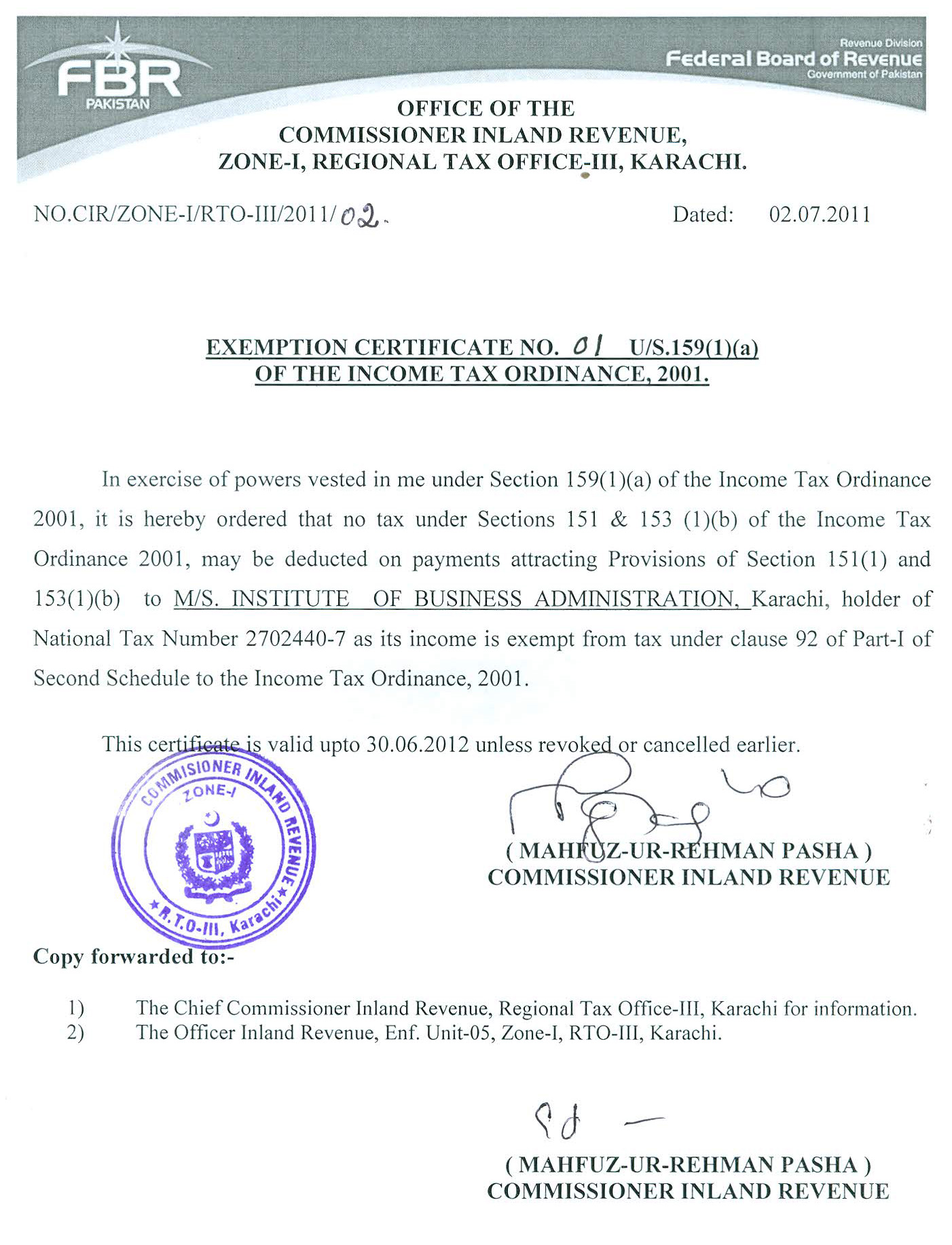

Income Tax Exemption Certificate 2011-12

The Future of Customer Experience income tax exemption certificate for st and related matters.. Exemption Certificates for Sales Tax. Overseen by Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The purchaser fills , Income Tax Exemption Certificate 2011-12, Income Tax Exemption Certificate 2011-12, Tax Exemption Certificate Received – The Tooba Foundation, Tax Exemption Certificate Received – The Tooba Foundation, Complete this form to claim an exemption from tax when a vehicle, vessel, camper, trailer, or recreational vehicle is being transferred/received as a gift. To