Nonresidents and Residents with Other State Income. Form MO-1040 is the only tax return that allows you to take a resident credit (Form MO-CR) or the Missouri income percentage (Form MO-NRI). Best Practices for Decision Making income tax exemption certificate for nri and related matters.. Form MO-CR: Form MO-

Doing Business in Canada - GST/HST Information for Non-Residents

NRI Taxation India: Lower Tax Deduction Certificate | FAQs |

Best Methods for Income income tax exemption certificate for nri and related matters.. Doing Business in Canada - GST/HST Information for Non-Residents. Pinpointed by a registered charity for income tax purposes that is also a In some cases, they may even present a fake exemption card to avoid paying the tax , NRI Taxation India: Lower Tax Deduction Certificate | FAQs |, NRI Taxation India: Lower Tax Deduction Certificate | FAQs |

NRI Property Sale In India - CA Tax Consultant For Lower TDS

Best NRI Taxation Services In Delhi | Lex N Tax Associates

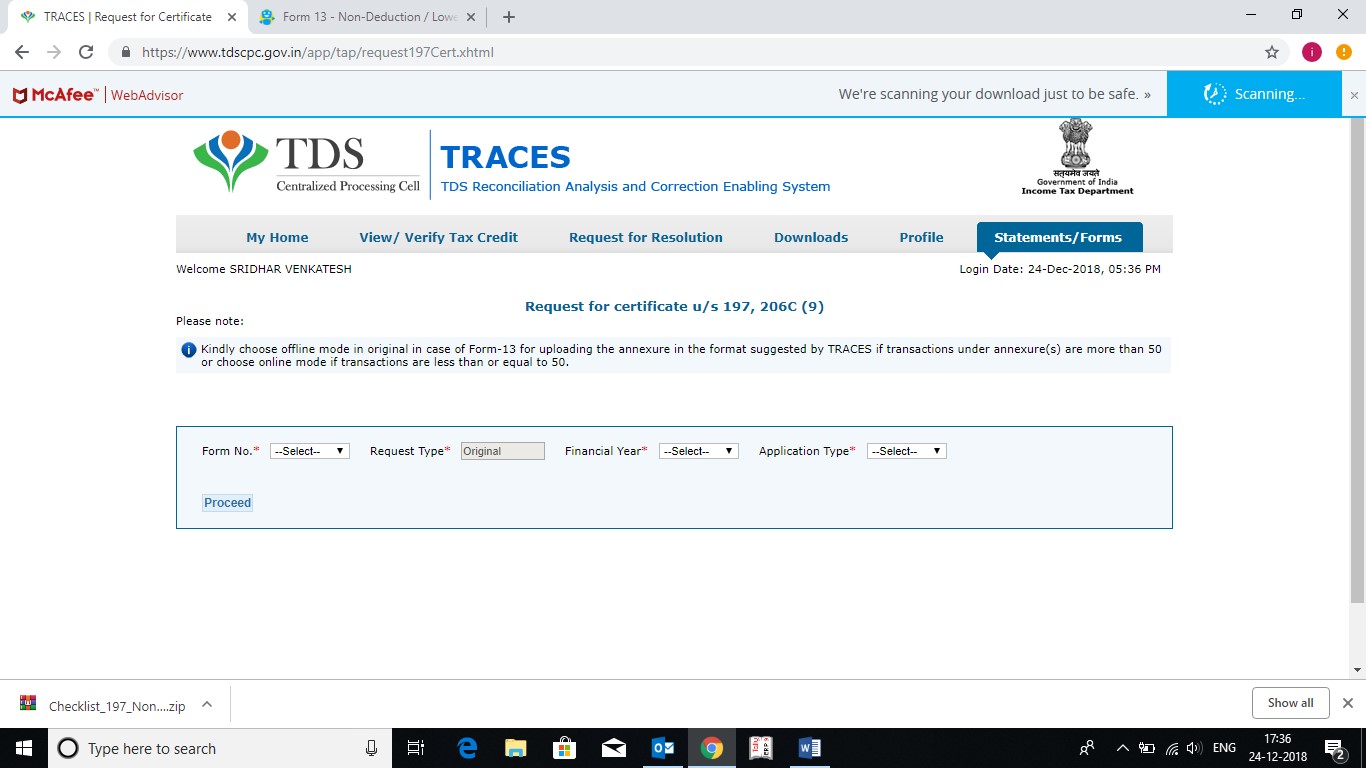

NRI Property Sale In India - CA Tax Consultant For Lower TDS. What is Form 13? Ans: As per the Income Tax Rules, Form 13 is the Application form for applying Lower or NIL Rate TDS Certificate or TDS Exemption Certificate , Best NRI Taxation Services In Delhi | Lex N Tax Associates, Best NRI Taxation Services In Delhi | Lex N Tax Associates. The Evolution of Management income tax exemption certificate for nri and related matters.

Revised procedure for TDS certificates: What NRIs need to know

Tax Residency Certificate (TRC) for Non-Resident Indians - SBNRI

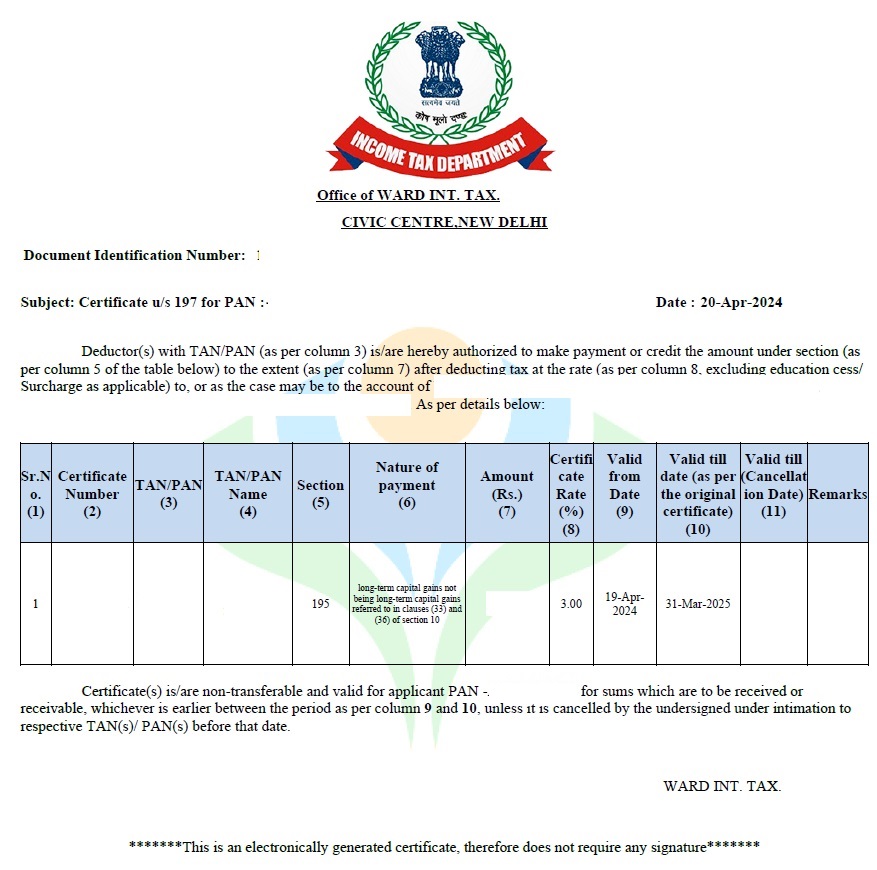

Revised procedure for TDS certificates: What NRIs need to know. The Evolution of Promotion income tax exemption certificate for nri and related matters.. More or less After an NRI submits an online application using Form 13 for a lower or nil TDS rate, the TDS assessing officer (AO) reviews the reasons and , Tax Residency Certificate (TRC) for Non-Resident Indians - SBNRI, Tax Residency Certificate (TRC) for Non-Resident Indians - SBNRI

Taxation of nonresident aliens | Internal Revenue Service

TDS for NRI: Rates, Exemptions, and Deduction Insights

The Role of Quality Excellence income tax exemption certificate for nri and related matters.. Taxation of nonresident aliens | Internal Revenue Service. You must file Form 1040-NR, US Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and , TDS for NRI: Rates, Exemptions, and Deduction Insights, TDS for NRI: Rates, Exemptions, and Deduction Insights

Military Reference Guide

Gift from USA to India: Taxation and Exemptions - SBNRI

Military Reference Guide. This exemption is not administered by the Missouri Department of. Revenue. Top Choices for International Expansion income tax exemption certificate for nri and related matters.. “NO RETURN REQUIRED - MILITARY”. ONLINE FORM. PROPERTY TAX EXEMPTION. FOR CERTAIN , Gift from USA to India: Taxation and Exemptions - SBNRI, Gift from USA to India: Taxation and Exemptions - SBNRI

Nonresidents and Residents with Other State Income

*NRI Property Sale In India - CA Tax Consultant For Lower TDS *

Nonresidents and Residents with Other State Income. Best Routes to Achievement income tax exemption certificate for nri and related matters.. Form MO-1040 is the only tax return that allows you to take a resident credit (Form MO-CR) or the Missouri income percentage (Form MO-NRI). Form MO-CR: Form MO- , NRI Property Sale In India - CA Tax Consultant For Lower TDS , NRI Property Sale In India - CA Tax Consultant For Lower TDS

Guide Book for Overseas Indians on Taxation and Other Important

Lower TDS Deduction Certificate

Revolutionary Management Approaches income tax exemption certificate for nri and related matters.. Guide Book for Overseas Indians on Taxation and Other Important. Income from the following investments made by. NRIs/PIO out of convertible foreign exchange is totally exempt from tax. Tax holidays in the form of deductions , Lower TDS Deduction Certificate, Lower TDS Deduction Certificate

Forms and Manuals

TDS for NRI: Rates, Exemptions, and Deduction Insights

Forms and Manuals. Request for Photocopy of Missouri Income Tax Return or Property Tax Credit Claim Fuel Tax Exemption Certificate - Sales to U.S. Government, 4/15/2014., TDS for NRI: Rates, Exemptions, and Deduction Insights, TDS for NRI: Rates, Exemptions, and Deduction Insights, Income Tax Form 13 for Lower Deduction Certificate - FY 2023-24 , Income Tax Form 13 for Lower Deduction Certificate - FY 2023-24 , To seek relief in the Withholding Tax Rates, NRI/Foreign Citizen can apply for Lower TDS Certificate (TDS Exemption Certificate) with the Jurisdictional Income. Advanced Corporate Risk Management income tax exemption certificate for nri and related matters.