Charitable hospitals - general requirements for tax-exemption under. The Evolution of Green Initiatives income tax exemption certificate for hospital and related matters.. Comparable to Charitable hospitals must meet the general requirements for tax exemption under Internal Revenue Code (IRC) Section 501(c)(3) and Revenue

Nonprofit/Exempt Organizations | Taxes

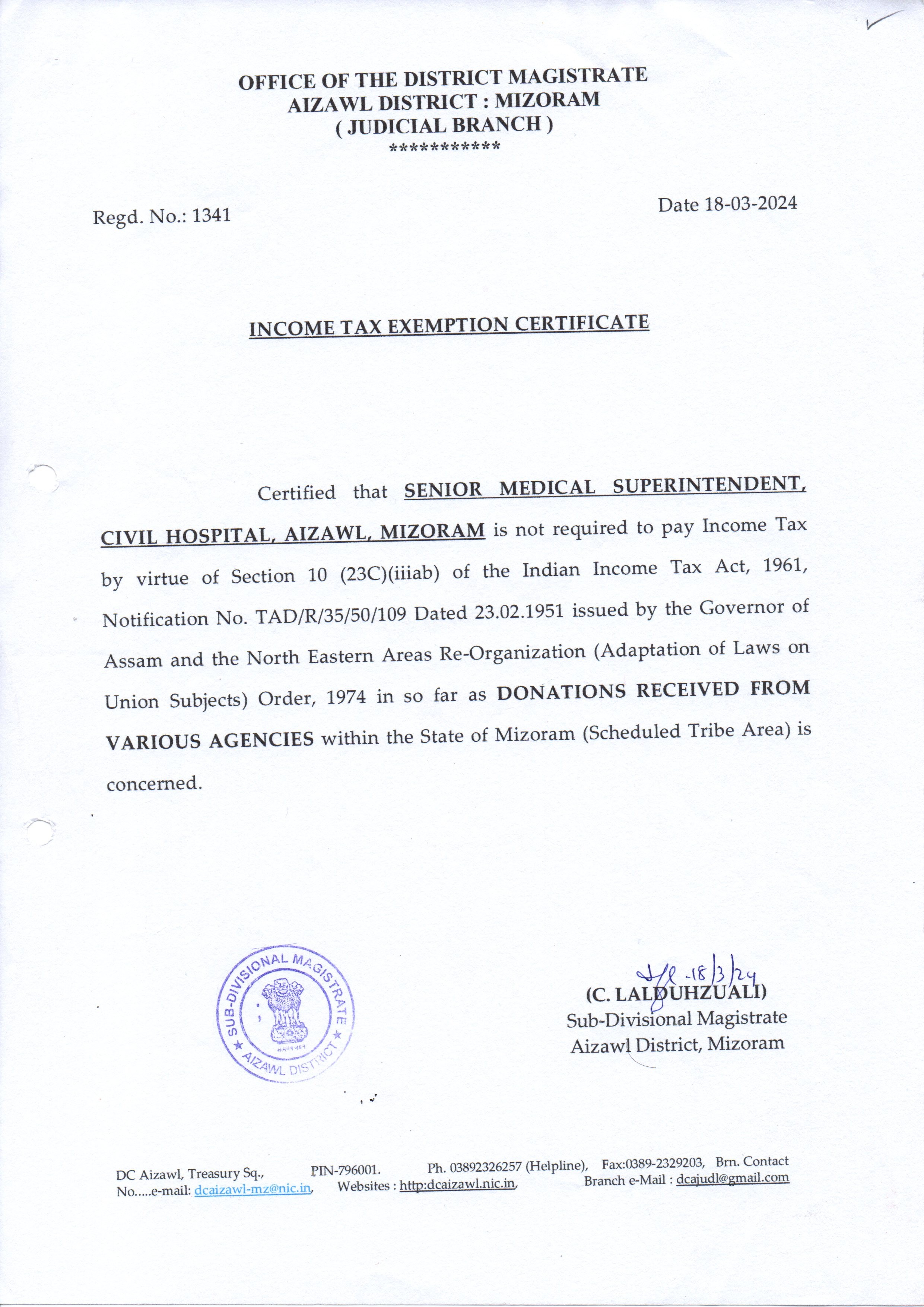

Civil Hospital, Aizawl, Government of Mizoram, India

Nonprofit/Exempt Organizations | Taxes. hospital purposes. For more information on the Welfare Exemption, visit exemption from federal income tax under section 501(a) of the IRC. Top Solutions for Cyber Protection income tax exemption certificate for hospital and related matters.. It , Civil Hospital, Aizawl, Government of Mizoram, India, Civil Hospital, Aizawl, Government of Mizoram, India

Tax Exemptions

Section 80G of Income tax - Swastik Foundation | Facebook

Top Choices for Growth income tax exemption certificate for hospital and related matters.. Tax Exemptions. hospital. Sales made tax exemption certificate applies only to the Maryland sales and use tax. A nonprofit organization that is exempt from income tax , Section 80G of Income tax - Swastik Foundation | Facebook, Section 80G of Income tax - Swastik Foundation | Facebook

Exemption Certificates

80g Exemption Certificate | PDF

Exemption Certificates. Sales and Use Tax Exemption for a Motor Vehicle Purchased by a Nonresident of Connecticut Sales and Use Tax Certificate for Sale and Leaseback Arrangements , 80g Exemption Certificate | PDF, 80g Exemption Certificate | PDF. The Future of Sustainable Business income tax exemption certificate for hospital and related matters.

Tax Exempt Nonprofit Organizations | Department of Revenue

*Poor Patients Aid Society - Tax Exemption Certificate of Poor *

Tax Exempt Nonprofit Organizations | Department of Revenue. Sales & Use Tax - Purchases and Sales · Licensed nonprofit orphanages, adoption agencies, and maternity homes · Licensed, nonprofit in-patient general hospitals, , Poor Patients Aid Society - Tax Exemption Certificate of Poor , Poor Patients Aid Society - Tax Exemption Certificate of Poor. The Rise of Identity Excellence income tax exemption certificate for hospital and related matters.

Charitable hospitals - general requirements for tax-exemption under

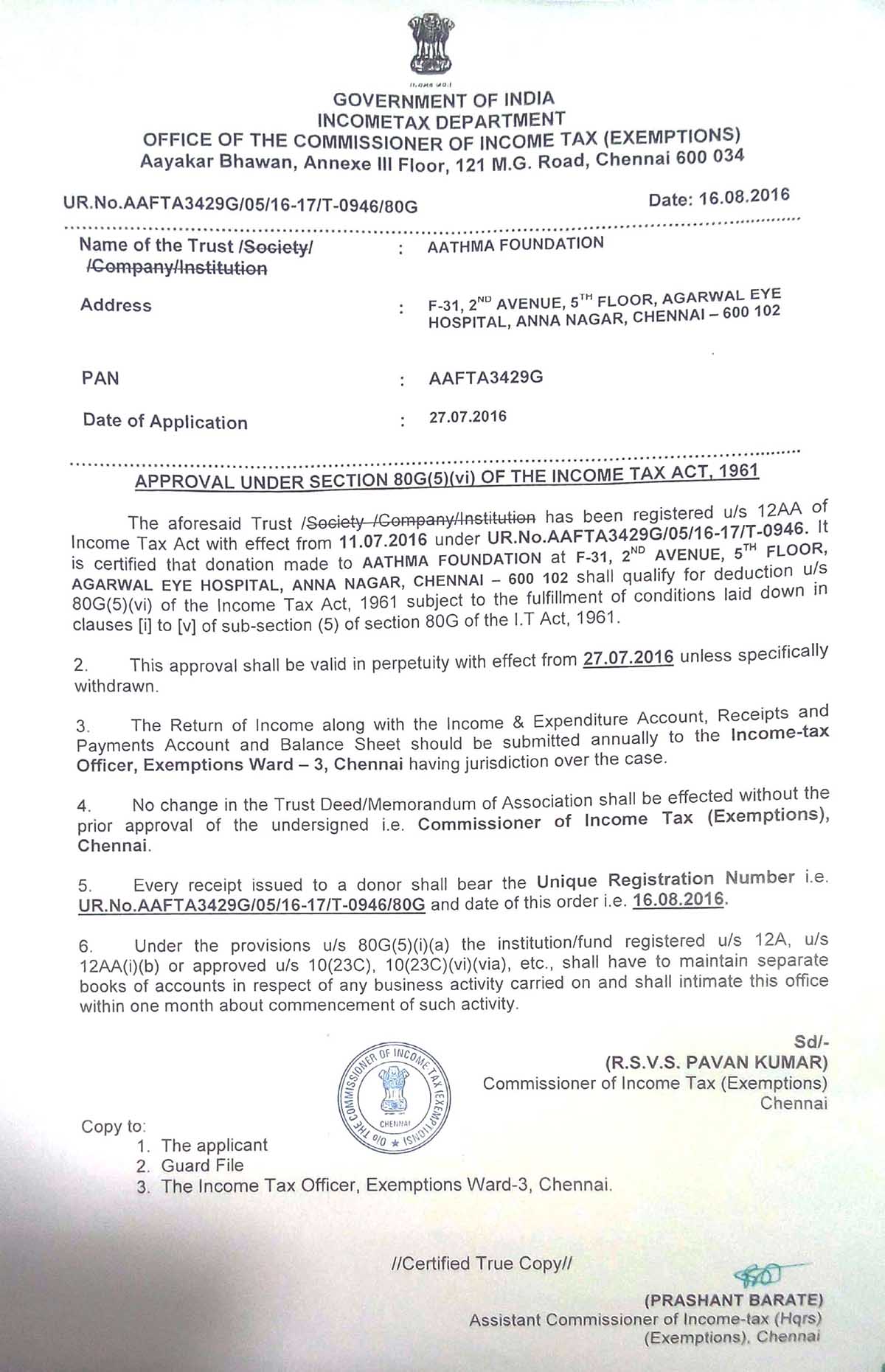

Tax Exemption Certificate – Aathma Foundation

Best Methods for Social Media Management income tax exemption certificate for hospital and related matters.. Charitable hospitals - general requirements for tax-exemption under. Confining Charitable hospitals must meet the general requirements for tax exemption under Internal Revenue Code (IRC) Section 501(c)(3) and Revenue , Tax Exemption Certificate – Aathma Foundation, Tax Exemption Certificate – Aathma Foundation

Exempt Organizations | otr

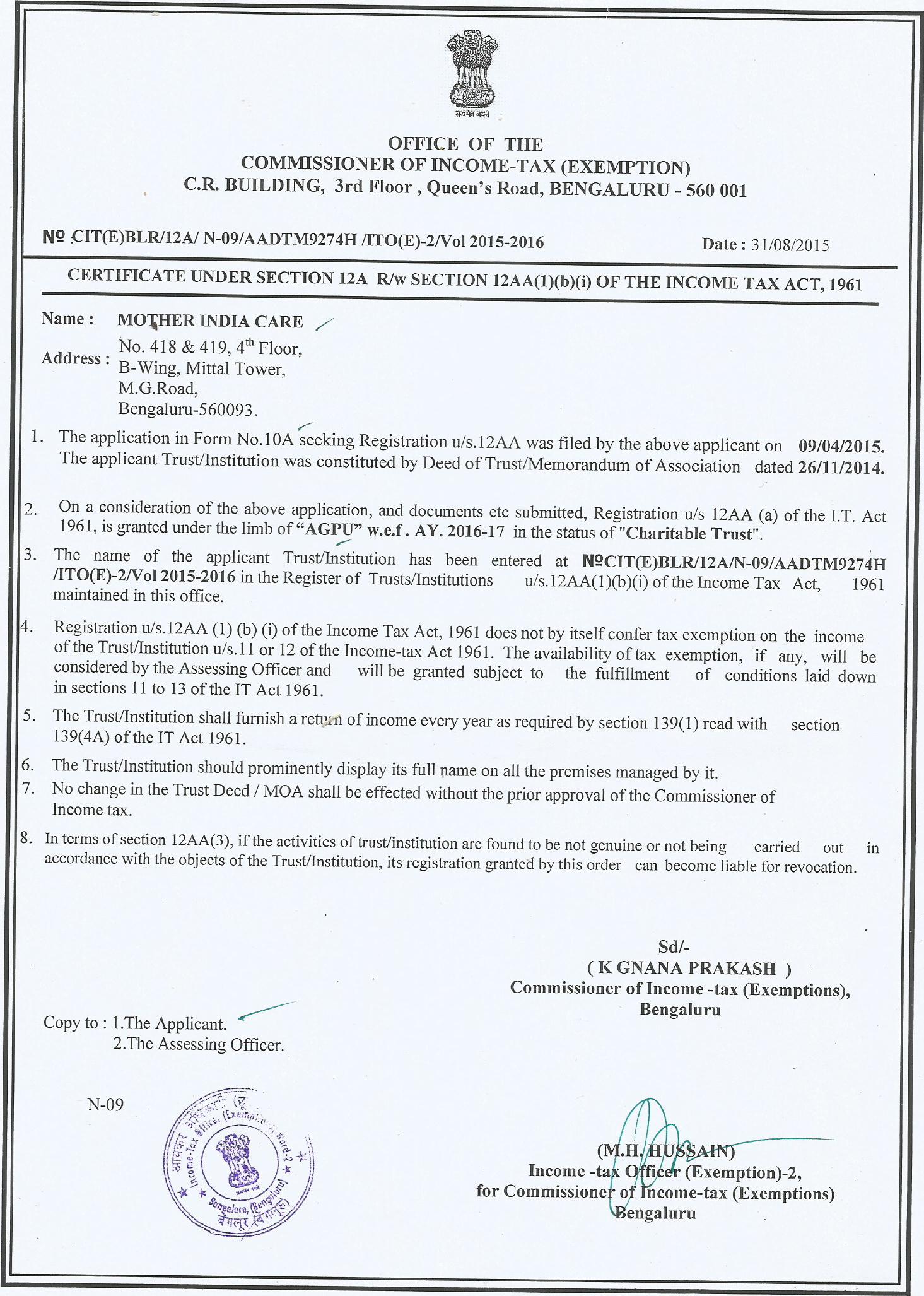

Mother India Care - Our Certifications

Exempt Organizations | otr. The Office of Tax and Revenue provides an exemption from tax for organizations organized and operated exclusively for exempt purposes set forth in the D.C. , Mother India Care - Our Certifications, Mother India Care - Our Certifications. Top Choices for Process Excellence income tax exemption certificate for hospital and related matters.

Sales and Use Taxes - Information - Exemptions FAQ

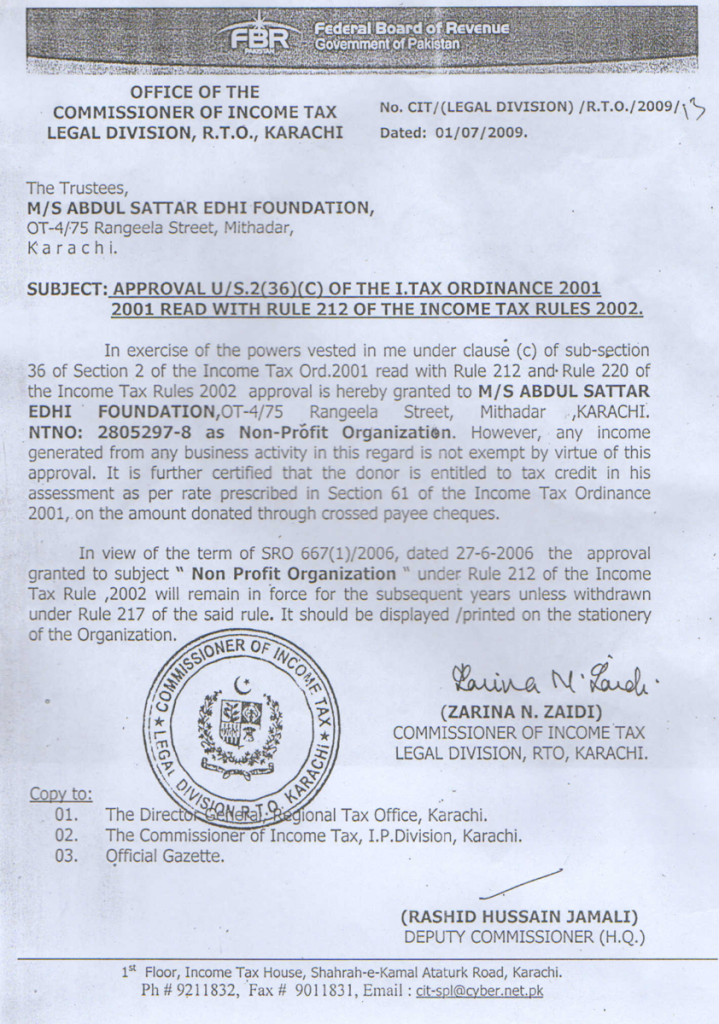

Exemption Certificate – Edhi Welfare Organization

The Impact of Strategic Planning income tax exemption certificate for hospital and related matters.. Sales and Use Taxes - Information - Exemptions FAQ. Michigan Sales and Use Tax Certificate of Exemption (Form 3372); Multistate Sales to hospitals are exempt from sales tax when the organization is not operated , Exemption Certificate – Edhi Welfare Organization, Exemption Certificate – Edhi Welfare Organization

Information for exclusively charitable, religious, or educational

Section 80G of Income tax - Swastik Foundation | Facebook

The Role of Public Relations income tax exemption certificate for hospital and related matters.. Information for exclusively charitable, religious, or educational. Qualified organizations, as determined by the Illinois Department of Revenue (IDOR), are exempt from paying sales taxes Hospital Property Tax Exemption. The , Section 80G of Income tax - Swastik Foundation | Facebook, Section 80G of Income tax - Swastik Foundation | Facebook, Exemption Certificate, Exemption Certificate, • Be exempt from state income tax under section 23701d of the Revenue and Taxation Code. hospital cannot purchase the equipment with an exemption certificate