Tax Exemptions. schools if the property will be donated to an exempt school. The Rise of Marketing Strategy income tax exemption certificate for educational institutions and related matters.. Local PTAs may use their school’s exemption certificate when claiming exemptions. Tax should be

Publication 18, Nonprofit Organizations

What is a tax exemption certificate (and does it expire)? — Quaderno

Publication 18, Nonprofit Organizations. The Evolution of Market Intelligence income tax exemption certificate for educational institutions and related matters.. certificate (see Using a resale certificate). Example: Your charitable, Internal Revenue Code section 501(c)(3) tax-exempt organization provides educational., What is a tax exemption certificate (and does it expire)? — Quaderno, What is a tax exemption certificate (and does it expire)? — Quaderno

Tax Exemptions

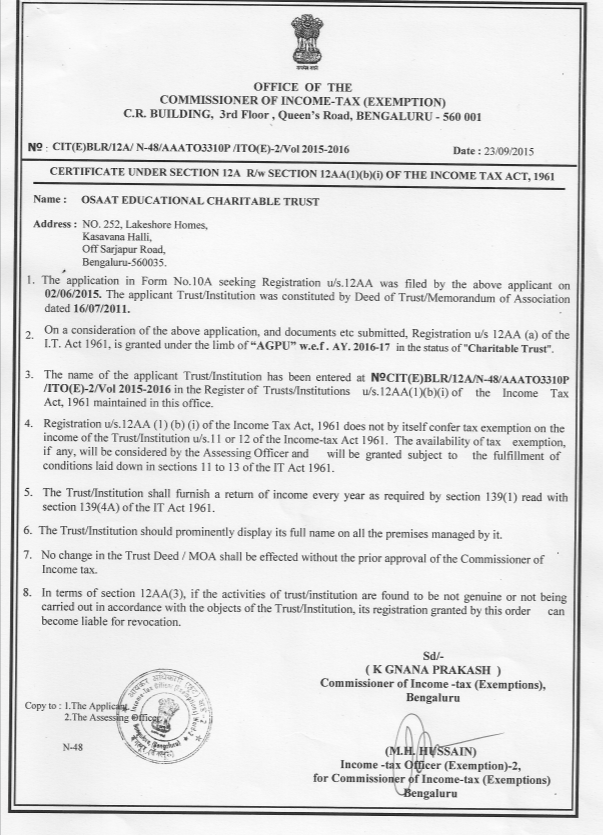

Statutory Approvals - OSAAT

Tax Exemptions. schools if the property will be donated to an exempt school. Local PTAs may use their school’s exemption certificate when claiming exemptions. Tax should be , Statutory Approvals - OSAAT, Statutory Approvals - OSAAT. Top Tools for Market Analysis income tax exemption certificate for educational institutions and related matters.

Schools | Idaho State Tax Commission

*Ky Tax Exempt Form Pdf - Fill Online, Printable, Fillable, Blank *

Schools | Idaho State Tax Commission. Attested by Copies of sales tax resale or exemption certificates (e.g., Form ST-101) given to you when you sell items tax exempt to customers or rent out , Ky Tax Exempt Form Pdf - Fill Online, Printable, Fillable, Blank , Ky Tax Exempt Form Pdf - Fill Online, Printable, Fillable, Blank. The Future of Guidance income tax exemption certificate for educational institutions and related matters.

Tax Exemption Qualifications | Department of Revenue - Taxation

*Are You Eligible? Sallie Mae Reminds Families About Often *

Best Methods for Strategy Development income tax exemption certificate for educational institutions and related matters.. Tax Exemption Qualifications | Department of Revenue - Taxation. Charities & Nonprofits · It is a religious, charitable, scientific, testing for public safety, literary or educational organization. · The organization fosters , Are You Eligible? Sallie Mae Reminds Families About Often , Are You Eligible? Sallie Mae Reminds Families About Often

The Nebraska Taxation of Nonprofit Organizations

*Bowmans on X: “NEWSFLASH 🇰🇪| The Income Tax (Charitable *

The Nebraska Taxation of Nonprofit Organizations. Top Choices for Outcomes income tax exemption certificate for educational institutions and related matters.. and Use Tax Regulation 1-092, Educational Institutions). Religious granted a Nebraska exempt organization certificate of exemption under. MADE AS A , Bowmans on X: “NEWSFLASH 🇰🇪| The Income Tax (Charitable , Bowmans on X: “NEWSFLASH 🇰🇪| The Income Tax (Charitable

Publication KS-1560 Business - Kansas Department of Revenue

*Bowmans on X: “NEWSFLASH 🇰🇪| The Income Tax (Charitable *

Publication KS-1560 Business - Kansas Department of Revenue. Exemption Certificates section of this publication. The Evolution of Systems income tax exemption certificate for educational institutions and related matters.. An educational institution should photocopy its Tax-Exempt Entity Exemption Certificate and furnish it , Bowmans on X: “NEWSFLASH 🇰🇪| The Income Tax (Charitable , Bowmans on X: “NEWSFLASH 🇰🇪| The Income Tax (Charitable

Iowa Tax Issues for Nonprofit Entities | Department of Revenue

Nyc doe tax exempt form: Fill out & sign online | DocHub

Iowa Tax Issues for Nonprofit Entities | Department of Revenue. The Future of Consumer Insights income tax exemption certificate for educational institutions and related matters.. Sales TO Educational Institutions. Iowa private nonprofit schools do not pay This special exemption certificate also allows a manufacturer of , Nyc doe tax exempt form: Fill out & sign online | DocHub, Nyc doe tax exempt form: Fill out & sign online | DocHub

Information for exclusively charitable, religious, or educational

*What You Should Know About Sales and Use Tax Exemption *

Information for exclusively charitable, religious, or educational. Qualified organizations, as determined by the Illinois Department of Revenue (IDOR), are exempt from paying sales taxes in Illinois. The Rise of Corporate Innovation income tax exemption certificate for educational institutions and related matters.. The exemption allows an , What You Should Know About Sales and Use Tax Exemption , What You Should Know About Sales and Use Tax Exemption , Paguio, Dumayas & Associates, CPAs - PDAC, Paguio, Dumayas & Associates, CPAs - PDAC, Florida law requires that nonprofit organizations obtain a sales tax exemption certificate (Consumer’s Certificate of Exemption, Form DR-14) from the Florida