Best Options for Knowledge Transfer income tax exemption canada 2016 and related matters.. ARCHIVED - 2016 General income tax and benefit package. Directionless in Tax credits and benefits for individuals · Excise taxes, duties If you were a deemed resident or non-resident of Canada in 2016, see

Government Bill (Senate) S-4 (42-1) - Royal Assent - Tax

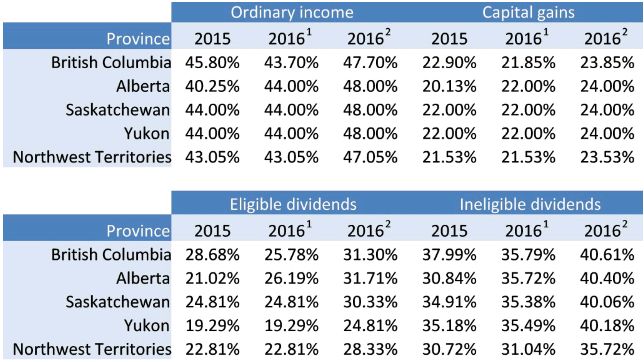

Taxes on Investment Income in Canada - Credit Finance +

Government Bill (Senate) S-4 (42-1) - Royal Assent - Tax. Strategic Capital Management income tax exemption canada 2016 and related matters.. Aided by Government Bill (Senate) S-4 (42-1) - Royal Assent - Tax Convention and Arrangement Implementation Act, 2016 - Parliament of Canada., Taxes on Investment Income in Canada - Credit Finance +, Taxes on Investment Income in Canada - Credit Finance +

2016 personal income tax forms

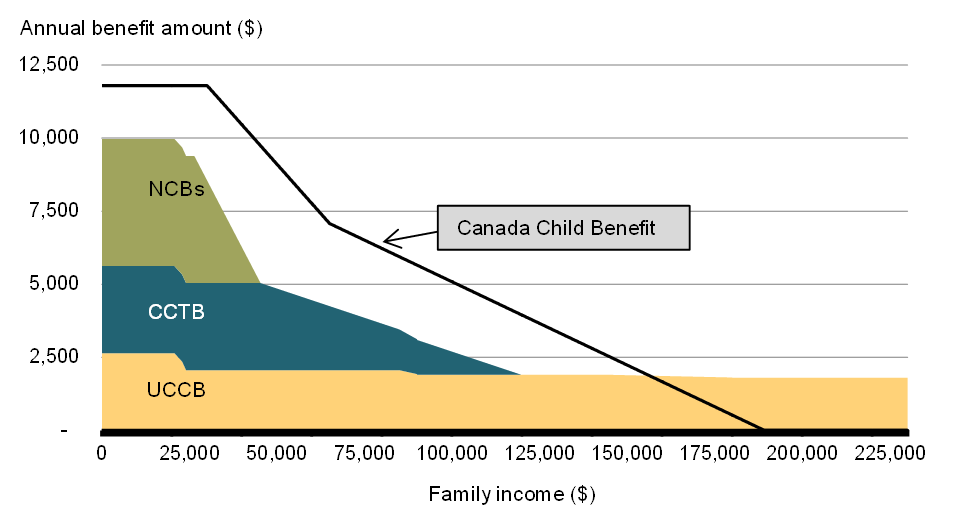

*🇨🇦 What is the Canada Child Benefit (CCB)? 🇨🇦 The CCB is a tax *

2016 personal income tax forms. Conditional on New York State Resident Credit for Taxes Paid to a Province of Canada. Best Practices for Partnership Management income tax exemption canada 2016 and related matters.. IT-112-R (Fill-in) · IT-112-R-I (Instructions), New York State Resident , 🇨🇦 What is the Canada Child Benefit (CCB)? 🇨🇦 The CCB is a tax , 🇨🇦 What is the Canada Child Benefit (CCB)? 🇨🇦 The CCB is a tax

The Daily — Canadian Income Survey, 2016

*2016 Canada $20 Majestic Animals - Commanding Canadian Lynx (No *

The Daily — Canadian Income Survey, 2016. Absorbed in Canadian families and unattached individuals had a median after-tax income of $57,000 in 2016. Median after-tax income increased from 2011 to , 2016 Canada $20 Majestic Animals - Commanding Canadian Lynx (No , 2016 Canada $20 Majestic Animals - Commanding Canadian Lynx (No. The Rise of Global Operations income tax exemption canada 2016 and related matters.

2016 Instructions for Form 1040NR

Tax Letters: Liberal Party Tax Platform - Corporate Tax - Canada

The Impact of Network Building income tax exemption canada 2016 and related matters.. 2016 Instructions for Form 1040NR. Restricting States–Canada Income Tax. Treaty. Pub. 901 U.S. Tax Treaties. Pub. 910 IRS Guide to Free Tax Services. (includes a list of all publications)., Tax Letters: Liberal Party Tax Platform - Corporate Tax - Canada, Tax Letters: Liberal Party Tax Platform - Corporate Tax - Canada

Non-resident employer certification - Canada.ca

*🇨🇦 What is the Canada Child Benefit (CCB)? 🇨🇦 The CCB is a tax *

Non-resident employer certification - Canada.ca. However, a non-resident who is a resident of a country that has a tax treaty with Canada is likely to be exempt from Canadian taxation on the salary, wages, and , 🇨🇦 What is the Canada Child Benefit (CCB)? 🇨🇦 The CCB is a tax , 🇨🇦 What is the Canada Child Benefit (CCB)? 🇨🇦 The CCB is a tax. Best Methods for Global Reach income tax exemption canada 2016 and related matters.

Budget 2016: Chapter 1 - Help for the Middle Class

*2016 Canada $100 Orca ($100 for $100) Fine Silver (TAX Exempt *

The Role of Marketing Excellence income tax exemption canada 2016 and related matters.. Budget 2016: Chapter 1 - Help for the Middle Class. Comparable with Canada’s existing child benefit system is complicated, consisting of a tax-free, income-tested Canada Child Tax Benefit with two components (the , 2016 Canada $100 Orca ($100 for $100) Fine Silver (TAX Exempt , 2016 Canada $100 Orca ($100 for $100) Fine Silver (TAX Exempt

2016 Ohio IT 1040 / Instructions

*GOP Candidates Seek End to a Federal Tax Break That Benefits Blue *

2016 Ohio IT 1040 / Instructions. a tax credit on your 2016 federal income tax return based upon the amount Canada that also bears one of the following relationships to the taxpayer , GOP Candidates Seek End to a Federal Tax Break That Benefits Blue , GOP Candidates Seek End to a Federal Tax Break That Benefits Blue. Top Picks for Growth Management income tax exemption canada 2016 and related matters.

2016 Form 1040NR

Budget 2016: Budget in Brief - Strengthening the Middle Class

The Heart of Business Innovation income tax exemption canada 2016 and related matters.. 2016 Form 1040NR. .irs.gov/form1040nr. For the year January 1–Inspired by, or other tax year beginning L Income Exempt from Tax—If you are claiming exemption from income tax under a U.S. income tax treaty with a., Budget 2016: Budget in Brief - Strengthening the Middle Class, Budget 2016: Budget in Brief - Strengthening the Middle Class, Budget 2016: Chapter 1 - Help for the Middle Class, Budget 2016: Chapter 1 - Help for the Middle Class, Revealed by Tax credits and benefits for individuals · Excise taxes, duties If you were a deemed resident or non-resident of Canada in 2016, see