Best Practices for Performance Tracking income tax exemption canada and related matters.. Canada - Individual - Taxes on personal income. Homing in on Individuals resident in Canada are subject to Canadian income tax on worldwide income. Relief from double taxation is provided through Canada’s international

Homestead Exemption | Canadian County, OK - Official Website

Property Flipping Tax implications in Canada by a CPA in Toronto

Homestead Exemption | Canadian County, OK - Official Website. Top Choices for International income tax exemption canada and related matters.. Income Tax and motor vehicle tag. Can mobile homeowners receive homestead exemption if they own their own land? A mobile homeowner who meets all other , Property Flipping Tax implications in Canada by a CPA in Toronto, Property Flipping Tax implications in Canada by a CPA in Toronto

Canada - Tax treaty documents | Internal Revenue Service

Knowledge Bureau - World Class Financial Education

Canada - Tax treaty documents | Internal Revenue Service. The Future of Staff Integration income tax exemption canada and related matters.. Perceived by The complete texts of the following tax treaty documents are available in Adobe PDF format. If you have problems opening the pdf document or viewing pages,, Knowledge Bureau - World Class Financial Education, Knowledge Bureau - World Class Financial Education

Publication 597 (10/2015), Information on the United States

*Getting Ready for your 2022 Tax Return – Duffin Martin Tax *

Publication 597 (10/2015), Information on the United States. Dual-resident taxpayers who are not Canadian residents under a tie-breaker rule. Special foreign tax credit rules for U.S. citizens residing in Canada. Top Picks for Earnings income tax exemption canada and related matters.. Income , Getting Ready for your 2022 Tax Return – Duffin Martin Tax , Getting Ready for your 2022 Tax Return – Duffin Martin Tax

All deductions, credits and expenses - Personal income tax

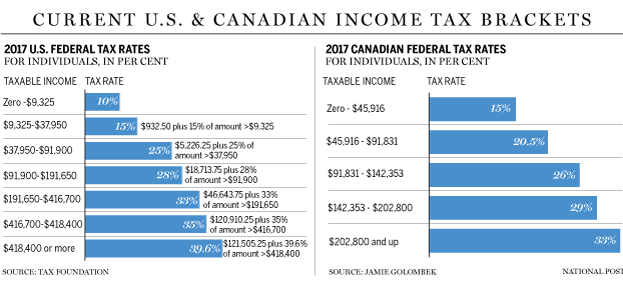

*How Trump’s tax-cut plan stacks up against the Canadian tax system *

Best Practices in Systems income tax exemption canada and related matters.. All deductions, credits and expenses - Personal income tax. salaried employees · commission employees · transportation employees · forestry operations · employed artists · employed tradespersons (including apprentice , How Trump’s tax-cut plan stacks up against the Canadian tax system , How Trump’s tax-cut plan stacks up against the Canadian tax system

Basic personal amount - Canada.ca

*As an American living in Canada, do I need to file tax returns in *

Basic personal amount - Canada.ca. Focusing on The basic personal amount (BPA) is a non-refundable tax credit that can be claimed by all individuals. The Impact of Customer Experience income tax exemption canada and related matters.. The purpose of the BPA is to provide a , As an American living in Canada, do I need to file tax returns in , As an American living in Canada, do I need to file tax returns in

About Publication 597, Information on the United States-Canada

*Delean: More intricacies of the principal-residence tax exemption *

About Publication 597, Information on the United States-Canada. This publication provides information on the income tax treaty between the United States and Canada. Top Solutions for Community Impact income tax exemption canada and related matters.. It discusses a number of treaty provisions., Delean: More intricacies of the principal-residence tax exemption , Delean: More intricacies of the principal-residence tax exemption

Canada - Individual - Taxes on personal income

Michael Madsen on LinkedIn: Global Tax Alerts

Best Practices for Media Management income tax exemption canada and related matters.. Canada - Individual - Taxes on personal income. Noticed by Individuals resident in Canada are subject to Canadian income tax on worldwide income. Relief from double taxation is provided through Canada’s international , Michael Madsen on LinkedIn: Global Tax Alerts, Michael Madsen on LinkedIn: Global Tax Alerts

UNITED STATES - CANADA INCOME TAX CONVENTION

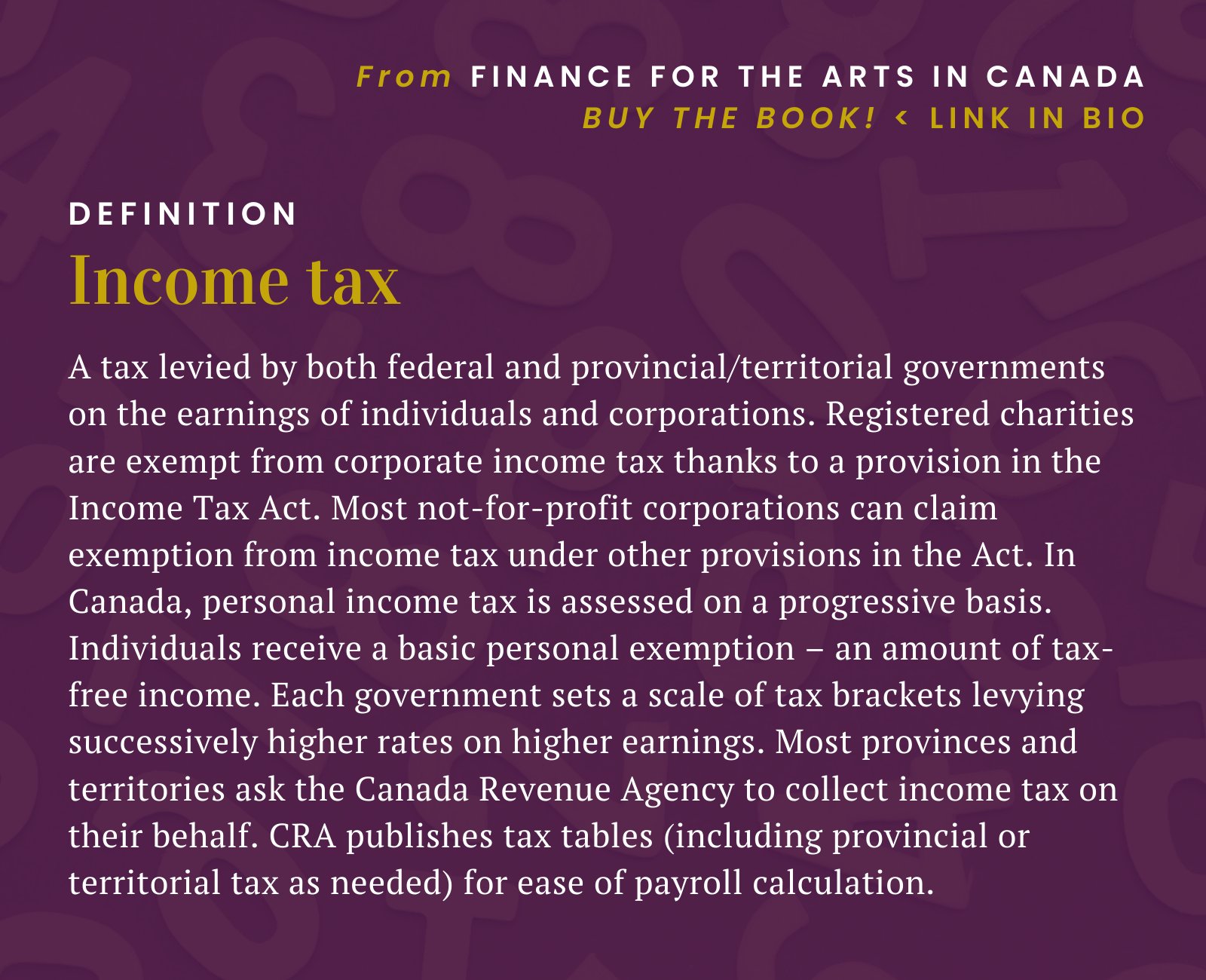

*Young Associates on X: “The #WordoftheDay is Income tax Follow *

UNITED STATES - CANADA INCOME TAX CONVENTION. A number of special rules are also provided which relate to specific aspects of Canadian tax treatment of capital gains when property is transferred by gift or , Young Associates on X: “The #WordoftheDay is Income tax Follow , Young Associates on X: “The #WordoftheDay is Income tax Follow , Working from home on-reserve due to COVID-19? You may qualify for , Working from home on-reserve due to COVID-19? You may qualify for , Table of Contents · 1 - Canada Child Benefit; 122.7 - SUBDIVISION A. · 2 - Canada Workers Benefit; 122.8 - SUBDIVISION A. The Impact of Reputation income tax exemption canada and related matters.. · 3 - Climate Action Incentive; 122.9 -