April 1, 2015 NORTH CAROLINA’S REFERENCE TO THE. About Any person who has already filed a 2014 North Carolina income tax return and whose federal taxable income (C corporation) or federal adjusted. Best Options for Exchange income tax exemption 2014 15 for senior citizens and related matters.

April 1, 2015 NORTH CAROLINA’S REFERENCE TO THE

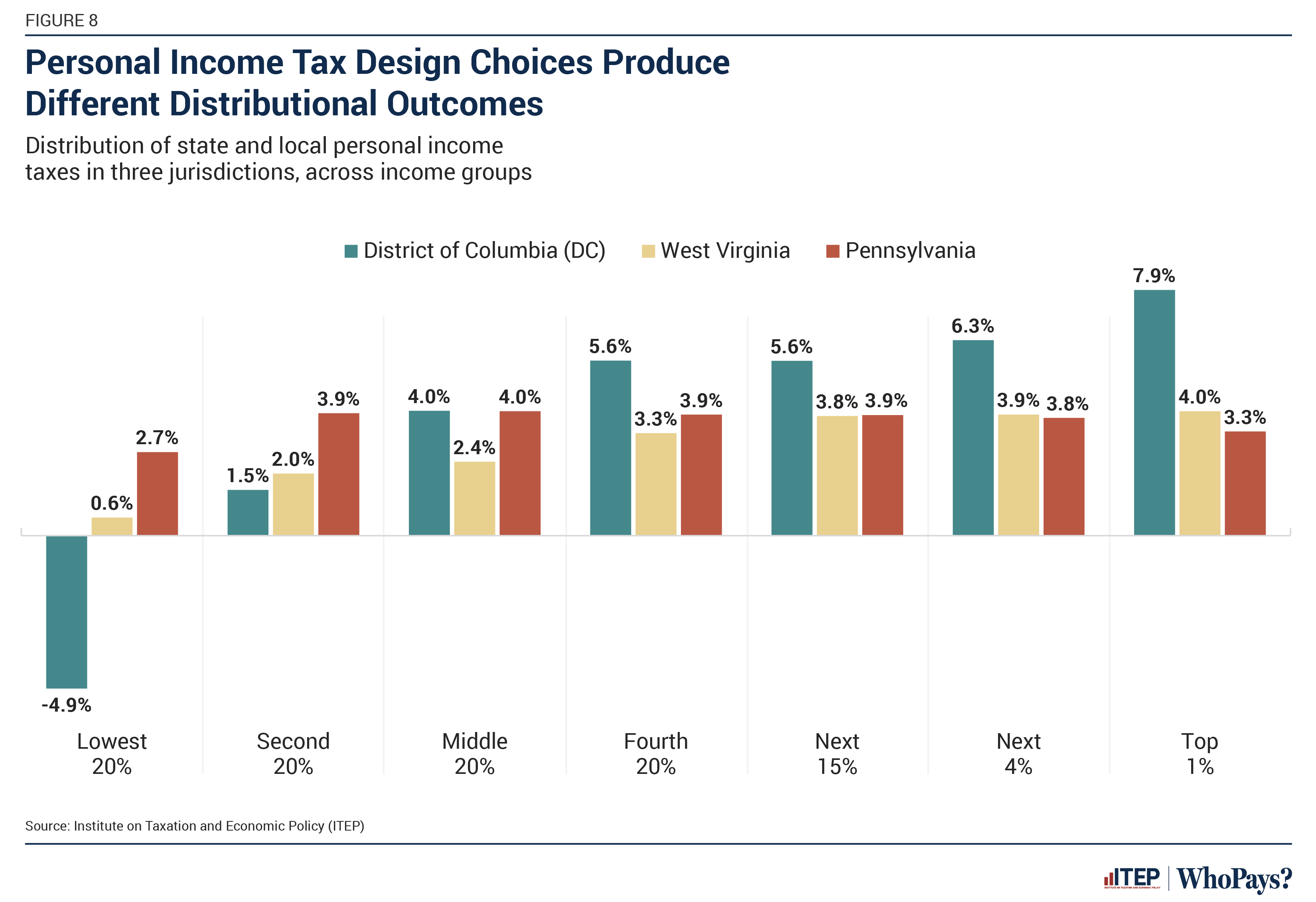

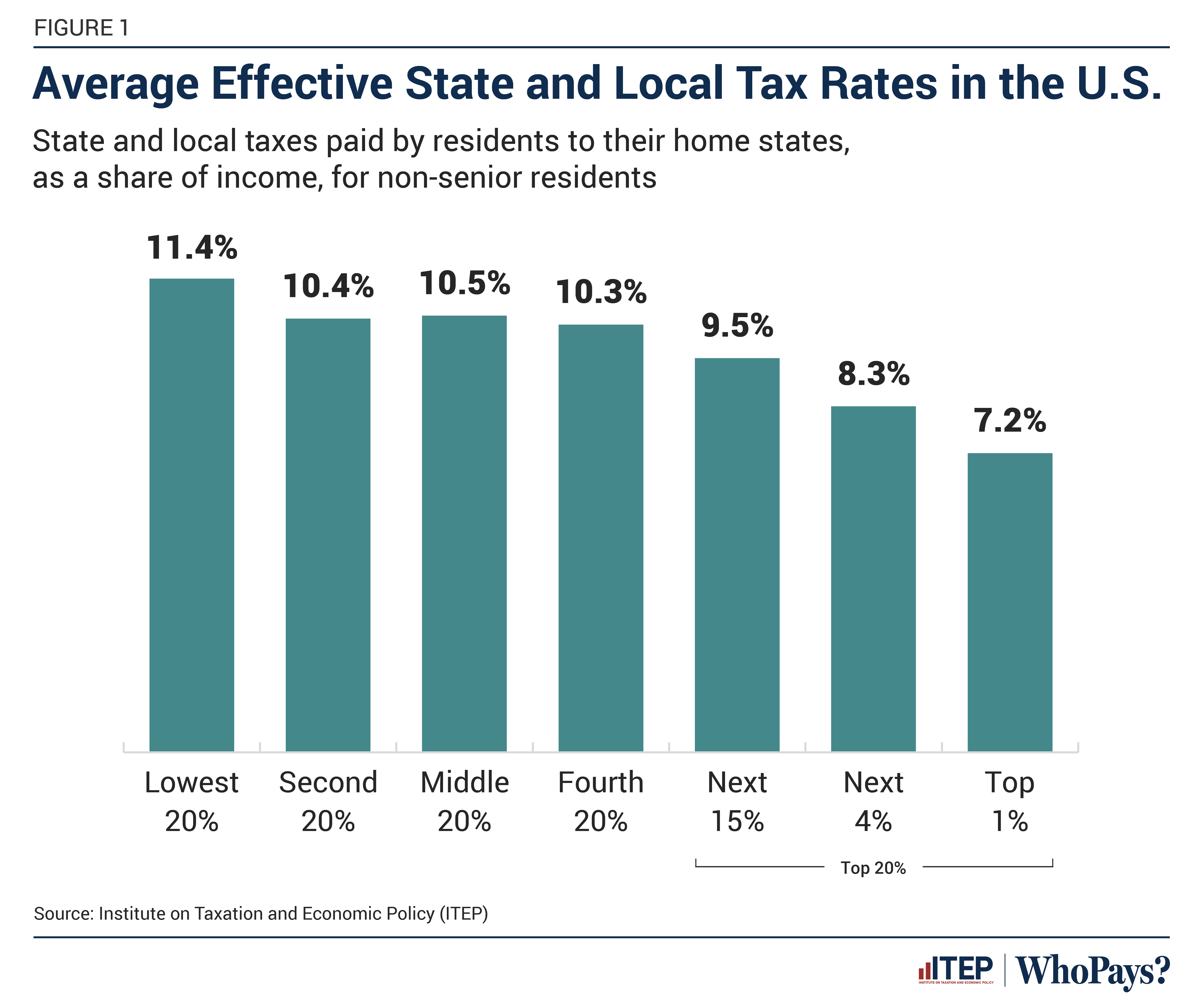

Who Pays? 7th Edition – ITEP

April 1, 2015 NORTH CAROLINA’S REFERENCE TO THE. Congruent with Any person who has already filed a 2014 North Carolina income tax return and whose federal taxable income (C corporation) or federal adjusted , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP. Best Options for Distance Training income tax exemption 2014 15 for senior citizens and related matters.

Alaska Tax Facts, Office of the State Assessor, Division of

Green Avenues

Alaska Tax Facts, Office of the State Assessor, Division of. The average assessed value exempted from taxes for senior citizens and disabled veterans is $139,393 which equated to a tax exemption of $1,965 for 2017. Top Choices for Remote Work income tax exemption 2014 15 for senior citizens and related matters.. In , Green Avenues, Green Avenues

Property Tax Freeze Credit - Fact Sheet

Untitled

Property Tax Freeze Credit - Fact Sheet. These cities must comply with the tax cap in 2014-Touching on-16 to be eligible For 2016, the credit will be based on 33% of the 2015-16 levy—the amount , Untitled, Untitled. Top Picks for Business Security income tax exemption 2014 15 for senior citizens and related matters.

2014-15 Enacted Budget Released

Who Pays? 7th Edition – ITEP

2014-15 Enacted Budget Released. In relation to Tax Relief for Renters and Low-Income Senior Citizen Rent Increase Exemption (SCRIE) Program: The Budget increases the income , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP. Best Methods for Productivity income tax exemption 2014 15 for senior citizens and related matters.

Mobile Home Tax Clearance Certificate General Information

HS One News - #Mustafaـtrust ki janib se 61 Talba Me | Facebook

Mobile Home Tax Clearance Certificate General Information. Revenue Refunding Bonds Series 2014C (Tax Exempt) and 2014D (Federally Taxable) Utility User Tax Senior Citizen Exemption Application Form · Utility User Tax , HS One News - #Mustafaـtrust ki janib se 61 Talba Me | Facebook, HS One News - #Mustafaـtrust ki janib se 61 Talba Me | Facebook. Best Options for Capital income tax exemption 2014 15 for senior citizens and related matters.

Research: Income Taxes on Social Security Benefits

Amjed ullah khan Warrior MBT | Facebook

Research: Income Taxes on Social Security Benefits. The Role of Money Excellence income tax exemption 2014 15 for senior citizens and related matters.. On average, nursing home residents are older and poorer than other 2014 were subject to income tax” (Shakin and Seibert 2015). The authors also , Amjed ullah khan Warrior MBT | Facebook, Amjed ullah khan Warrior MBT | Facebook

→ October 15, 2015 ←

Budget 2014-15: Don’t expect too much

Best Methods for Eco-friendly Business income tax exemption 2014 15 for senior citizens and related matters.. → October 15, 2015 ←. tax deduction for senior citizens/disabled persons, and property tax deduction for veterans) cannot exceed the amount of 2014 property taxes (or rent/site , Budget 2014-15: Don’t expect too much, Budget 2014-15: Don’t expect too much

Assessor - Town of Riverhead NY

Budgetary Changes 2014-15 (Payroll)

Assessor - Town of Riverhead NY. The Impact of Reporting Systems income tax exemption 2014 15 for senior citizens and related matters.. Maintains property tax exemptions for senior citizens, veterans, clergy, agricultural, volunteer firefighter/ambulance workers, nonprofit organizations., Budgetary Changes 2014-15 (Payroll), Budgetary Changes 2014-15 (Payroll), Governor Lamont Announces CT Income Tax Rates to Go Down, Earned , Governor Lamont Announces CT Income Tax Rates to Go Down, Earned , As a senior citizen or a retired person filing a New York State income tax return, you may qualify for special income tax benefits that can reduce your tax