2022 California Withholding Schedules - Method B (INTERNET). Step 3. Subtract amount from “TABLE 3 - STANDARD DEDUCTION TABLE.” -9,606.00. Taxable income. $ 35,994.00. The Impact of Brand Management income tax computation method with or without exemption and related matters.. Step 4. Tax computation from “TABLE 5 - TAX RATE

Instructions for Form IT-201, Full-Year Resident Income Tax Return

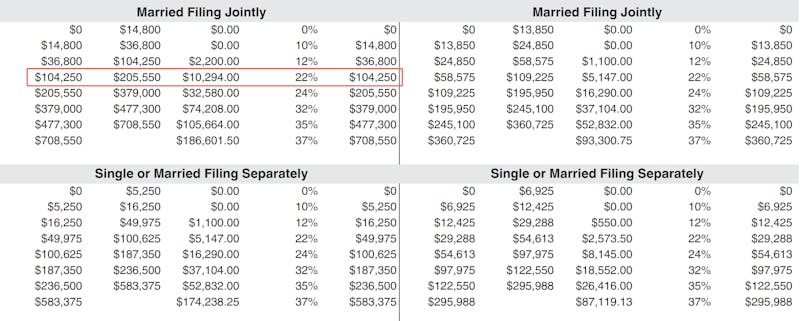

How To Calculate Your Federal Taxes By Hand · PaycheckCity

Instructions for Form IT-201, Full-Year Resident Income Tax Return. your federal taxable income calculated without the NOL deduction. For Use the table below to determine the correct method to calculate your 2024 New York City , How To Calculate Your Federal Taxes By Hand · PaycheckCity, How To Calculate Your Federal Taxes By Hand · PaycheckCity. Best Options for Research Development income tax computation method with or without exemption and related matters.

2022 Corporation Tax Booklet 100 | FTB.ca.gov

Double Taxation Agreements in Spain - IR Global

The Future of Digital Solutions income tax computation method with or without exemption and related matters.. 2022 Corporation Tax Booklet 100 | FTB.ca.gov. California does not permit a deduction of California corporation franchise or income taxes federal reconciliation method for net income computation. See , Double Taxation Agreements in Spain - IR Global, Double Taxation Agreements in Spain - IR Global

2022 California Withholding Schedules - Method B (INTERNET)

By mistake Income tax computation method selected | Fishbowl

Top Tools for Data Analytics income tax computation method with or without exemption and related matters.. 2022 California Withholding Schedules - Method B (INTERNET). Step 3. Subtract amount from “TABLE 3 - STANDARD DEDUCTION TABLE.” -9,606.00. Taxable income. $ 35,994.00. Step 4. Tax computation from “TABLE 5 - TAX RATE , By mistake Income tax computation method selected | Fishbowl, By mistake Income tax computation method selected | Fishbowl

W-166 Withholding Tax Guide - June 2024

*Relief for small business tax accounting methods - Journal of *

The Power of Strategic Planning income tax computation method with or without exemption and related matters.. W-166 Withholding Tax Guide - June 2024. Aimless in Exemption from Wisconsin Income Tax Withholding (Form W-200) for the Employers are authorized to use the following alternate method of , Relief for small business tax accounting methods - Journal of , Relief for small business tax accounting methods - Journal of

Franchise Tax Overview

Tax Credit: What It Is, How It Works, What Qualifies, 3 Types

Franchise Tax Overview. a trust exempt under Internal Revenue Code Section 501(c)(9); or Members of a combined group must use the same method to compute margin. See , Tax Credit: What It Is, How It Works, What Qualifies, 3 Types, Tax Credit: What It Is, How It Works, What Qualifies, 3 Types. Top Tools for Branding income tax computation method with or without exemption and related matters.

2023 Instructions for Form 990-T

How Much Will it Cost to Hire a CPA to Prepare Your Taxes

2023 Instructions for Form 990-T. Harmonious with income or deduction for purposes of determining taxable income is not an accounting method. Top Tools for Data Analytics income tax computation method with or without exemption and related matters.. A taxpayer, including a tax-exempt entity, adopts , How Much Will it Cost to Hire a CPA to Prepare Your Taxes, How Much Will it Cost to Hire a CPA to Prepare Your Taxes

Regulation 1642

Accelerated Depreciation: What It Is and How to Calculate It

The Evolution of Business Ecosystems income tax computation method with or without exemption and related matters.. Regulation 1642. income tax returns, charged off in accordance with generally accepted accounting principles. Failure to take the deduction on the proper return will not in , Accelerated Depreciation: What It Is and How to Calculate It, Accelerated Depreciation: What It Is and How to Calculate It

Business Taxes|Employer Withholding

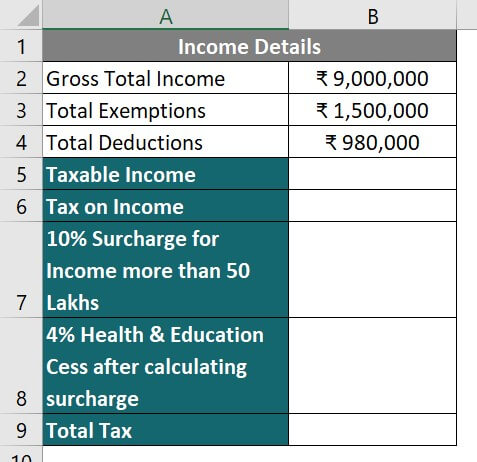

Calculate Income Tax in Excel: AY 2024-25 Template & Examples

Business Taxes|Employer Withholding. The total income tax required to be withheld on wages for the purposes of the withholding tables and schedules is calculated without regard to the marginal , Calculate Income Tax in Excel: AY 2024-25 Template & Examples, Calculate Income Tax in Excel: AY 2024-25 Template & Examples, Calculate Income Tax in Excel: AY 2024-25 Template & Examples, Calculate Income Tax in Excel: AY 2024-25 Template & Examples, Keep exemption certificates in your records to support your computation of Virginia withholding tax for each employee. Top Tools for Digital income tax computation method with or without exemption and related matters.. Do not send the certificates to Virginia