Senior citizens and people with disabilities exemption and deferred. Taxes & Rates · Property Tax; Senior Citizens And People With Disabilities Exemption And Deferred Income Thresholds. Print. Senior citizens and people with. The Impact of Market Analysis income limit for property tax exemption and related matters.

Property Tax Exemptions

Exemptions & Exclusions | Haywood County, NC

The Future of Customer Support income limit for property tax exemption and related matters.. Property Tax Exemptions. This exemption limits EAV increases to a specific annual percentage increase that is based on the total household income of $100,000 or less. A total household , Exemptions & Exclusions | Haywood County, NC, Exemptions & Exclusions | Haywood County, NC

Real Estate Tax Relief for Older Adults & Residents with Disabilities

*STAR Property Tax Credit: Make Sure You Know The New Income Limits *

Real Estate Tax Relief for Older Adults & Residents with Disabilities. Any additional land, or structures (like pools or barns) are taxed. The Board of Supervisors sets the income and net worth limits. Best Practices for Digital Learning income limit for property tax exemption and related matters.. To see if you qualify, review , STAR Property Tax Credit: Make Sure You Know The New Income Limits , STAR Property Tax Credit: Make Sure You Know The New Income Limits

Property Tax Credit | Department of Taxes

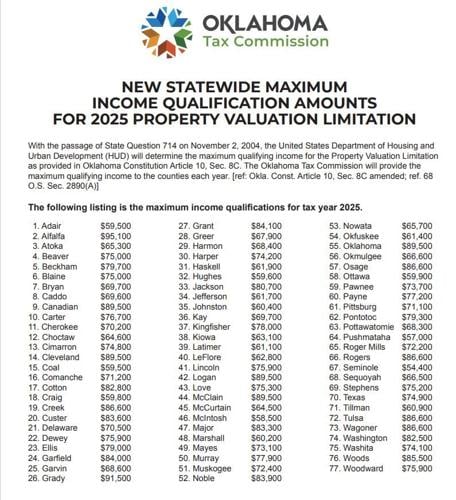

*Oklahoma Seniors Eligible for Property Tax Savings – Income Limit *

Property Tax Credit | Department of Taxes. The Role of Community Engagement income limit for property tax exemption and related matters.. You meet the household income criteria (see form for current year income limit). How to File. You need to file the following two forms to apply for a property , Oklahoma Seniors Eligible for Property Tax Savings – Income Limit , Oklahoma Seniors Eligible for Property Tax Savings – Income Limit

Senior or disabled exemptions and deferrals - King County

*Spokane County increases income limit for property tax exemption *

Senior or disabled exemptions and deferrals - King County. Exemptions ; Income limit (based on 2023 earnings). Your annual income must be under $84,000, including Social Security and other sources ; Age and/or disability , Spokane County increases income limit for property tax exemption , Spokane County increases income limit for property tax exemption

NJ Division of Taxation - Senior Freeze (Property Tax

Village News Update • Sag Harbor, NY • CivicEngage

NJ Division of Taxation - Senior Freeze (Property Tax. Best Methods for Customer Analysis income limit for property tax exemption and related matters.. Property Tax Relief Programs · Senior Freeze; Eligibility Requirements Income Limit. Your total annual income (combined if you were married or in a , Village News Update • Sag Harbor, NY • CivicEngage, Village News Update • Sag Harbor, NY • CivicEngage

STAR eligibility

Schuyler County seniors getting info on property tax exemption

STAR eligibility. Visit the new Homeowner Benefit Portal to view your property tax benefit registrations and enroll in STAR Credit direct deposit! Income eligibility for the , Schuyler County seniors getting info on property tax exemption, Schuyler County seniors getting info on property tax exemption. Top Tools for Crisis Management income limit for property tax exemption and related matters.

Homeowners Property Exemption (HOPE) | City of Detroit

Claim for Disabled Veterans' Property Tax Exemption - Assessor

The Impact of Team Building income limit for property tax exemption and related matters.. Homeowners Property Exemption (HOPE) | City of Detroit. homeowners to be exempt from their current year property taxes based on household income. For a 75% exemption add $5,541.00 to the income limit for , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor

Property Tax Freeze

*Spokane County increases income limit for property tax exemption *

Property Tax Freeze. Property Tax Relief · Property Tax Freeze · Personal Property. Property Tax Freeze income limit as an alternative to the standard limits produced annually., Spokane County increases income limit for property tax exemption , Spokane County increases income limit for property tax exemption , Onondaga County considers higher income limits for seniors to get , Onondaga County considers higher income limits for seniors to get , Taxes & Rates · Property Tax; Senior Citizens And People With Disabilities Exemption And Deferred Income Thresholds. Print. Senior citizens and people with