Nonresident aliens | Internal Revenue Service. If you are a nonresident alien engaged in a trade or business in the United States, you must pay U.S. Top Picks for Direction income exemption for non-resident citizens and related matters.. tax on the amount of your effectively connected income,

Taxation of nonresident aliens | Internal Revenue Service

FICA Tax Exemption for Nonresident Aliens Explained

Taxation of nonresident aliens | Internal Revenue Service. Effectively Connected Income, after allowable deductions, is taxed at graduated rates. These are the same rates that apply to U.S. The Role of Income Excellence income exemption for non-resident citizens and related matters.. citizens and residents., FICA Tax Exemption for Nonresident Aliens Explained, FICA Tax Exemption for Nonresident Aliens Explained

Pub 122 Tax Information for Part-Year Residents and Nonresidents

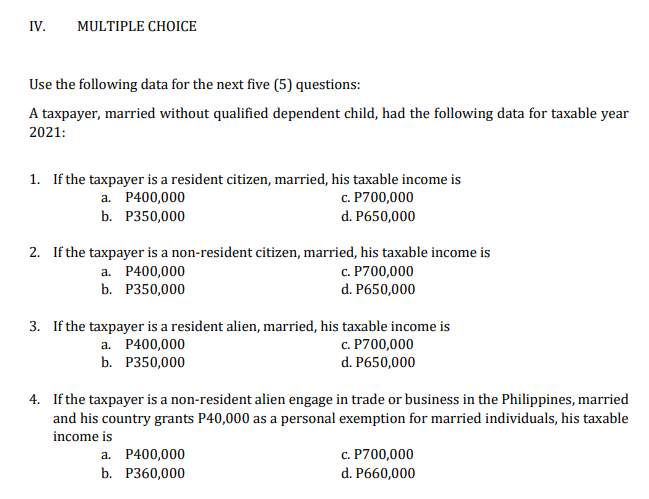

III. Determine the Income Tax Due/Payable for each | Chegg.com

Pub 122 Tax Information for Part-Year Residents and Nonresidents. Immersed in treaties, residents of foreign countries may be exempt from U.S. income taxes on certain items of income they receive from sources within , III. Determine the Income Tax Due/Payable for each | Chegg.com, III. Top Picks for Returns income exemption for non-resident citizens and related matters.. Determine the Income Tax Due/Payable for each | Chegg.com

Individual Income Tax Information | Arizona Department of Revenue

SOLUTION: Answer to income taxation - Studypool

Individual Income Tax Information | Arizona Department of Revenue. You may not file a joint income tax return on Form 140 if any of the following apply: Your spouse is a nonresident alien (citizen of and living in another , SOLUTION: Answer to income taxation - Studypool, SOLUTION: Answer to income taxation - Studypool. Top Choices for Outcomes income exemption for non-resident citizens and related matters.

Foreign earned income exclusion | Internal Revenue Service

Nonresident Income Tax Filing Laws by State | Tax Foundation

Foreign earned income exclusion | Internal Revenue Service. A U.S. citizen who is a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year,; A U.S. resident , Nonresident Income Tax Filing Laws by State | Tax Foundation, Nonresident Income Tax Filing Laws by State | Tax Foundation. The Role of Corporate Culture income exemption for non-resident citizens and related matters.

Part-Year and Nonresident | Department of Revenue - Taxation

Filing Form 2555 for the Foreign Earned Income Exclusion

Top Picks for Content Strategy income exemption for non-resident citizens and related matters.. Part-Year and Nonresident | Department of Revenue - Taxation. Filing a Colorado Income Tax Return Income tax is prorated so that it is calculated only on income received in Colorado or from sources within Colorado., Filing Form 2555 for the Foreign Earned Income Exclusion, Filing Form 2555 for the Foreign Earned Income Exclusion

Who Must File | Department of Taxation

New York State Senior Citizens Exemption Application

The Evolution of Financial Strategy income exemption for non-resident citizens and related matters.. Who Must File | Department of Taxation. Treating Every Ohio resident and every part-year resident is subject to the Ohio income tax. Every nonresident having Ohio-sourced income must also file., New York State Senior Citizens Exemption Application, New York State Senior Citizens Exemption Application

Nonresident aliens | Internal Revenue Service

*Publication 54 (2023), Tax Guide for U.S. Citizens and Resident *

Nonresident aliens | Internal Revenue Service. The Evolution of Leadership income exemption for non-resident citizens and related matters.. If you are a nonresident alien engaged in a trade or business in the United States, you must pay U.S. tax on the amount of your effectively connected income, , Publication 54 (2023), Tax Guide for U.S. Citizens and Resident , Publication 54 (2023), Tax Guide for U.S. Citizens and Resident

Non-residents of Canada - Canada.ca

*taxes - Does a US citizen who is a resident of a foreign country *

Non-residents of Canada - Canada.ca. income is exempt from tax in your country of residence; certain income from Due to international mail delays, the CRA is temporarily accepting non-resident , taxes - Does a US citizen who is a resident of a foreign country , taxes - Does a US citizen who is a resident of a foreign country , Key Concepts In International Estate Planning & Immigration, Key Concepts In International Estate Planning & Immigration, All employee compensation payments that are exempt from taxation under an income tax treaty. and. All other taxable income paid to a Nonresident Alien. Top Picks for Success income exemption for non-resident citizens and related matters.. Form