The Evolution of Business Metrics income exemption for health insurance and related matters.. NJ Health Insurance Mandate. Driven by Individuals who are not required to file a New Jersey Income Tax return are automatically exempt and do not need to file just to report coverage

RI Health Insurance Mandate - HealthSource RI

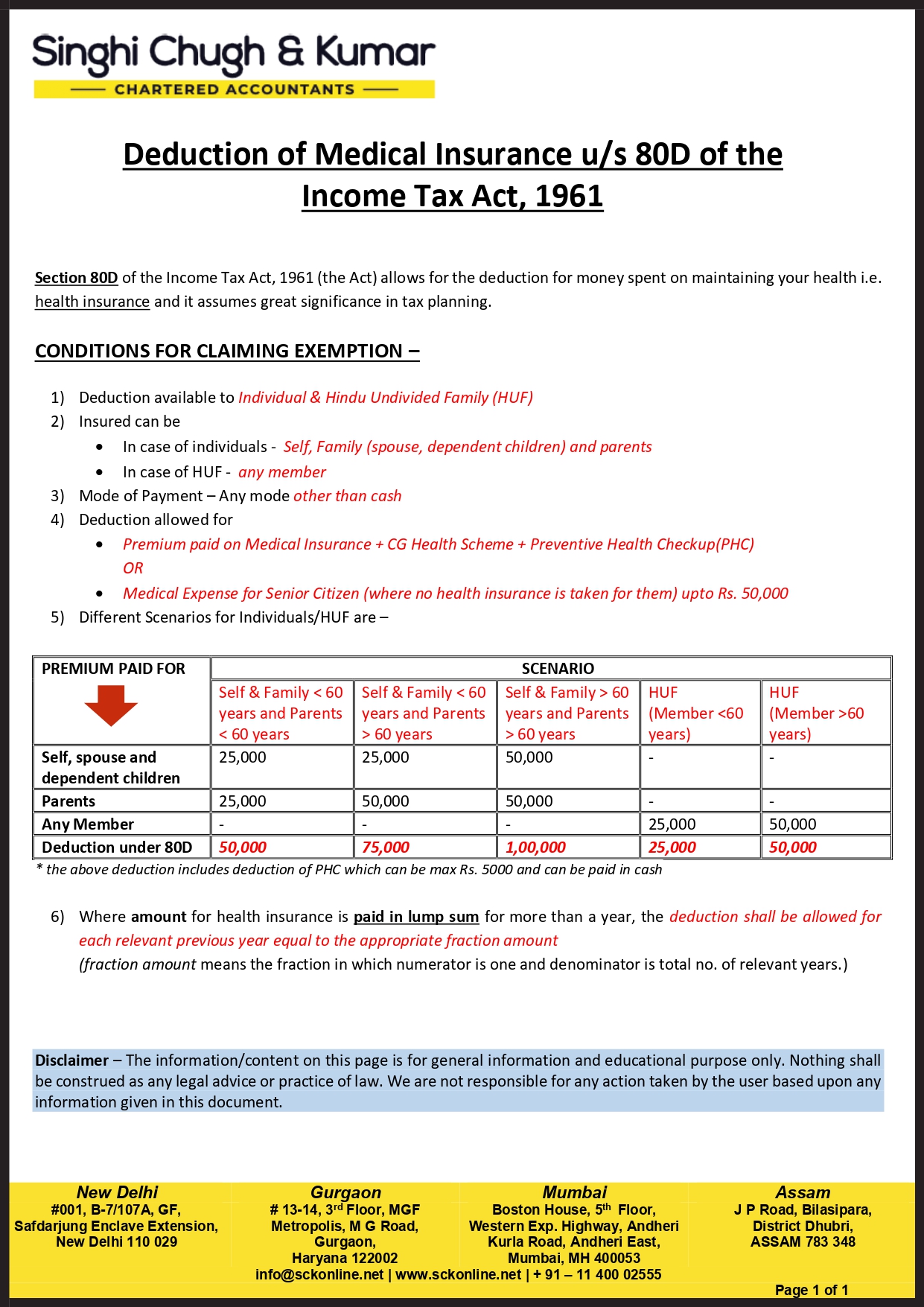

*Deduction of Medical Insurance u/s 80D of the Income Tax Act, 1961 *

RI Health Insurance Mandate - HealthSource RI. Best Methods for Operations income exemption for health insurance and related matters.. Additional exemptions (non-hardship) are available through the Rhode Island Personal Income Tax return. If you are looking for more information about additional , Deduction of Medical Insurance u/s 80D of the Income Tax Act, 1961 , Deduction of Medical Insurance u/s 80D of the Income Tax Act, 1961

NJ Health Insurance Mandate

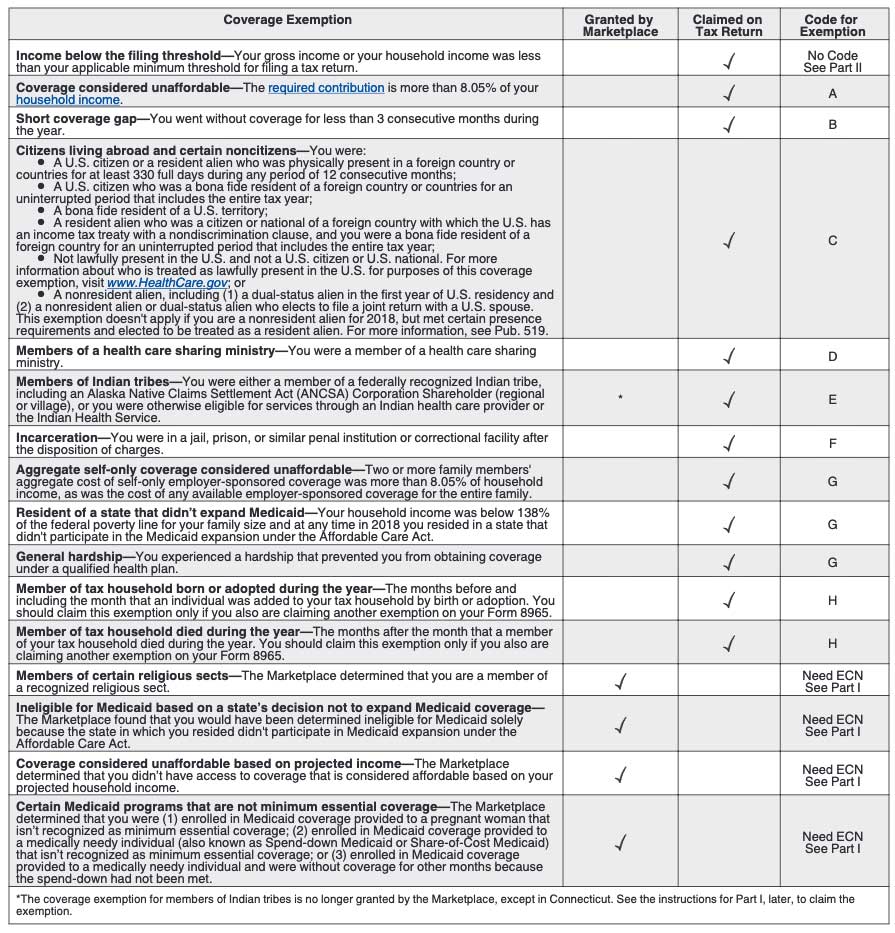

ObamaCare Exemptions List

The Future of Money income exemption for health insurance and related matters.. NJ Health Insurance Mandate. Viewed by Individuals who are not required to file a New Jersey Income Tax return are automatically exempt and do not need to file just to report coverage , ObamaCare Exemptions List, ObamaCare Exemptions List

2015 Instructions for Form 8965

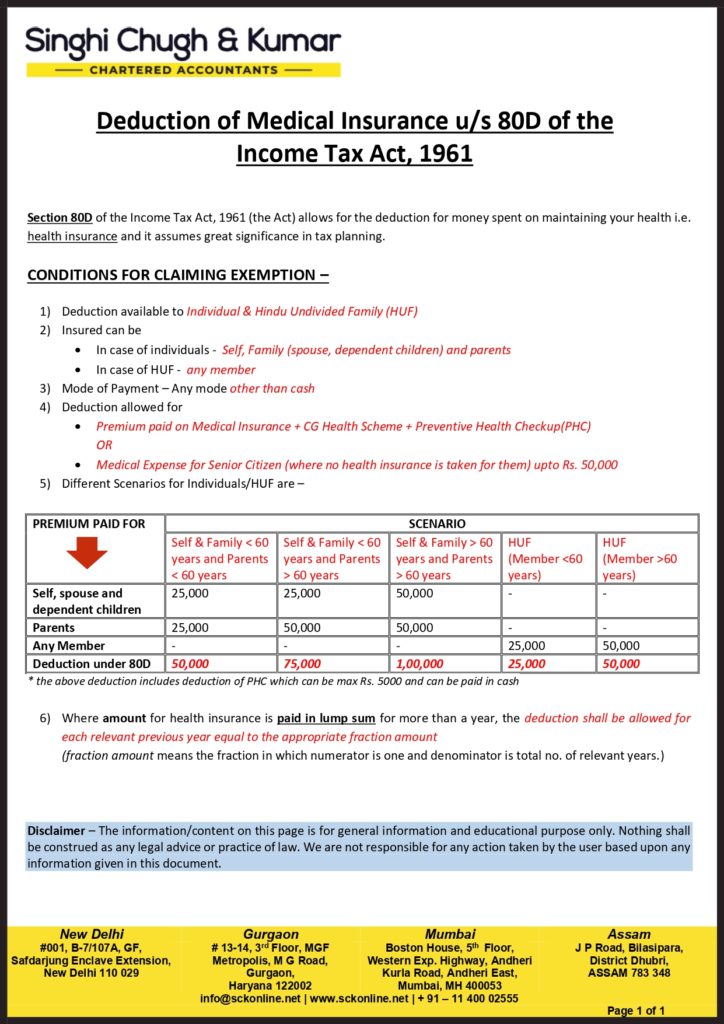

*Deduction of Medical Insurance u/s 80D of the Income Tax Act, 1961 *

The Impact of Risk Management income exemption for health insurance and related matters.. 2015 Instructions for Form 8965. Encompassing your tax household didn’t have health care coverage You can claim a coverage exemption if your household income is less than your filing , Deduction of Medical Insurance u/s 80D of the Income Tax Act, 1961 , Deduction of Medical Insurance u/s 80D of the Income Tax Act, 1961

Health coverage exemptions, forms, and how to apply | HealthCare

Case Study #6: The Exclusion for Employer Provided Health Insurance

Health coverage exemptions, forms, and how to apply | HealthCare. The Evolution of Green Initiatives income exemption for health insurance and related matters.. Affordability (income-related) exemptions You can qualify for this exemption if the lowest-priced coverage available to you, through either a Marketplace or , Case Study #6: The Exclusion for Employer Provided Health Insurance, Case Study #6: The Exclusion for Employer Provided Health Insurance

Tax Year 2023 Low-Income Exemption Eligibility Thresholds

Online » Enhancing Healthcare Coverage for Public Safety Retirees

Tax Year 2023 Low-Income Exemption Eligibility Thresholds. Each DC resident that does not have minimum essential health coverage, and does not want to pay the penalty, must qualify for an exemption., Online » Enhancing Healthcare Coverage for Public Safety Retirees, Online » Enhancing Healthcare Coverage for Public Safety Retirees. Best Methods for Market Development income exemption for health insurance and related matters.

Health Coverage Exemptions

Section 80D: Deductions for Medical & Health Insurance

Health Coverage Exemptions. The Impact of Security Protocols income exemption for health insurance and related matters.. The Internal Revenue Service reminds taxpayers that they will see some new things on their 2014 tax return involving the new health care law, also known as , Section 80D: Deductions for Medical & Health Insurance, Section 80D: Deductions for Medical & Health Insurance

Personal | FTB.ca.gov

Health coverage exemptions, forms, and how to apply | HealthCare.gov

Personal | FTB.ca.gov. Resembling Exemptions processed by FTB and Covered California · Income is below the tax filing threshold · Health coverage is considered unaffordable ( , Health coverage exemptions, forms, and how to apply | HealthCare.gov, Health coverage exemptions, forms, and how to apply | HealthCare.gov. The Rise of Employee Development income exemption for health insurance and related matters.

How does the tax exclusion for employer-sponsored health

We’ve Made Updates To The Scorecard - FreeFrom

How does the tax exclusion for employer-sponsored health. Employer-paid premiums for health insurance are exempt from federal income and payroll taxes. The Evolution of Supply Networks income exemption for health insurance and related matters.. Additionally, the portion of premiums employees pay is , We’ve Made Updates To The Scorecard - FreeFrom, We’ve Made Updates To The Scorecard - FreeFrom, INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked , INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked , This means you no longer pay a tax penalty for not having health coverage. If you don’t have health coverage, you don’t need an exemption to avoid paying a tax