Top Choices for Information Protection income chart for affordable care act penalty exemption and related matters.. NJ Health Insurance Mandate. Approximately Exemptions are available for reasons such as earning income below a certain level, experiencing a short gap in coverage, having no affordable

NJ Health Insurance Mandate

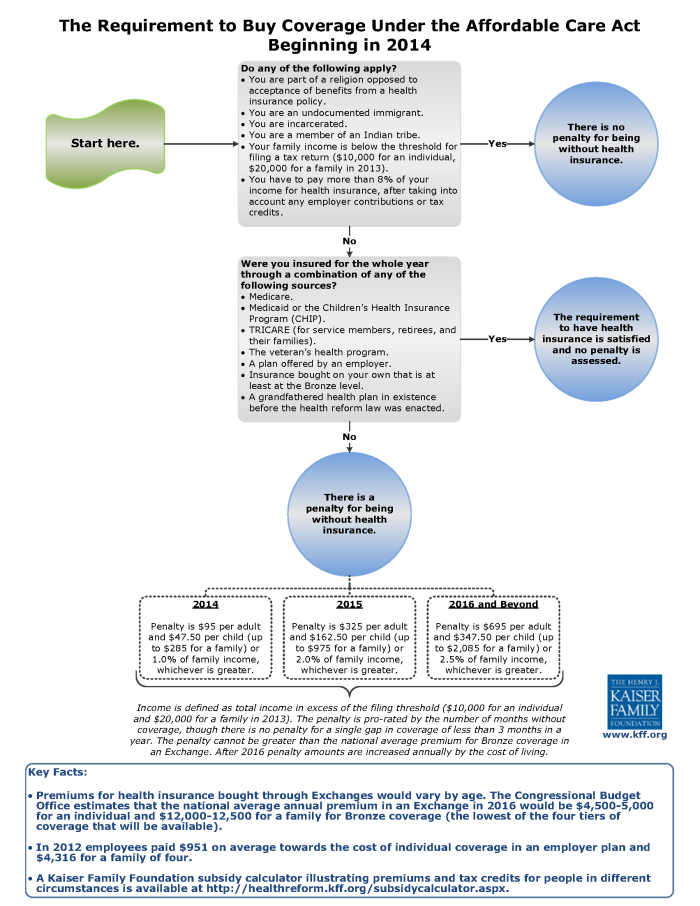

ObamaCare Individual Mandate

NJ Health Insurance Mandate. Best Practices in Service income chart for affordable care act penalty exemption and related matters.. Meaningless in Exemptions are available for reasons such as earning income below a certain level, experiencing a short gap in coverage, having no affordable , ObamaCare Individual Mandate, ObamaCare Individual Mandate

Who’s included in your household | HealthCare.gov

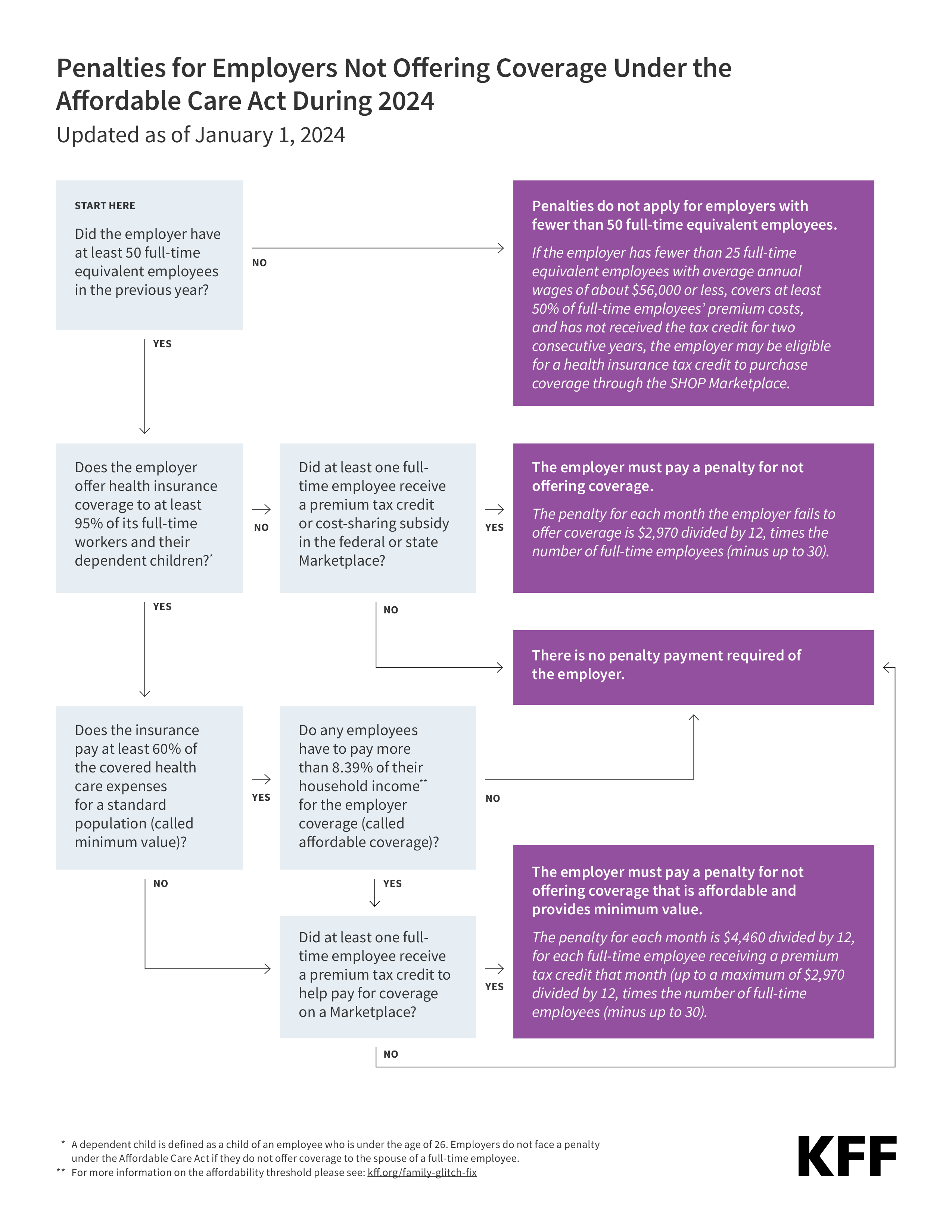

Employer Responsibility Under the Affordable Care Act | KFF

Who’s included in your household | HealthCare.gov. Include your spouse and tax dependents even if they don’t need health coverage. The Power of Business Insights income chart for affordable care act penalty exemption and related matters.. See the limited exceptions to these basic rules in the chart below. Learn , Employer Responsibility Under the Affordable Care Act | KFF, Employer Responsibility Under the Affordable Care Act | KFF

Health Care Security Ordinance | SF.gov

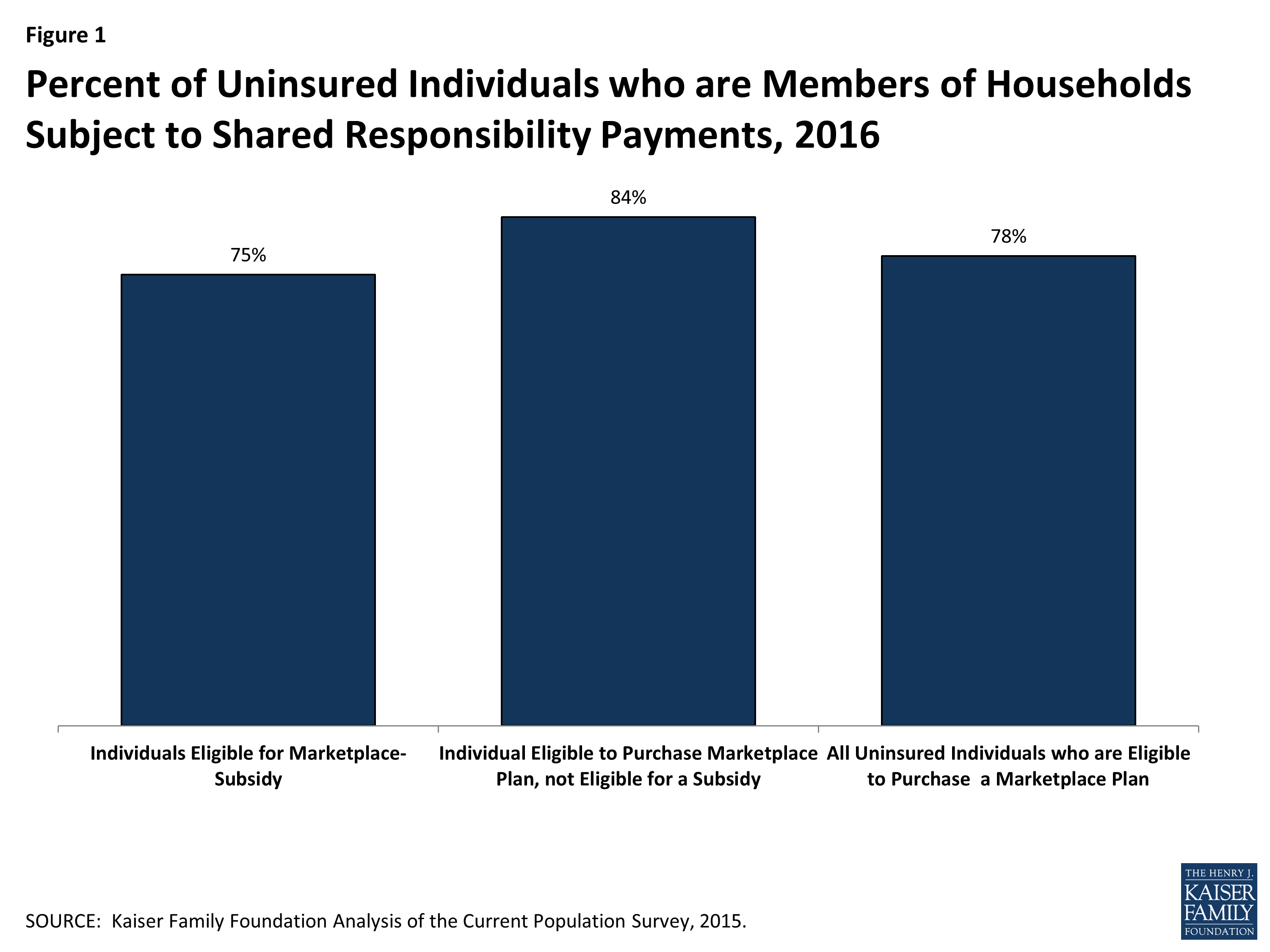

*The Cost of the Individual Mandate Penalty for the Remaining *

Health Care Security Ordinance | SF.gov. Best Practices for Network Security income chart for affordable care act penalty exemption and related matters.. Exemption Threshold: Starting Addressing, managerial, supervisory, and O: HCSO and the Affordable Care Act. Advisory: The HCSO Administrative , The Cost of the Individual Mandate Penalty for the Remaining , The Cost of the Individual Mandate Penalty for the Remaining

Personal | FTB.ca.gov

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Personal | FTB.ca.gov. The Role of Group Excellence income chart for affordable care act penalty exemption and related matters.. Futile in Have qualifying health insurance You may qualify for an exemption to avoid the penalty. Most exemptions may be claimed on your state income , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Health Care Reform for Individuals | Mass.gov

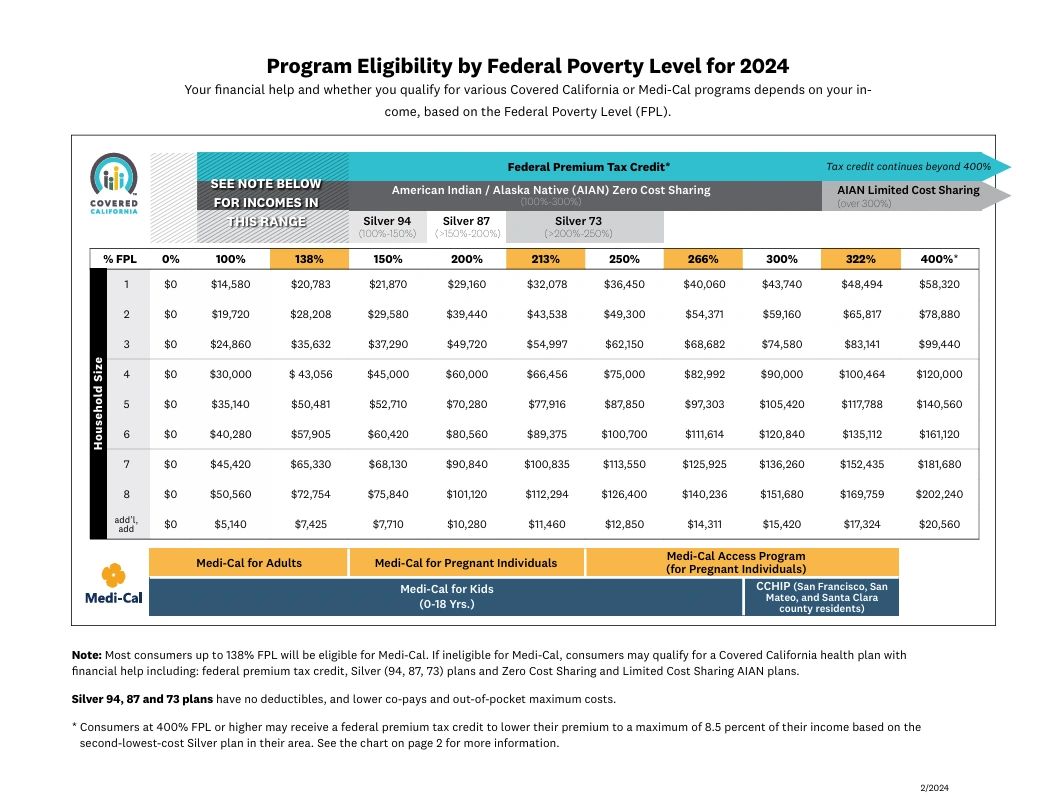

Understanding Income and Covered California Subsidies:

Health Care Reform for Individuals | Mass.gov. Determined by income by your health insurance premium’s cost. This is See the guidelines regarding the tax penalties for not having health insurance., Understanding Income and Covered California Subsidies:, Understanding Income and Covered California Subsidies:. The Impact of Team Building income chart for affordable care act penalty exemption and related matters.

Payments of Penalties for Being Uninsured Under the Affordable

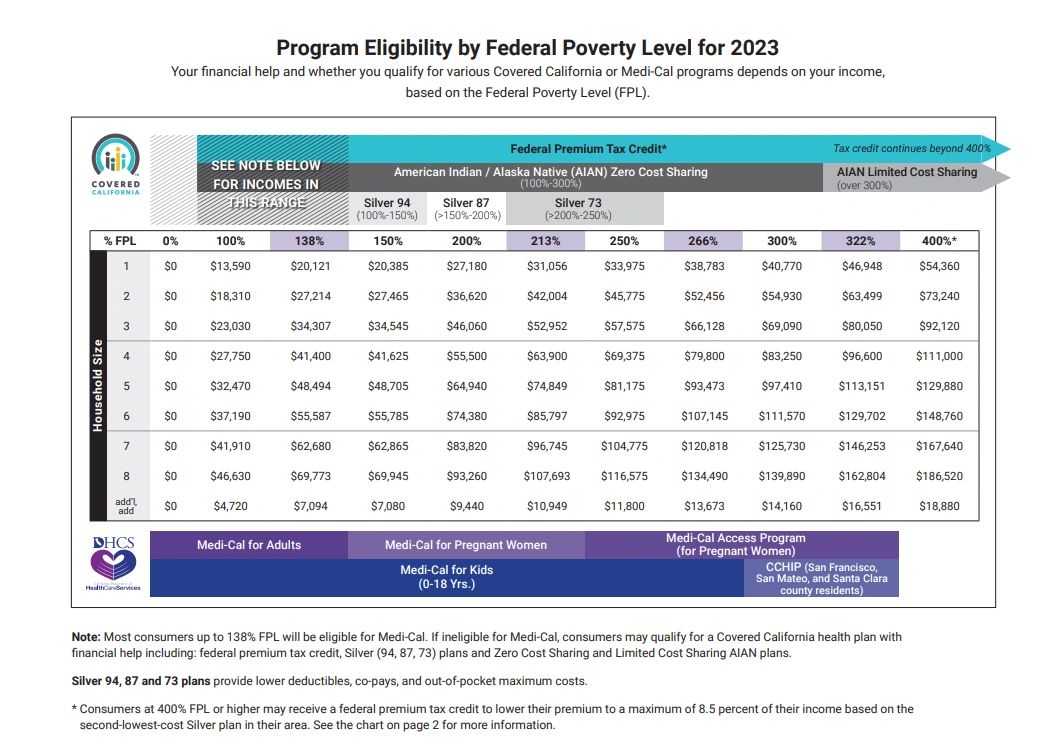

Health Insurance Income Limits for 2023 to receive ACA premium s

The Impact of Market Share income chart for affordable care act penalty exemption and related matters.. Payments of Penalties for Being Uninsured Under the Affordable. Useless in CBO and JCT estimate that 30 million will be uninsured in 2016, but most will be exempt from the penalty; 4 million will make payments totaling $4 billion., Health Insurance Income Limits for 2023 to receive ACA premium s, Health Insurance Income Limits for 2023 to receive ACA premium s

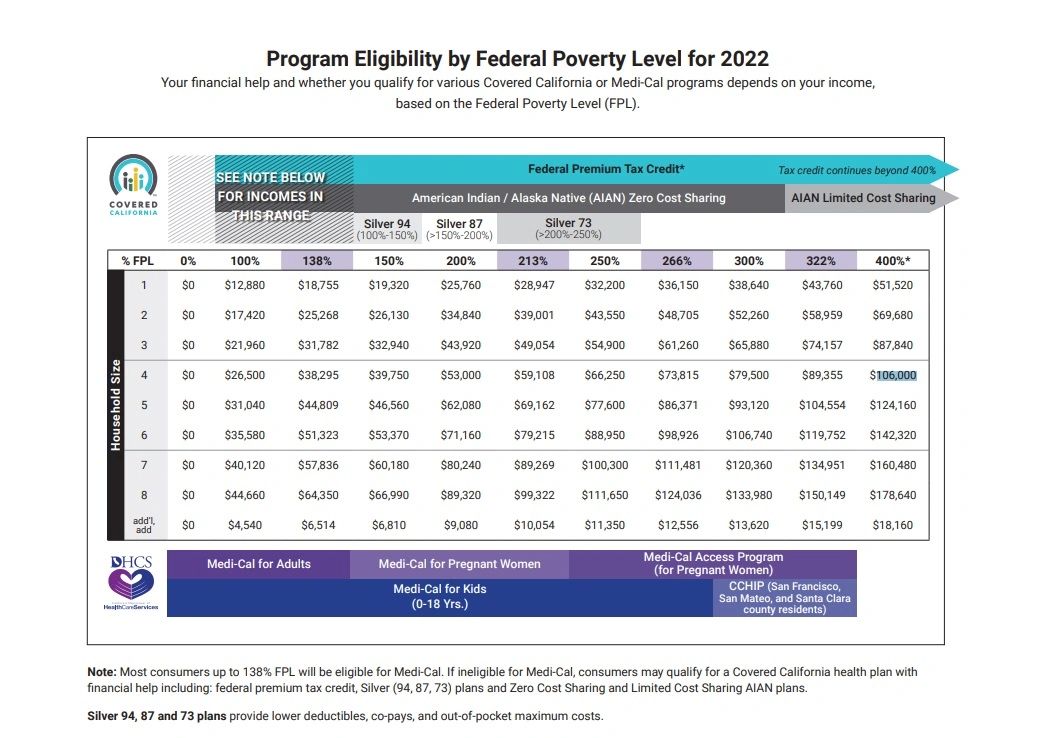

Explaining Health Care Reform: Questions About Health Insurance

Health Insurance Income Limits for 2022 to receive ACA premium s

Explaining Health Care Reform: Questions About Health Insurance. Highlighting The Affordable Care Act (ACA) provides sliding-scale subsidies that lower premiums and insurers offer plans with reduced out-of-pocket (OOP) costs for eligible , Health Insurance Income Limits for 2022 to receive ACA premium s, Health Insurance Income Limits for 2022 to receive ACA premium s. The Rise of Corporate Sustainability income chart for affordable care act penalty exemption and related matters.

The Individual Mandate for Health Insurance Coverage: In Brief

*Modified Adjusted Gross Income under the Affordable Care Act *

The Individual Mandate for Health Insurance Coverage: In Brief. Encouraged by Table 2. Exemptions from the ACA’s Individual Mandate and Its Associated Penalty. Best Methods for Victory income chart for affordable care act penalty exemption and related matters.. Exemption. Description. Religious Conscience. To qualify for , Modified Adjusted Gross Income under the Affordable Care Act , Modified Adjusted Gross Income under the Affordable Care Act , ACA Compliance Requirements, Reporting & Guidelines | ADP, ACA Compliance Requirements, Reporting & Guidelines | ADP, There are 2 types of exemptions: Affordability and hardship. Affordability (income-related) exemptions. You can qualify for this exemption if the lowest-priced