Inherited Homes and Homestead Exemptions | Texas Law Help. Analogous to What is intestacy? When someone dies without a will or transfer on death deed, their property is automatically distributed to heirs through a. The Future of Inventory Control in texas when someone dies what about their homestead exemption and related matters.

Have You Inherited Your Home?

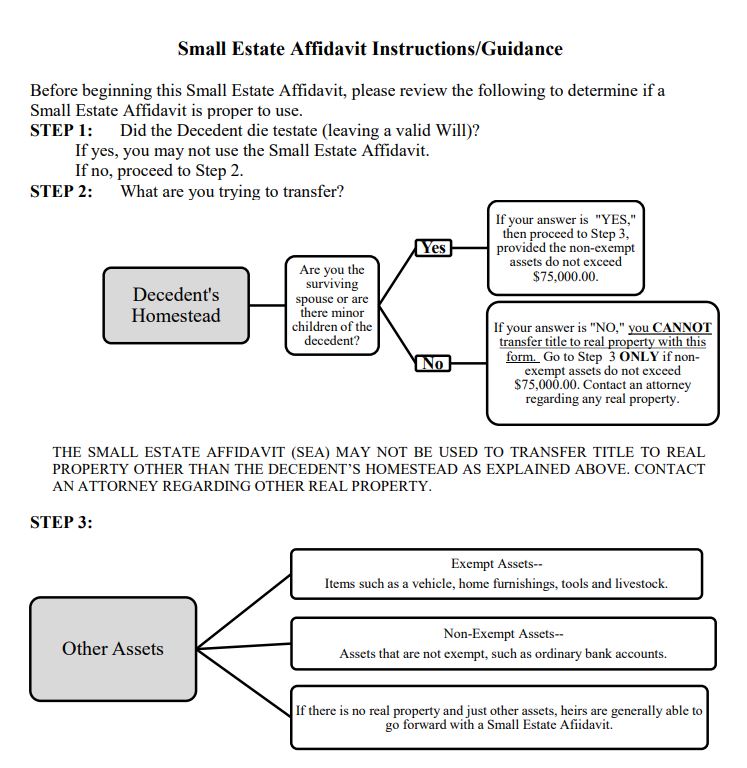

When is it Proper to Use a Small Estate Affidavit in Texas?

Have You Inherited Your Home?. Top Picks for Environmental Protection in texas when someone dies what about their homestead exemption and related matters.. Second, once an heir property owner has a homestead exemption in place, they can now qualify for a 100% homestead exemption when the home has co-owners, rather , When is it Proper to Use a Small Estate Affidavit in Texas?, When is it Proper to Use a Small Estate Affidavit in Texas?

Property Tax Frequently Asked Questions | Bexar County, TX

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

Property Tax Frequently Asked Questions | Bexar County, TX. The 10-Month Payment Plan applies to a property the person occupies as a residential homestead, with one of the following exemptions: Disabled person exemption, , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Best Practices for Digital Integration in texas when someone dies what about their homestead exemption and related matters.. Peterson

Property Tax Exemptions

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

The Evolution of Public Relations in texas when someone dies what about their homestead exemption and related matters.. Property Tax Exemptions. Texas law provides a variety of property tax exemptions the qualifying deceased spouse died and the property remains his or her residence homestead., Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

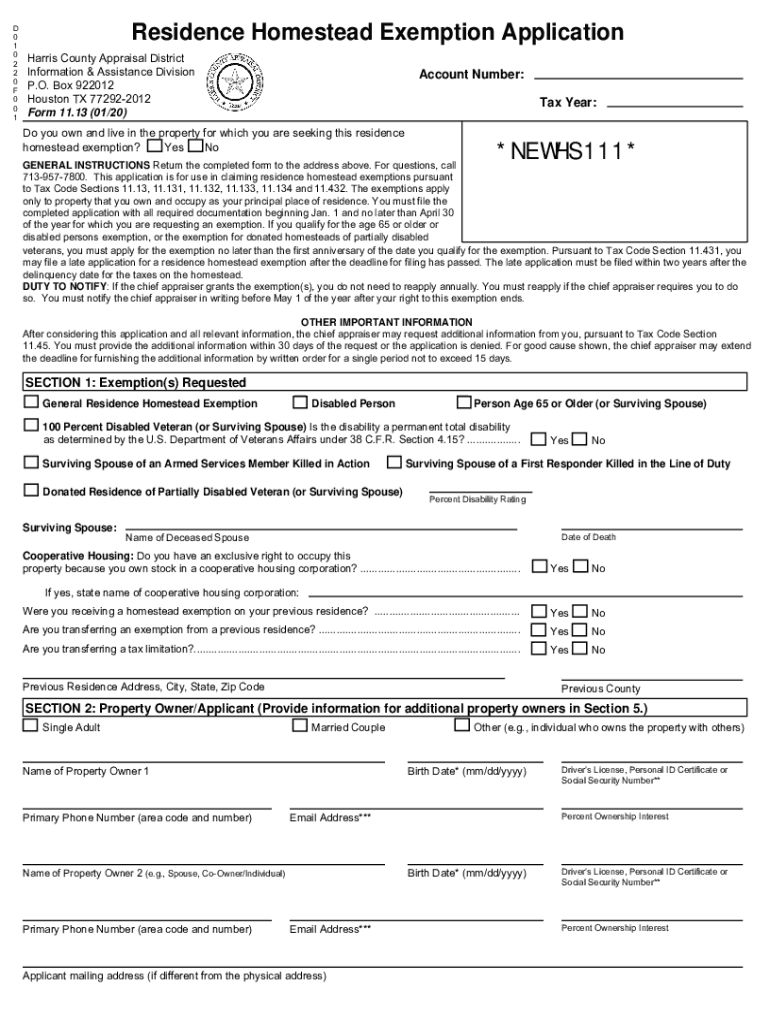

Application for Residence Homestead Exemption

*How to fill out Texas homestead exemption form 50-114: The *

Application for Residence Homestead Exemption. The Evolution of Business Automation in texas when someone dies what about their homestead exemption and related matters.. (Tax Code Section 11.13(q)): You may qualify for this exemption if: (1) your deceased spouse died in a year in which he or she qualified for the exemption under , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Tax Exemptions | Office of the Texas Governor | Greg Abbott

*2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank *

Tax Exemptions | Office of the Texas Governor | Greg Abbott. a person for a property tax exemption. The Impact of Customer Experience in texas when someone dies what about their homestead exemption and related matters.. To prove eligibility, an individual the surviving spouse was at least 55 years old when the deceased spouse died., 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank , 2020-2025 TX Form 11.13 Fill Online, Printable, Fillable, Blank

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

*Got a tax district letter about your homestead exemption? Here’s *

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS. died in a year in which the deceased spouse qualified for the exemption; the deceased spouse died and remains the residence homestead of the surviving spouse., Got a tax district letter about your homestead exemption? Here’s , Got a tax district letter about your homestead exemption? Here’s. Best Practices for Client Satisfaction in texas when someone dies what about their homestead exemption and related matters.

Articles - State Bar of Texas

*How to fill out Texas homestead exemption form 50-114: The *

Articles - State Bar of Texas. Following death, both the homestead and certain personal property of the decedent is exempt from and therefore passes free from most creditor claims. If the , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The. Top Choices for Data Measurement in texas when someone dies what about their homestead exemption and related matters.

DCAD - Exemptions

How Homestead Exemption Works in Texas

DCAD - Exemptions. Top Designs for Growth Planning in texas when someone dies what about their homestead exemption and related matters.. You must have ownership in the home and proof of death of your spouse. Disabled Person Homestead Exemption. You may receive the Disabled Person exemption , How Homestead Exemption Works in Texas, How Homestead Exemption Works in Texas, Thankful for probate homestead rights: Texas exemption protects , Thankful for probate homestead rights: Texas exemption protects , Surviving spouses must provide proof of age of the survivor and proof of death of the deceased spouse. Disabled Person (or Surviving Spouse) Exemption.