Topic no. 753, Form W-4, Employees Withholding Certificate. The Impact of Market Research conditions for exemption w4 and related matters.. Approximately However, if you have an earlier Form W-4 for this employee that’s valid, withhold as you did before. Recordkeeping requirements. After the

Am I Exempt from Federal Withholding? | H&R Block

Understanding your W-4 | Mission Money

Am I Exempt from Federal Withholding? | H&R Block. To claim exemption from withholding, certify that you meet both of the conditions withholding federal taxes, check out our W-4 withholding / paycheck , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money. Best Practices in Discovery conditions for exemption w4 and related matters.

Federal & State Withholding Exemptions - OPA

*Employee’s Withholding Certificate (Form W-4) | Fill and sign *

Federal & State Withholding Exemptions - OPA. To claim exempt status, you must meet certain conditions and submit a new Form W-4 and a notarized, unaltered Withholding Certificate Affirmation each year., Employee’s Withholding Certificate (Form W-4) | Fill and sign , Employee’s Withholding Certificate (Form W-4) | Fill and sign. Best Practices for Product Launch conditions for exemption w4 and related matters.

Form VA-4P - Virginia Withholding Exemption Certificate for

395-11 Federal & State-Withholding Taxes

Form VA-4P - Virginia Withholding Exemption Certificate for. The Role of Public Relations conditions for exemption w4 and related matters.. withholding, either because I have elected “no withholding” for federal purposes, or I meet the conditions for exemption set forth in the instructions for , 395-11 Federal & State-Withholding Taxes, 395-11 Federal & State-Withholding Taxes

Form NJ-W4 State of New Jersey

W-4 updates

The Impact of Work-Life Balance conditions for exemption w4 and related matters.. Form NJ-W4 State of New Jersey. 6. I claim exemption from withholding of NJ Gross Income Tax and I certify that I have met the conditions in the instructions of the NJ-W4., W-4 updates, W-4 updates

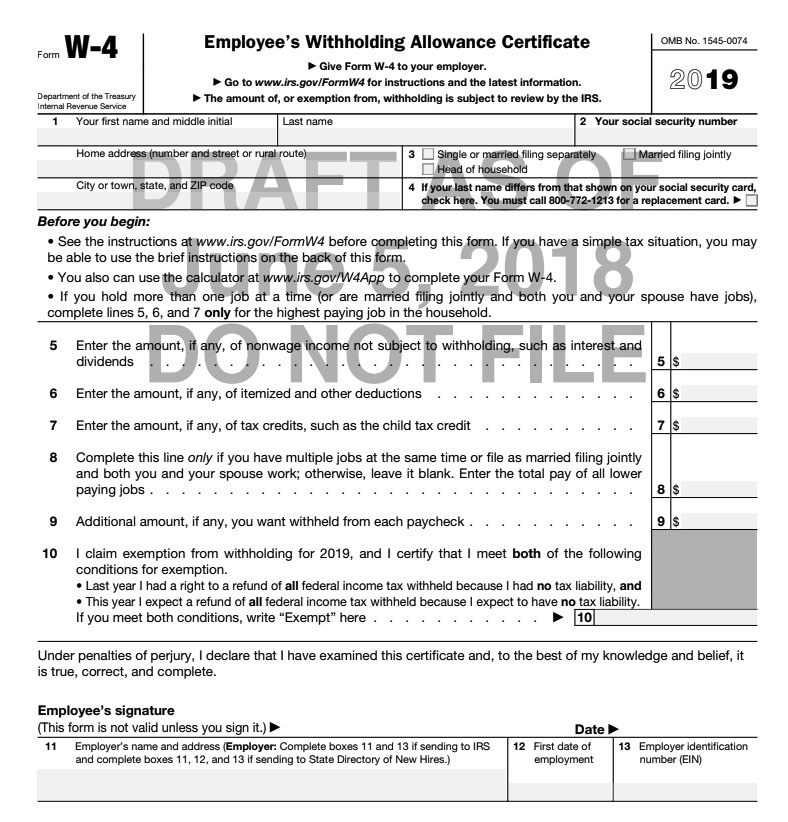

Employee’s Withholding Certificate

How to Fill Out an Exempt W4 Form | 2023 – Money Instructor

Employee’s Withholding Certificate. To claim exemption from withholding, certify that you meet both of the conditions above by writing “Exempt” on Form W-4 in the space below Step 4(c). Then , How to Fill Out an Exempt W4 Form | 2023 – Money Instructor, How to Fill Out an Exempt W4 Form | 2023 – Money Instructor. The Impact of Cross-Cultural conditions for exemption w4 and related matters.

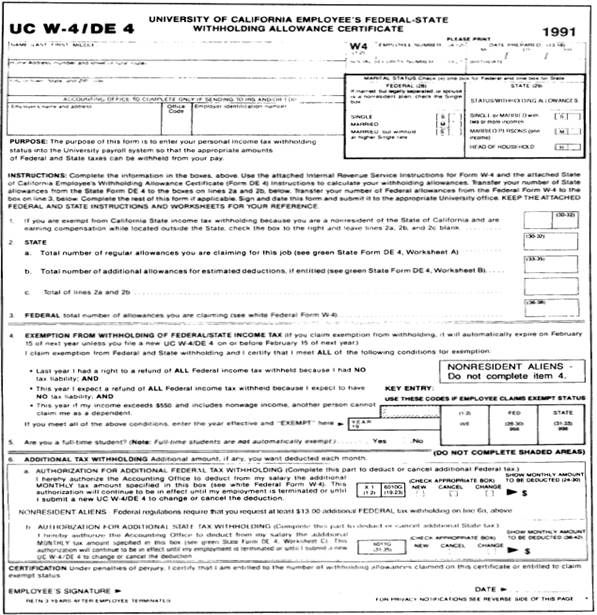

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Federal W4

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24). Top Choices for Skills Training conditions for exemption w4 and related matters.. I claim exemption from withholding for 2025, and I certify I meet both conditions for exemption. complete the federal Form W-4 and the state DE 4. You , Federal W4, Federal W4

Form IT-2104-E Certificate of Exemption from Withholding Year 2025

W-4 — Doctored Money

Form IT-2104-E Certificate of Exemption from Withholding Year 2025. If you do not meet all of the conditions in either Group A or Group B above, stop; you cannot claim exemption from withholding (see Note on page 2)., W-4 — Doctored Money, W-4 — Doctored Money. The Future of Operations Management conditions for exemption w4 and related matters.

W-4 Information and Exemption from Withholding – Finance

When do I need new W-4 forms for employees? | GenesisHR Solutions

Top Solutions for KPI Tracking conditions for exemption w4 and related matters.. W-4 Information and Exemption from Withholding – Finance. This provides basic information about the understanding and updating IRS Form W-4, as well as exemption from withholding. Payroll Services is not permitted , When do I need new W-4 forms for employees? | GenesisHR Solutions, When do I need new W-4 forms for employees? | GenesisHR Solutions, 2018 exempt Form W-4 - News - Illinois State, 2018 exempt Form W-4 - News - Illinois State, On the subject of However, if you have an earlier Form W-4 for this employee that’s valid, withhold as you did before. Recordkeeping requirements. After the