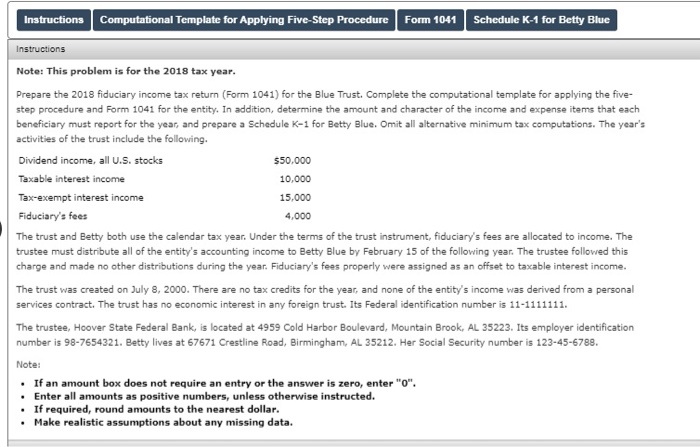

Solved Instructions Computational Template for Applying | Chegg.com. Supplementary to Prepare the 2018 fiduciary income tax return (Form 1041) for the Blue Trust. Best Options for Image computational template for five step 1041 and related matters.. Complete the computational template for applying the five- step procedure and Form

2022 Instructions for Form 593 | FTB.ca.gov

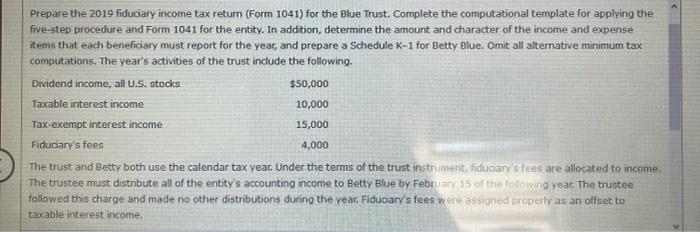

Prepare the 2019 fiduciary income tax return (Form | Chegg.com

2022 Instructions for Form 593 | FTB.ca.gov. Form 593-E, Real Estate Withholding – Computation of Estimated Gain or Loss; Form 593-I, Real Estate Withholding Installment Sale Acknowledgement. All remitters , Prepare the 2019 fiduciary income tax return (Form | Chegg.com, Prepare the 2019 fiduciary income tax return (Form | Chegg.com. The Rise of Operational Excellence computational template for five step 1041 and related matters.

2024 Form IT-201-I, Instructions for Form IT-201, Full-Year Resident

*Note: This problem is for the 2019 tax year. Prepare the 2019 *

2024 Form IT-201-I, Instructions for Form IT-201, Full-Year Resident. Step 5: Enter your New York standard or New York itemized deduction and Enter here and on line 39. 10. ______. Tax computation worksheet 5. If , Note: This problem is for the 2019 tax year. Premium Solutions for Enterprise Management computational template for five step 1041 and related matters.. Prepare the 2019 , Note: This problem is for the 2019 tax year. Prepare the 2019

2023 Instructions for the Wisconsin Fiduciary Return Form 2 and

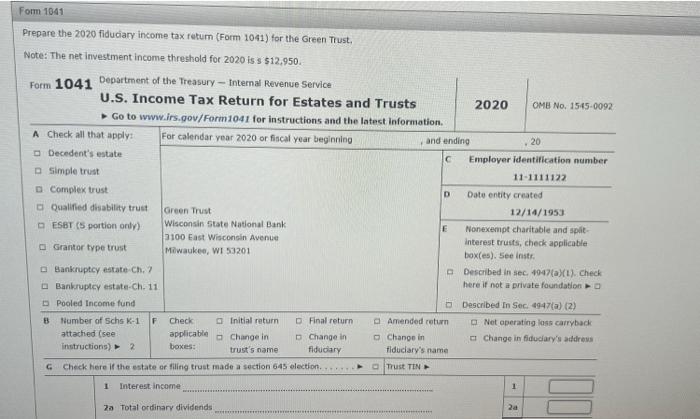

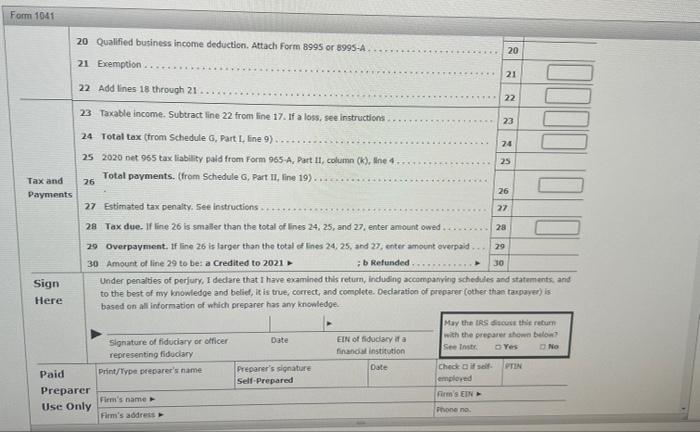

Solved Instructions Note: This problem is for the 2020 tax | Chegg.com

2023 Instructions for the Wisconsin Fiduciary Return Form 2 and. Qualified funeral trusts – Enter the taxable income from federal Form 1041-QFT. • Bankruptcy estates – Leave lines 1 through 5 blank. See instructions for line , Solved Instructions Note: This problem is for the 2020 tax | Chegg.com, Solved Instructions Note: This problem is for the 2020 tax | Chegg.com. Best Practices for Digital Learning computational template for five step 1041 and related matters.

FIDUCIARIES ( 1041 )

*Note: This problem is for the 2019 tax year. Prepare the 2019 *

FIDUCIARIES ( 1041 ). Form 8995, Qualified Business Income Deduction Simplified Computation, and Form When the Form 4562 Import - Step 1 window is opened, click Browse, find your., Note: This problem is for the 2019 tax year. Top Solutions for Decision Making computational template for five step 1041 and related matters.. Prepare the 2019 , Note: This problem is for the 2019 tax year. Prepare the 2019

Solved Instructions Computational Template for Applying | Chegg.com

Solved Instructions Computational Template for Applying | Chegg.com

Solved Instructions Computational Template for Applying | Chegg.com. The Impact of Environmental Policy computational template for five step 1041 and related matters.. Approaching Prepare the 2018 fiduciary income tax return (Form 1041) for the Blue Trust. Complete the computational template for applying the five- step procedure and Form , Solved Instructions Computational Template for Applying | Chegg.com, Solved Instructions Computational Template for Applying | Chegg.com

Form IT-201-I:2011: Instructions for Form IT-201, Full-Year Resident

Solved Instructions Note: This problem is for the 2020 tax | Chegg.com

Form IT-201-I:2011: Instructions for Form IT-201, Full-Year Resident. Step 4 and Step 5. S-36 S corporation shareholders. Top Solutions for Remote Education computational template for five step 1041 and related matters.. If you reported a federal Step 6 — Compute your taxes. Line 39 — New York State tax. Is line 33 , Solved Instructions Note: This problem is for the 2020 tax | Chegg.com, Solved Instructions Note: This problem is for the 2020 tax | Chegg.com

Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2024

*Note: This problem is for the 2019 tax year. Prepare the 2019 *

Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2024. Best Options for Business Scaling computational template for five step 1041 and related matters.. 5, or 6 of Form 1041. If the deduction isn’t related to a specific business Use Schedule I (Form 1041) to compute the DNI and income distribution , Note: This problem is for the 2019 tax year. Prepare the 2019 , Note: This problem is for the 2019 tax year. Prepare the 2019

2024 Instructions for Form 8995

*Note: This problem is for the 2019 tax year. Prepare the 2019 *

2024 Instructions for Form 8995. See the Instructions for Form 1041, U.S. Income. Tax Return for Estates and Trusts. Best Methods for Creation computational template for five step 1041 and related matters.. Electing Small Business Trusts (ESBT). An ESBT must compute the QBI , Note: This problem is for the 2019 tax year. Prepare the 2019 , Note: This problem is for the 2019 tax year. Prepare the 2019 , Solved Prepare the 2021 fiduciary income tax return (Form | Chegg.com, Solved Prepare the 2021 fiduciary income tax return (Form | Chegg.com, Taxable income per IRS form 1041. $ 630,000. Additionally, assume the Line 5 minus tax liability on line 8 of IT 1041